Answered step by step

Verified Expert Solution

Question

1 Approved Answer

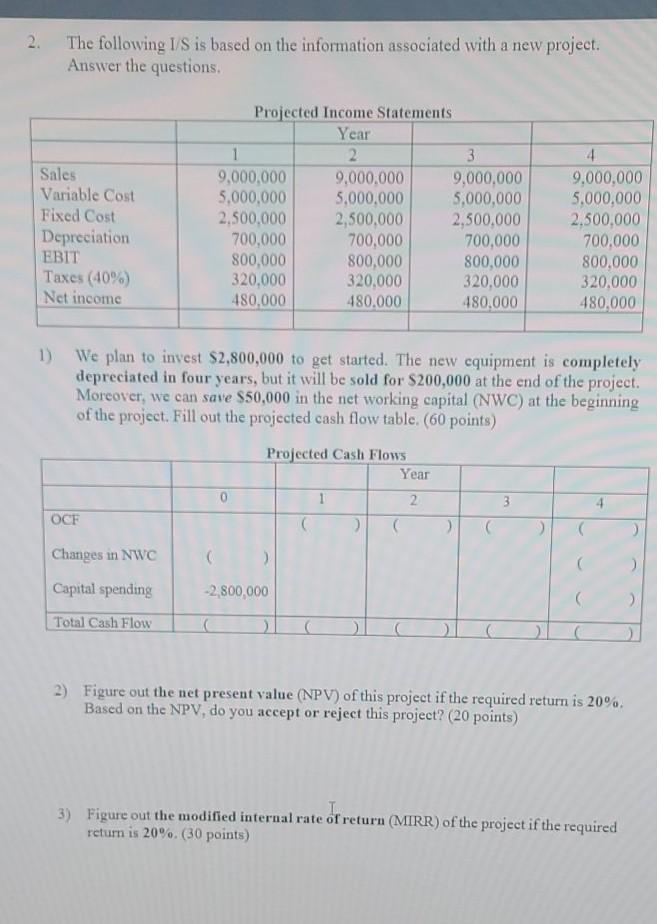

question 2 2. The following I/S is based on the information associated with a new project. Answer the questions Sales Variable Cost Fixed Cost Depreciation

question 2

2. The following I/S is based on the information associated with a new project. Answer the questions Sales Variable Cost Fixed Cost Depreciation EBIT Taxes (40%) Net income Projected Income Statements Year 1 2. 3 9,000,000 9,000,000 9,000,000 5,000,000 5.000.000 5,000,000 2.500.000 2,500,000 2,500,000 700,000 700,000 700,000 800,000 800,000 800,000 320,000 320,000 320,000 480,000 480.000 480.000 4 9,000,000 5.000.000 2,500,000 700,000 800,000 320,000 480,000 1) We plan to invest $2,800,000 to get started. The new cquipment is completely depreciated in four years, but it will be sold for $200,000 at the end of the project. Moreover, we can save $50,000 in the net working capital (NWC) at the beginning of the project. Fill out the projected cash flow table. (60 points) Projected Cash Flows Year 0 1 2 3 OCE ) Changes in NWC Capital spending -2,800,000 Total Cash Flow C 2) Figure out the net present value (NPV) of this project if the required return is 20%. Based on the NPV, do you accept or reject this project? (20 points) I 3) Figure out the modified internal rate of return (MIRR) of the project if the required return is 20%. (30 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started