Question 2

2.1 Outline a situation analysis and list the main strategic objectives of CITI BANK[12]

2.2 Outline a SWOT analysis, clearly showing possible combinations of events[15]

Question 3

3.1 Discuss the cost effective measures or value proposition CITI BANK could have used in devising its e-business strategy[12]

3.2Use the years and associated events in the case study and discuss how CITI BANK could havetaken advantage of the technological evolution in the e-business strategy.[13]

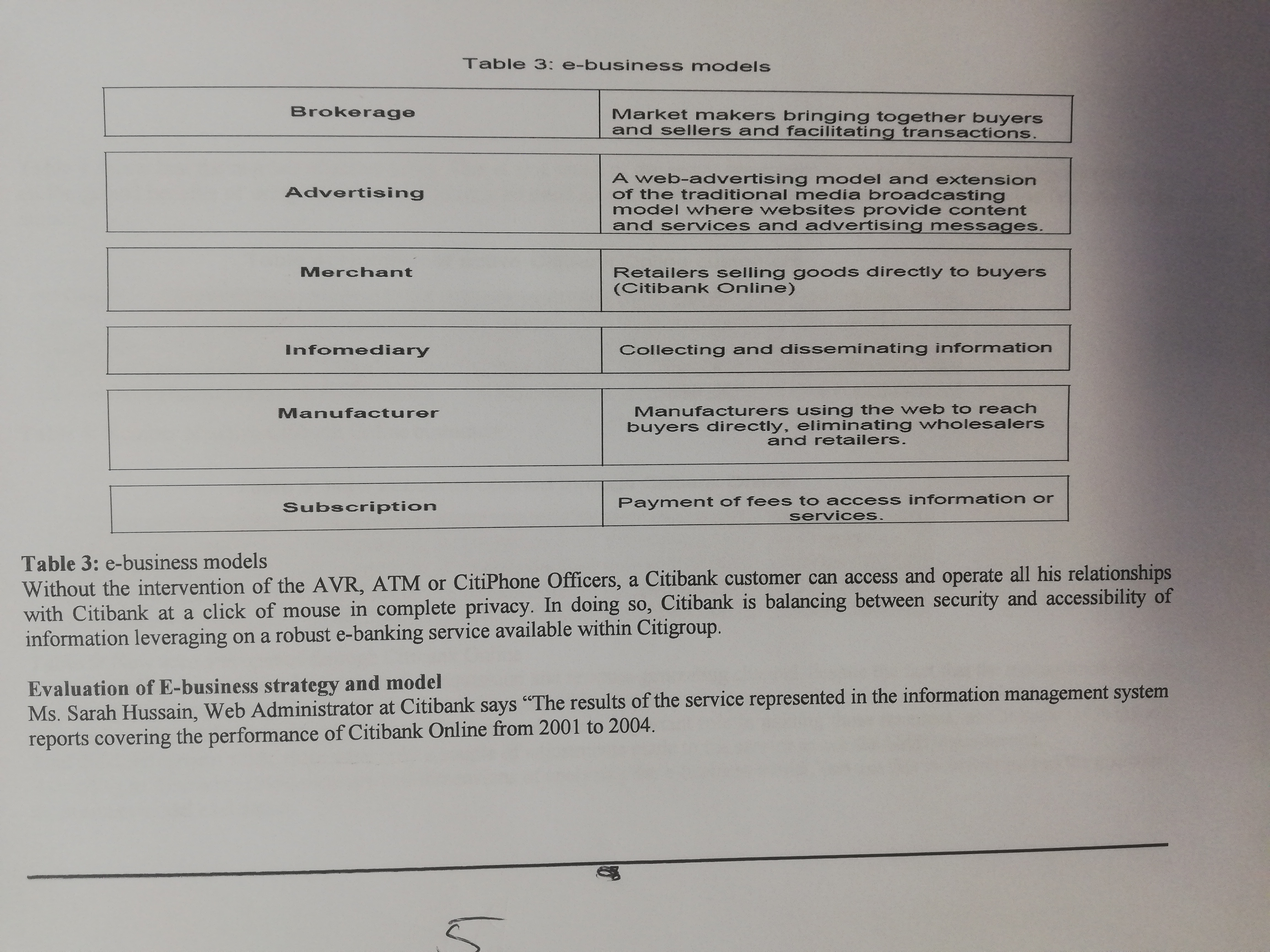

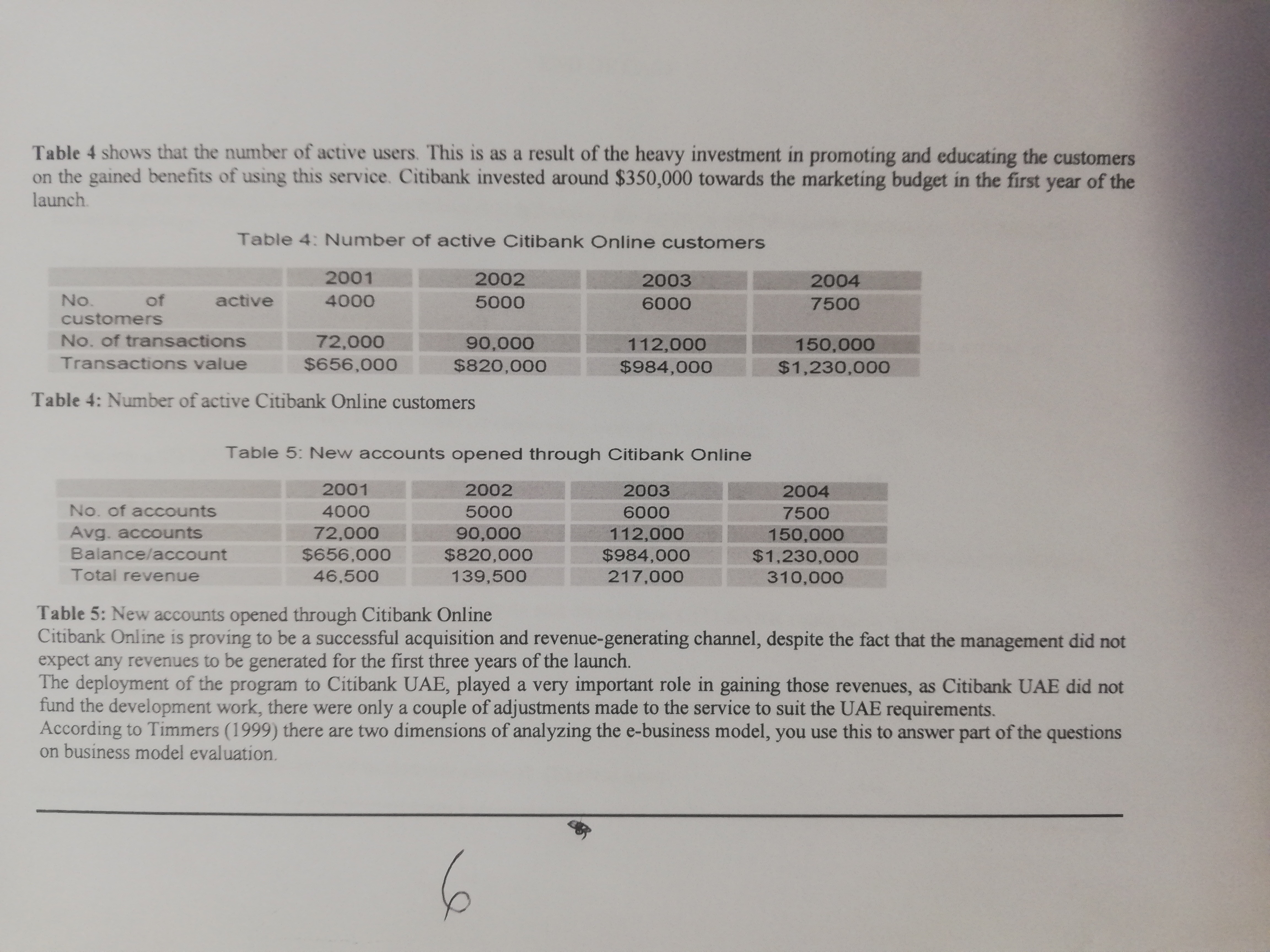

Read the case study and answer the following questions. Abstract Banks today are aware of both the threat and the opportunity that the Web represents. No traditional bank would dare face investment analysts without an Internet strategy. But even a detailed and thoughtful approach to the Web does not guarantee business success. The main purpose behind the launching of online banking services is to provide the customers with an alternative, more responsive and with less expensive options. With options just a click away, customers have more control than ever. They expect real-time answers and superior usability. They also want personal attention and highly customized products and services. The focus of e- business must always be on the customer. On the other hand, the technology and the business structure follow on form of the value you intend to provide to the customer. This paper evaluates the success of the e-business model and e-business strategy implemented by Citibank in the United Arab Emirates in offering its retail Internet Banking Service; Citibank Online. Keywords Electronic Banking, Online Banking, Retail Banking, Internet Usage Introduction E-business relies on the development of new business strategies based on networks. The world has become increasingly inter- connected via telecommunication networks and computers. These offer fast, flexible, and cost-effective ways of doing business. The Internet is driving the new economy by creating unprecedented opportunities for countries, companies and individuals around the world. CEOs worldwide recognize the strategic role that the Internet plays in their company's ability to survive and compete in the future. To be competitive in the Internet economy, companies need to harness the power of the Internet successfully. Citibank UAE - Background Information Citibank is a subsidiary of Citigroup, a strong financial brand with more than 100 million customers, 5.9 million online relationships and a global reach spanning 100 countries. Citibank UAE started its retail business in 1987 in a very highly competitive environment offering a comprehensive line of high- quality financial services targeted to the affluent and middle income segments. Citibank