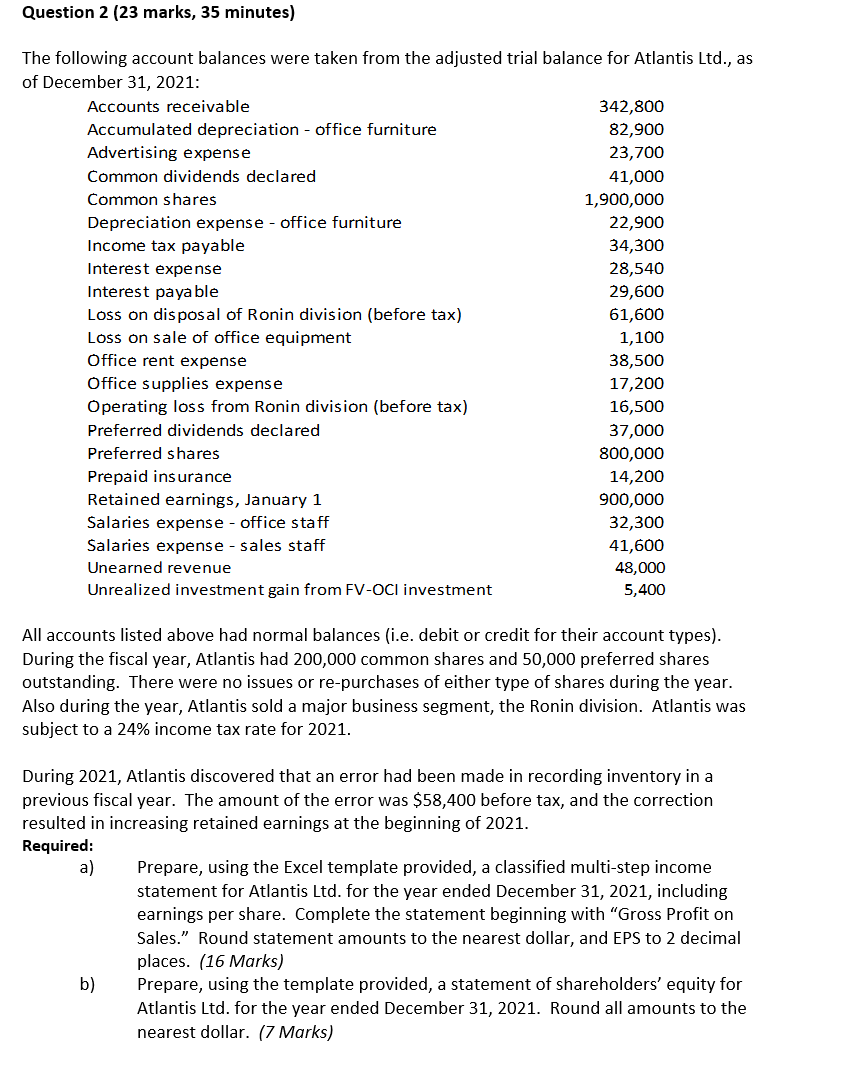

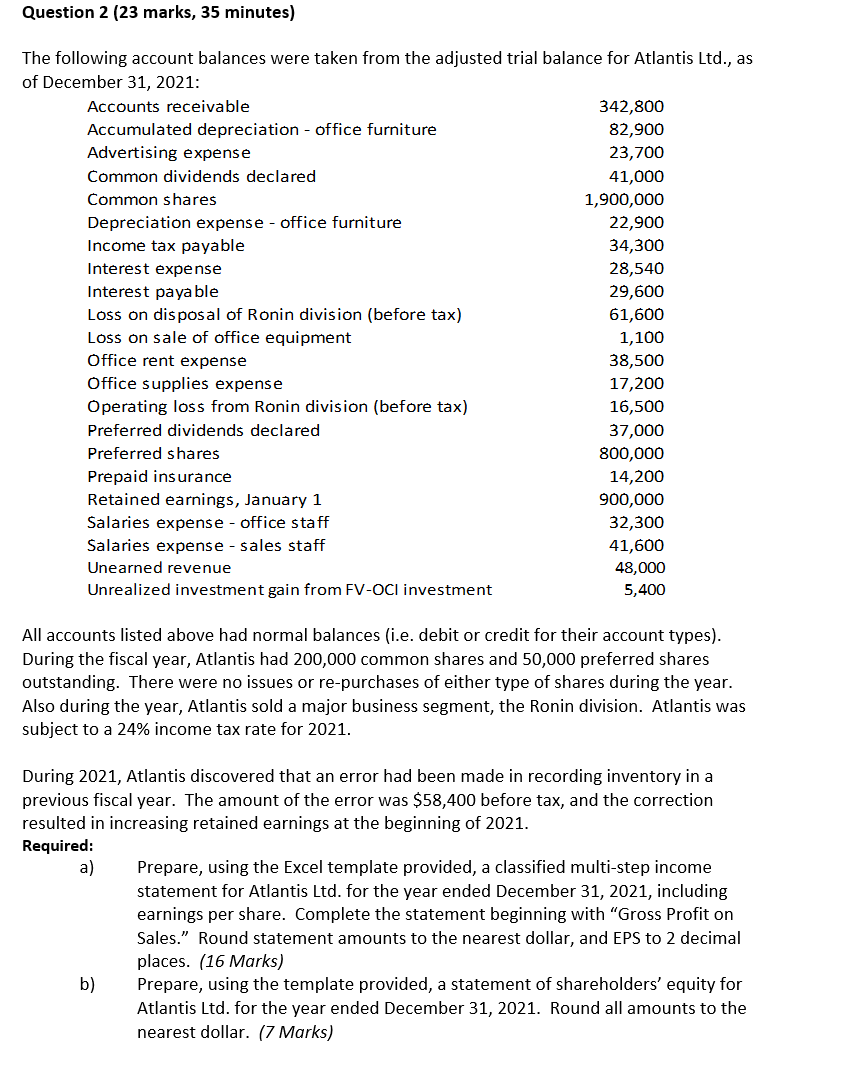

Question 2 (23 marks, 35 minutes) The following account balances were taken from the adjusted trial balance for Atlantis Ltd., as of December 31, 2021: Accounts receivable 342,800 Accumulated depreciation - Office furniture 82,900 Advertising expense 23,700 Common dividends declared 41,000 Common shares 1,900,000 Depreciation expense - office furniture 22,900 Income tax payable 34,300 Interest expense 28,540 Interest payable 29,600 Loss on disposal of Ronin division (before tax) 61,600 Loss on sale of office equipment 1,100 Office rent expense 38,500 Office supplies expense 17,200 Operating loss from Ronin division (before tax) 16,500 Preferred dividends declared 37,000 Preferred shares 800,000 Prepaid insurance 14,200 Retained earnings, January 1 900,000 Salaries expense - office staff 32,300 Salaries expense - sales staff 41,600 Unearned revenue 48,000 Unrealized investment gain from FV-OCl investment 5,400 All accounts listed above had normal balances (i.e. debit or credit for their account types). During the fiscal year, Atlantis had 200,000 common shares and 50,000 preferred shares outstanding. There were no issues or re-purchases of either type of shares during the year. Also during the year, Atlantis sold a major business segment, the Ronin division. Atlantis was subject to a 24% income tax rate for 2021. During 2021, Atlantis discovered that an error had been made in recording inventory in a previous fiscal year. The amount of the error was $58,400 before tax, and the correction resulted in increasing retained earnings at the beginning of 2021. Required: a) Prepare, using the Excel template provided, a classified multi-step income statement for Atlantis Ltd. for the year ended December 31, 2021, including earnings per share. Complete the statement beginning with "Gross Profit on Sales." Round statement amounts to the nearest dollar, and EPS to 2 decimal places. (16 Marks) b) Prepare, using the template provided, a statement of shareholders' equity for Atlantis Ltd. for the year ended December 31, 2021. Round all