Answered step by step

Verified Expert Solution

Question

1 Approved Answer

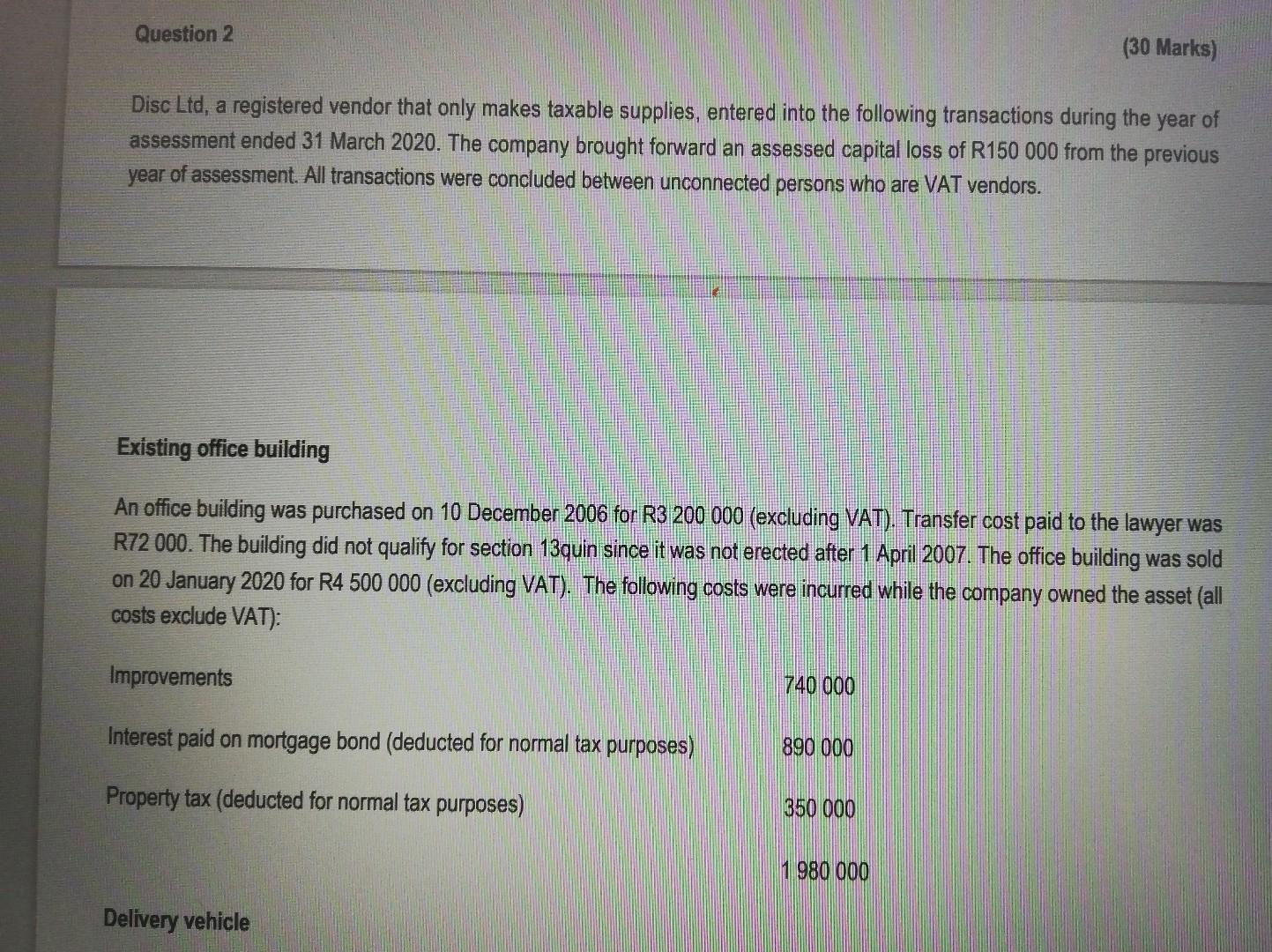

Question 2 (30 Marks) Disc Ltd, a registered vendor that only makes taxable supplies, entered into the following transactions during the year of assessment ended