has been perceived, as at the edge of innovation leveraging its global expertise, it was the first bank in the UAE to introduce innovative e-business solutions like: 1) CitiPhone - 24 hour Phone Banking Service 2) ATMs- Automated Teller Machines 13) CitiAlert - GSM notifications service 4) E-Card - Internet Shopping Card 5) CitiDirect - Corporate Internet Banking Service, and 6) Citibank Online - Retail Internet Banking Service. In the year 2000, Citibank had 160,000 retail customers serviced mainly through five branches, six ATMs and CitiPhone. Given the Central Bank restrictions on opening additional branches, being a foreign bank, the banks' e-business strategy was to focus on remote channels of distribution, mainly Internet Banking solutions. Ms. Sarah Hussain, Web Administrator at Citibank says, "Given the kind of Internet explosion which the market is going through, Internet is the channel of the future, it is critical for Citibank to leverage this channel aggressively and gain an early and dominant leadership". What encouraged Citibank to proceed with its investment in this direction is the tremendous growth of Internet usage since its introduction in 1996. According to Etisalat, the only Internet Service Provider in the UAE, in 2003 the number of Internet users was 1, 105,000 in a country with a population of 3.7 million, this number is fairly high and expected to increase even further. Table 1: Number of Internet users in some of the Arab countries (Etisalat, 2003) Internet Users Mobile as Phones users % of Mobile Phones as % of Country UAE Population Internet Users Population users Population 3,700,000 30% 2,655,000 Qatar 9% 328,000 72% 805,000 1,105,000 75,400 41% Bahrain 728,000 174,800 24% 400,000 55% Oman 2.760.000 167.500 4.387,000 515,000 6% 528,600 19% Lebanon 12% 840,000 19% Jordan 5,332.000 345,000 6% 1,260,000 24% Egypt 71,300,000 2.100,000 3% 5,040,000 7% Table 1: Number of Internet users in some of the Arab countries (Etisalat, 2003) In an industry that has became increasingly serviced through remote channels, Citibank UAE wanted to leverage on the advanced technology available within Citigroup to stand out, hence Citibank Online was launched in 2000 offering a comprehensive list of services/functionalities. E-business Strategy Based on Porter (1980) generic strategies, Citibank opted for a differentiation strategy for its home banking service by offering a superior web banking option with powerful and relevant functionalities wherein customers can access/operate their banking accounts on the net with full confidence and ease. 2In the year 2000, there were only four local banks offering simple home banking solutions, Citibank wanted to be the first multinational bank to launch a multifunctional home banking service and own the category before competition becomes fierce in the field. Citibank's mission was to be a leading e-Financial Services company in the UAE by becoming trusted, premier e-business enabler for its customers. The objectives of launching Citibank Online were: 1) Extend its network and overcome the limited branch situation. 