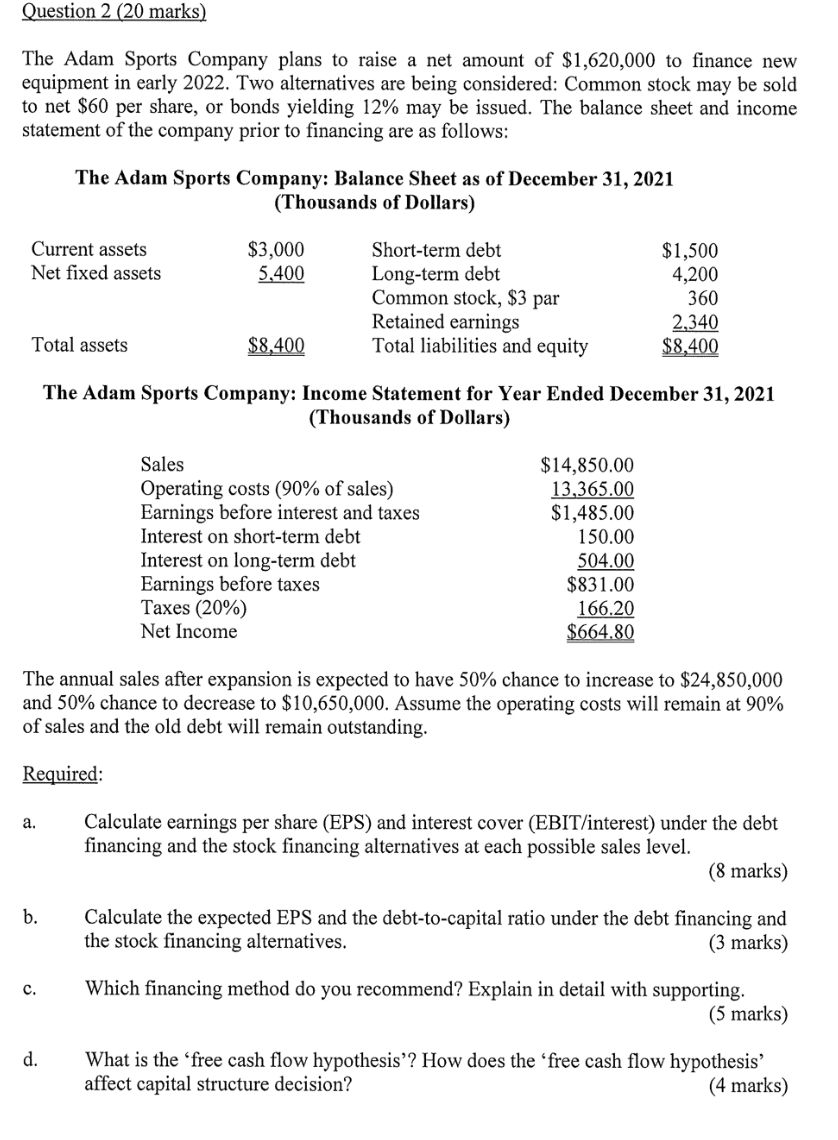

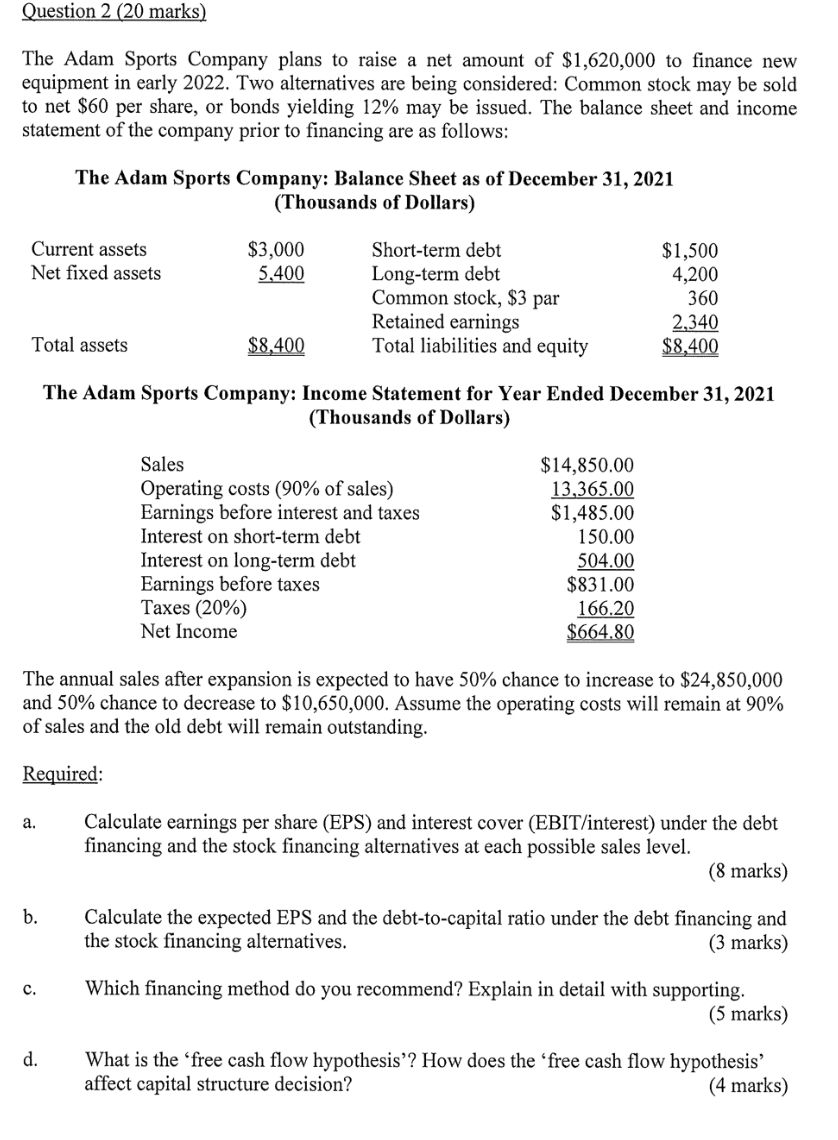

Question 2 (20 marks) The Adam Sports Company plans to raise a net amount of $1,620,000 to finance new equipment in early 2022. Two alternatives are being considered: Common stock may be sold to net $60 per share, or bonds yielding 12% may be issued. The balance sheet and income statement of the company prior to financing are as follows: The Adam Sports Company: Balance Sheet as of December 31, 2021 (Thousands of Dollars) Current assets Net fixed assets $3,000 5,400 Short-term debt Long-term debt Common stock, $3 par Retained earnings Total liabilities and equity $1,500 4,200 360 2,340 $8,400 Total assets $8,400 The Adam Sports Company: Income Statement for Year Ended December 31, 2021 (Thousands of Dollars) Sales Operating costs (90% of sales) Earnings before interest and taxes Interest on short-term debt Interest on long-term debt Earnings before taxes Taxes (20%) Net Income $14,850.00 13,365.00 $1,485.00 150.00 504.00 $831.00 166.20 $664.80 The annual sales after expansion is expected to have 50% chance to increase to $24,850,000 and 50% chance to decrease to $10,650,000. Assume the operating costs will remain at 90% of sales and the old debt will remain outstanding. Required: a. Calculate earnings per share (EPS) and interest cover (EBIT/interest) under the debt financing and the stock financing alternatives at each possible sales level. (8 marks) b. Calculate the expected EPS and the debt-to-capital ratio under the debt financing and the stock financing alternatives. (3 marks) c. Which financing method do you recommend? Explain in detail with supporting. (5 marks) d. What is the 'free cash flow hypothesis'? How does the 'free cash flow hypothesis' affect