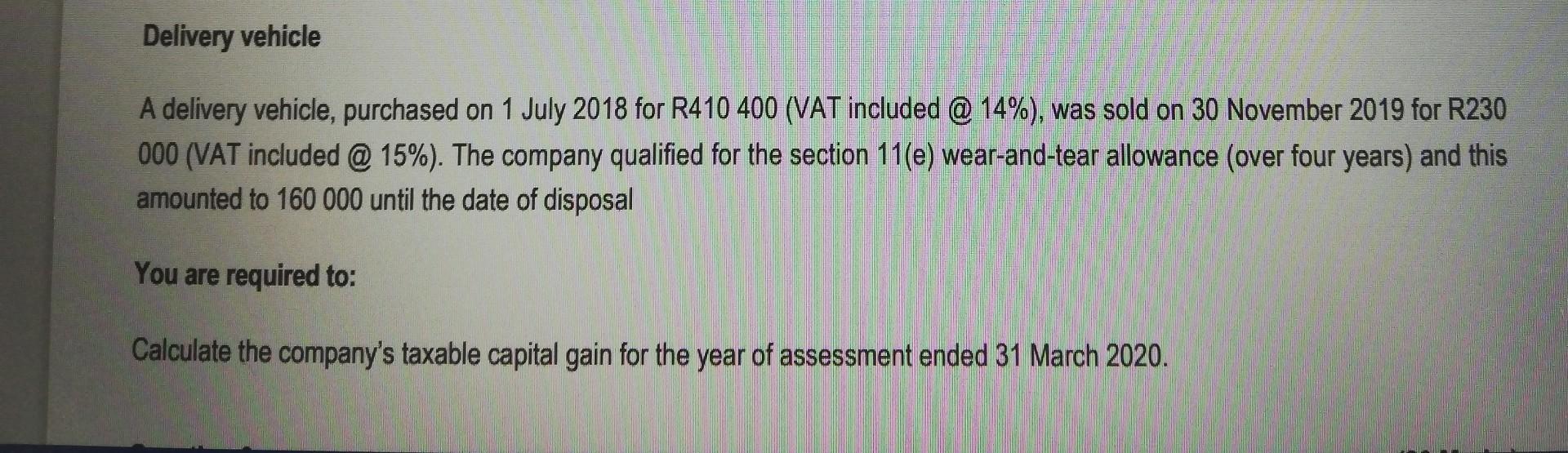

Question 2 (30 Marks) Disc Ltd, a registered vendor that only makes taxable supplies, entered into the following transactions during the year of assessment ended 31 March 2020. The company brought forward an assessed capital loss of R150 000 from the previous year of assessment. All transactions were concluded between unconnected persons who are VAT vendors. Existing office building An office building was purchased on 10 December 2006 for R3 200 000 (excluding VAT). Transfer cost paid to the lawyer was R72 000. The building did not qualify for section 13quin since it was not erected after 1 April 2007. The office building was sold on 20 January 2020 for R4 500 000 (excluding VAT). The following costs were incurred while the company owned the asset (all costs exclude VAT): Improvements 740 000 Interest paid on mortgage bond (deducted for normal tax purposes) 890 000 Property tax (deducted for normal tax purposes) 350 000 1 980 000 Delivery vehicle Delivery vehicle A delivery vehicle, purchased on 1 July 2018 for R410 400 (VAT included @ 14%), was sold on 30 November 2019 for R230 000 (VAT included @ 15%). The company qualified for the section 11(e) wear-and-tear allowance (over four years) and this amounted to 160 000 until the date of disposal You are required to: Calculate the company's taxable capital gain for the year of assessment ended 31 March 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started