Answered step by step

Verified Expert Solution

Question

1 Approved Answer

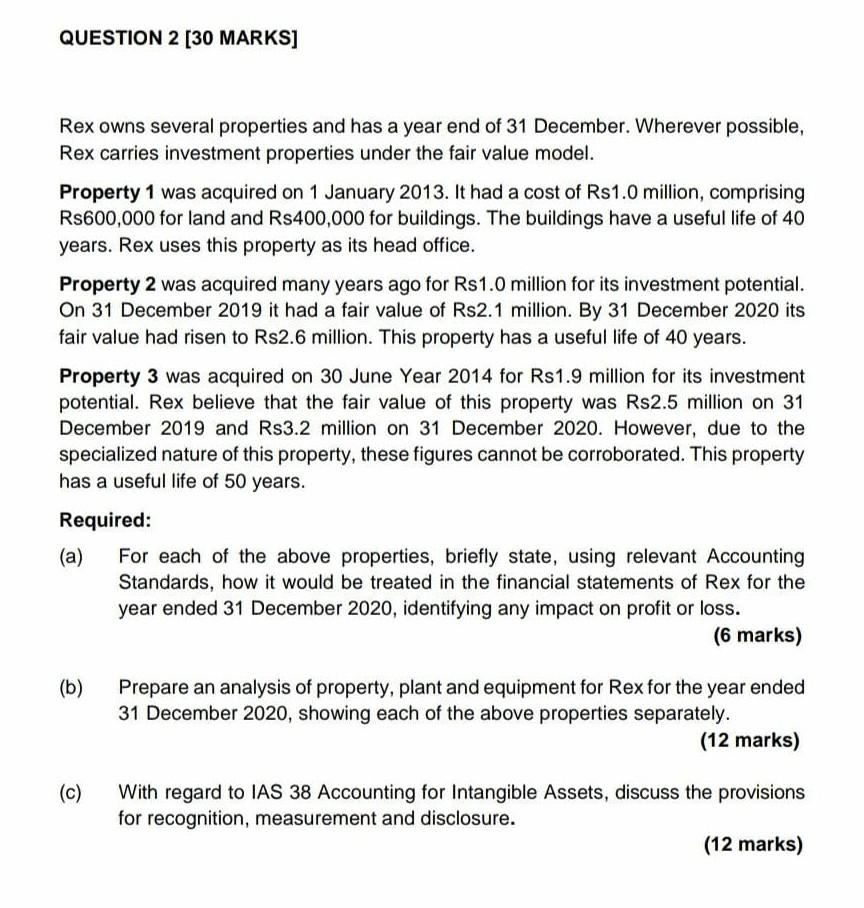

QUESTION 2 [30 MARKS] Rex owns several properties and has a year end of 31 December. Wherever possible, Rex carries investment properties under the fair

QUESTION 2 [30 MARKS] Rex owns several properties and has a year end of 31 December. Wherever possible, Rex carries investment properties under the fair value model. Property 1 was acquired on 1 January 2013. It had a cost of Rs1.0 million, comprising Rs600,000 for land and Rs400,000 for buildings. The buildings have a useful life of 40 years. Rex uses this property as its head office. Property 2 was acquired many years ago for Rs 1.0 million for its investment potential. On 31 December 2019 it had a fair value of Rs2.1 million. By 31 December 2020 its fair value had risen to Rs2.6 million. This property has a useful life of 40 years. Property 3 was acquired on 30 June Year 2014 for Rs1.9 million for its investment potential. Rex believe that the fair value of this property was Rs2.5 million on 31 December 2019 and Rs3.2 million on 31 December 2020. However, due to the specialized nature of this property, these figures cannot be corroborated. This property has a useful life of 50 years. Required: (a) For each of the above properties, briefly state, using relevant Accounting Standards, how it would be treated in the financial statements of Rex for the year ended 31 December 2020, identifying any impact on profit or loss. (6 marks) (b) Prepare an analysis of property, plant and equipment for Rex for the year ended 31 December 2020, showing each of the above properties separately. (12 marks) (c) With regard to IAS 38 Accounting for Intangible Assets, discuss the provisions for recognition, measurement and disclosure. (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started