capital structure decision? (4 marks) Question 2 (20 marks) The Adam Sports Company plans to raise a net amount of $1,620,000 to finance new equipment in early 2022. Two alternatives are being considered: Common stock may be sold to net $60 per share, or bonds yielding 12% may be issued. The balance sheet and income statement of the company prior to financing are as follows: The Adam Sports Company: Balance Sheet as of December 31, 2021 (Thousands of Dollars) Current assets Net fixed assets $3,000 5,400 Short-term debt Long-term debt Common stock, $3 par Retained earnings Total liabilities and equity $1,500 4,200 360 2,340 $8,400 Total assets $8,400 The Adam Sports Company: Income Statement for Year Ended December 31, 2021 (Thousands of Dollars) Sales Operating costs (90% of sales) Earnings before interest and taxes Interest on short-term debt Interest on long-term debt Earnings before taxes Taxes (20%) Net Income $14,850.00 13,365.00 $1,485.00 150.00 504.00 $831.00 166.20 $664.80 The annual sales after expansion is expected to have 50% chance to increase to $24,850,000 and 50% chance to decrease to $10,650,000. Assume the operating costs will remain at 90% of sales and the old debt will remain outstanding. Required: a. Calculate earnings per share (EPS) and interest cover (EBIT/interest) under the debt financing and the stock financing alternatives at each possible sales level. (8 marks) b. Calculate the expected EPS and the debt-to-capital ratio under the debt financing and the stock financing alternatives. (3 marks) c. Which financing method do you recommend? Explain in detail with supporting. (5 marks) d. What is the 'free cash flow hypothesis'? How does the 'free cash flow hypothesis' affect capital structure decision? (4 marks)