2) Achieve savings in CitiPhone/Branches' operating costs by diverting customers to the Internet. Citibank Online has one of the lowest "costs per interaction" as compared to the ATM, phone banking or branch banking. It contributes immensely as part of the Strategic Cost Management initiatives the bank is implementing without compromising on the quality of service. According to an online banking report published by Ernst & Young, the transaction costs of the various banking channels are as follows: Branch $1.07 Call Centre (human) $0.85 Automated Response System (AVR) $0.44 Automated Teller Machine $0.27 Dialup PC banking 1.5 Cent Internet Banking 1 Cent 3) Meet the increased consumer demand for quick and secure banking solutions, anywhere, any time on any device, this is important in staying ahead of competition. 4) Enhance the brand imagery and values in the mind of the customers and the prospects by owning this channel especially that Citibank is seen to be innovative and ahead of most other banks in terms of technology and product development. 5) Create another arm for deepening customer relationships through cross sell and acquisitions of new customers. Updated, Table 2 shows the list of Citibank Online functionalities covering all Citibanks' products in the UAE. 3Table 2: Citibank Online functionalities Account Information: Balance Summary Account details and Activity Transfers & Payment Download Account Activity Funds transfers within the UAE Funds transfers outside the UAE Payments Payee list Standing Instructions Investments Services Demand draft and managers checks Open a mutual fund account Complete a personal Investment worksheet Buy mutual funds Sell mutual funds Switch mutual funds View current mutual funds portfolio Customer Service Mutual funds information Account servicing Rate information Contact Center Apply now Send messages Read messages Read saved messages Information Center Link to the portal Table 2: Citibank Online functionalities In order to encourage trial and conversion, Citibank reduced the charges for many services if used on Citibank Online as part of its pricing strategy. Citibank addressed the security issues by using the industry level of encryption of 128 bit Secure Socket Layer (SSL) encryption. The bank also uses firewalls to prevent unauthorized access and an automatic 'timeout' feature if no activity was detected for a specific time period. The online session is launched by using a password selected by the customer. E-business Model Citibank Online is considered as a standard Business to Consumer approach, the e-business model Citibank is using can be classified as "Merchant". See Table 3. 