Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a fund manager of PNN Asset Management Berhad, you are managing a RM15,000,000 stock portfolio, consisting blue chips of Malaysian stocks and the

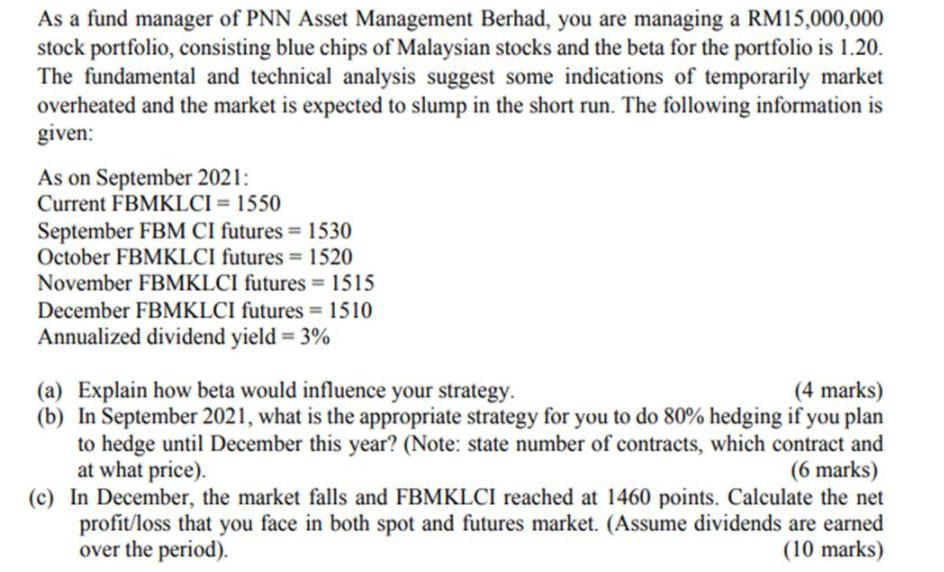

As a fund manager of PNN Asset Management Berhad, you are managing a RM15,000,000 stock portfolio, consisting blue chips of Malaysian stocks and the beta for the portfolio is 1.20. The fundamental and technical analysis suggest some indications of temporarily market overheated and the market is expected to slump in the short run. The following information is given: As on September 2021: Current FBMKLCI = 1550 September FBM CI futures = 1530 October FBMKLCI futures 1520 %3D %3! November FBMKLCI futures = 1515 %3D December FBMKLCI futures = 1510 Annualized dividend yield = 3% (a) Explain how beta would influence your strategy. (b) In September 2021, what is the appropriate strategy for you to do 80% hedging if you plan to hedge until December this year? (Note: state number of contracts, which contract and at what price). (c) In December, the market falls and FBMKLCI reached at 1460 points. Calculate the net profit/loss that you face in both spot and futures market. (Assume dividends are earned over the period). (4 marks) (6 marks) (10 marks)

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Solution Part A of the solution The sensitivity of a portfolio to changes in the broader market is m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started