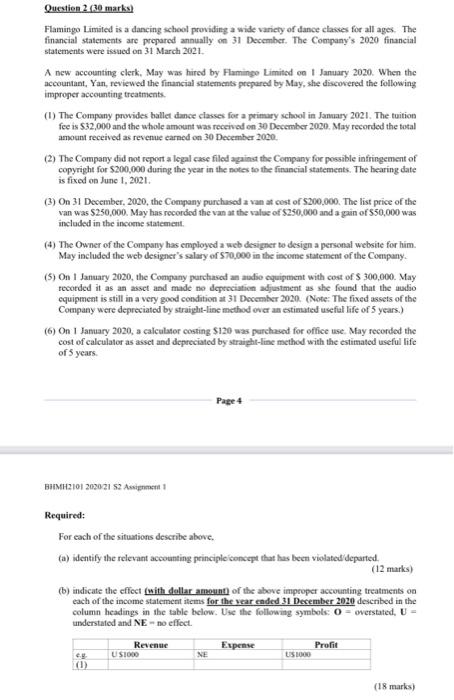

Question 2 (30 marks) Flamingo Limited is a dancing school providing a wide variety of dance classes for all ages. The financial statements are prepared annually on 31 December. The Company's 2020 financial statements were issued on 31 March 2021. A new accounting clerk. May was hired by Flamingo Limited on January 2020. When the accountant, Yan, reviewed the financial statements prepared by May, she discovered the following improper accounting treatments (1) The Company provides ballet dance classes for a primary school in January 2021. The tuition fee is $32,000 and the whole amount was received on 30 December 2020. May recorded the total amount received as revenue carned on 30 December 2020 (2) The Company did not report a legal case filed against the Company for possible infringement of copyright for $200,000 during the year in the notes to the financial statements. The hearing date is fixed on June 1, 2021 (3) On 31 December, 2020, the Company purchased a van a cost of $200,000. The list price of the van was $250,000. May has recorded the van at the value of $250,000 and a gain of $50,000 was included in the income statement. (4) The Owner of the Company has employed a web designer to design a personal website for him. May included the web designer's salary of S70,000 in the income statement of the Company. (5) On 1 January 2020, the Company purchased an audio equipment with cost of $ 300,000. May recorded it as an asset and made ne depreciation adjustment as she found that the audio equipment is still in a very good condition at 31 December 2020. (Note: The fixed assets of the Company were depreciated by straight-line method over an estimated useful life of 5 years.) (6) On 1 January 2020, a calculator costing $126 was purchased for office use May recorded the cost of calculator as asset and depreciated by straight-line method with the estimated useful life of 5 years Page 4 BHIMH2101 2020 21 S2 Assignment Required: For each of the situations describe above. (a) identify the relevant accounting principle concept that has been violated departed. (12 marks) (b) indicate the effect (with dollar amount of the above improper accounting treatments on each of the income statement items for the year ended 31 December 2020 described in the column headings in the table below. Use the following symbols: 0 = overstated, U = understated and NE - no effect. Revenue US1000 Expense Profit ce (1) NE USB (18 marks)