4Table 3: e-business models Brokerage Market makers bringing together buyers and sellers and facilitating transactions Advertising A web-advertising model and extension of the traditional media broadcasting model where websites provide content and services and advertising messages Merchant Retailers selling goods directly to buyers (Citibank Online) Infomediary Collecting and disseminating information Manufacturer Manufacturers using the web to reach buyers directly, eliminating wholesalers and retailers. Subscription Payment of fees to access information or services. Table 3: e-business models Without the intervention of the AVR, ATM or CitiPhone Officers, a Citibank customer can access and operate all his relationships with Citibank at a click of mouse in complete privacy. In doing so, Citibank is balancing between security and accessibility of information leveraging on a robust e-banking service available within Citigroup. Evaluation of E-business strategy and model Ms. Sarah Hussain, Web Administrator at Citibank says "The results of the service represented in the information management system reports covering the performance of Citibank Online from 2001 to 2004.Table 4 shows that the number of active users. This is as a result of the heavy investment in promoting and educating the customers on the gained benefits of using this service. Citibank invested around $350,000 towards the marketing budget in the first year of the launch. Table 4: Number of active Citibank Online customers 2001 2002 2003 2004 No. of active 4000 5000 6000 7500 customers No. of transactions 72,000 90,000 112,000 150,000 Transactions value $656,000 $820,000 $984,000 $1,230,000 Table 4: Number of active Citibank Online customers Table 5: New accounts opened through Citibank Online 2001 2002 2003 2004 No. of accounts 4000 5000 6000 7500 Avg. accounts 72,000 90,000 112,000 150,000 Balance/account $656,000 $820,000 $984,000 $1,230,000 Total revenue 46,500 139,500 217,000 310,000 Table 5: New accounts opened through Citibank Online Citibank Online is proving to be a successful acquisition and revenue-generating channel, despite the fact that the management did not expect any revenues to be generated for the first three years of the launch. The deployment of the program to Citibank UAE, played a very important role in gaining those revenues, as Citibank UAE did not fund the development work, there were only a couple of adjustments made to the service to suit the UAE requirements. According to Timmers (1999) there are two dimensions of analyzing the e-business model, you use this to answer part of the questions on business model evaluation