amounts to the nearest dollar. (7 Marks) Question 2 (23 marks, 35 minutes) The following account balances were taken from the adjusted trial balance for Atlantis Ltd., as of December 31, 2021: Accounts receivable 342,800 Accumulated depreciation - Office furniture 82,900 Advertising expense 23,700 Common dividends declared 41,000 Common shares 1,900,000 Depreciation expense - office furniture 22,900 Income tax payable 34,300 Interest expense 28,540 Interest payable 29,600 Loss on disposal of Ronin division (before tax) 61,600 Loss on sale of office equipment 1,100 Office rent expense 38,500 Office supplies expense 17,200 Operating loss from Ronin division (before tax) 16,500 Preferred dividends declared 37,000 Preferred shares 800,000 Prepaid insurance 14,200 Retained earnings, January 1 900,000 Salaries expense - office staff 32,300 Salaries expense - sales staff 41,600 Unearned revenue 48,000 Unrealized investment gain from FV-OCl investment 5,400 All accounts listed above had normal balances (i.e. debit or credit for their account types). During the fiscal year, Atlantis had 200,000 common shares and 50,000 preferred shares outstanding. There were no issues or re-purchases of either type of shares during the year. Also during the year, Atlantis sold a major business segment, the Ronin division. Atlantis was subject to a 24% income tax rate for 2021. During 2021, Atlantis discovered that an error had been made in recording inventory in a previous fiscal year. The amount of the error was $58,400 before tax, and the correction resulted in increasing retained earnings at the beginning of 2021. Required: a) Prepare, using the Excel template provided, a classified multi-step income statement for Atlantis Ltd. for the year ended December 31, 2021, including earnings per share. Complete the statement beginning with "Gross Profit on Sales." Round statement amounts to the nearest dollar, and EPS to 2 decimal places. (16 Marks) b) Prepare, using the template provided, a statement of shareholders' equity for Atlantis Ltd. for the year ended December 31, 2021. Round all amounts to the nearest dollar. (7 Marks)