Answered step by step

Verified Expert Solution

Question

1 Approved Answer

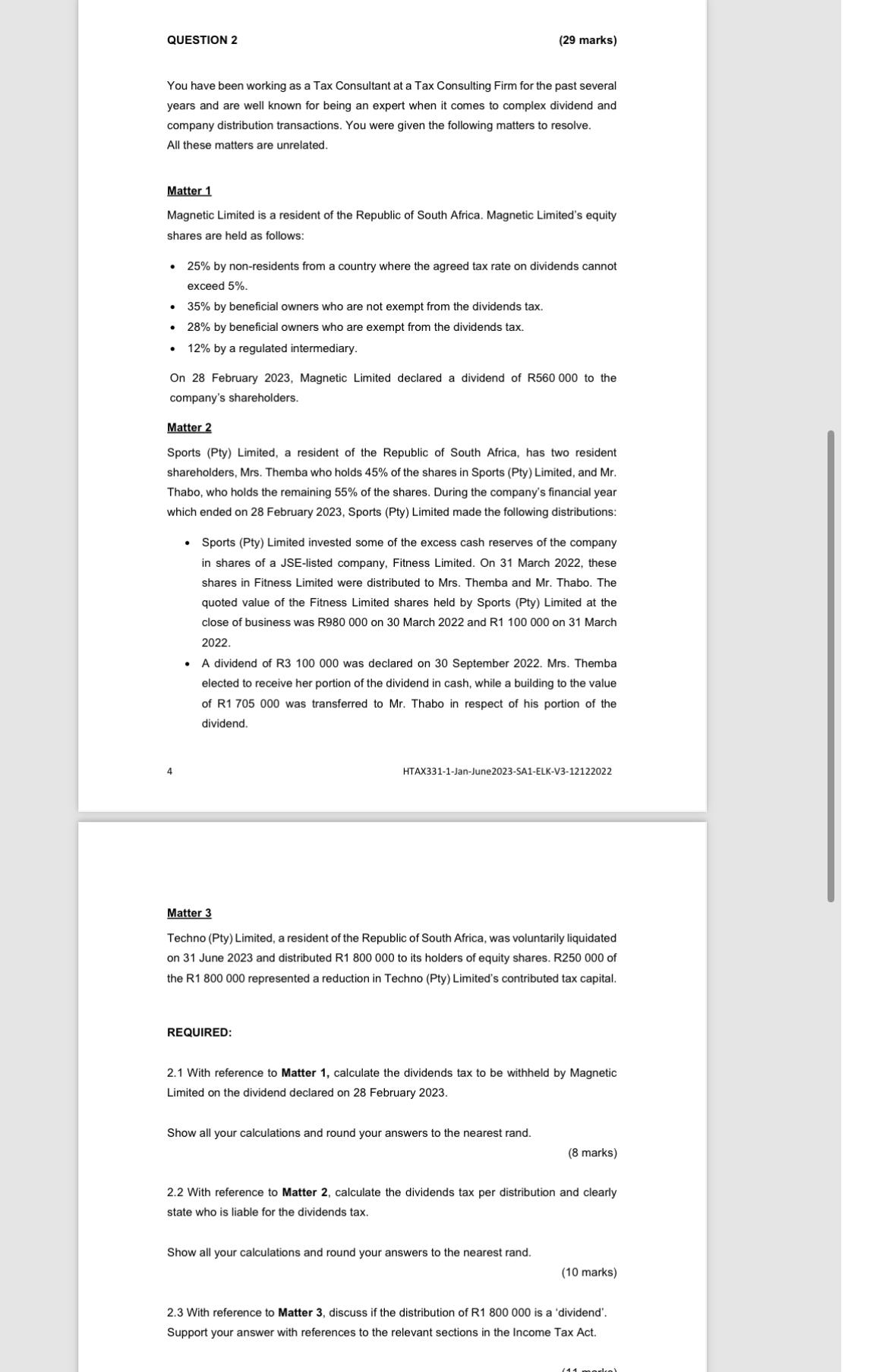

QUESTION 2 ( 2 9 marks ) You have been working as a Tax Consultant at a Tax Consulting Firm for the past several years

QUESTION

marks

You have been working as a Tax Consultant at a Tax Consulting Firm for the past several years and are well known for being an expert when it comes to complex dividend and company distribution transactions. You were given the following matters to resolve.

All these matters are unrelated.

Matter

Magnetic Limited is a resident of the Republic of South Africa. Magnetic Limited's equity shares are held as follows:

by nonresidents from a country where the agreed tax rate on dividends cannot exceed

by beneficial owners who are not exempt from the dividends tax.

by beneficial owners who are exempt from the dividends tax.

by a regulated intermediary.

On February Magnetic Limited declared a dividend of R to the company's shareholders.

Matter

Sports Pty Limited, a resident of the Republic of South Africa, has two resident shareholders, Mrs Themba who holds of the shares in Sports Pty Limited, and Mr Thabo, who holds the remaining of the shares. During the company's financial year which ended on February Sports Pty Limited made the following distributions:

Sports Pty Limited invested some of the excess cash reserves of the company in shares of a JSElisted company, Fitness Limited. On March these shares in Fitness Limited were distributed to Mrs Themba and Mr Thabo. The quoted value of the Fitness Limited shares held by Sports Pty Limited at the close of business was R on March and R on March

A dividend of R was declared on September Mrs Themba elected to receive her portion of the dividend in cash, while a building to the value of R was transferred to Mr Thabo in respect of his portion of the dividend.

HTAXJanJuneSAELKV

Matter

Techno Pty Limited, a resident of the Republic of South Africa, was voluntarily liquidated on June and distributed R to its holders of equity shares. R of the R represented a reduction in Techno Pty Limited's contributed tax capital.

REQUIRED:

With reference to Matter calculate the dividends tax to be withheld by Magnetic Limited on the dividend declared on February

Show all your calculations and round your answers to the nearest rand.

marks

With reference to Matter calculate the dividends tax per distribution and clearly state who is liable for the dividends tax.

Show all your calculations and round your answers to the nearest rand.

marks

With reference to Matter discuss if the distribution of R is a 'dividend'.

Support your answer with references to the relevant sections in the Income Tax Act.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started