Answered step by step

Verified Expert Solution

Question

1 Approved Answer

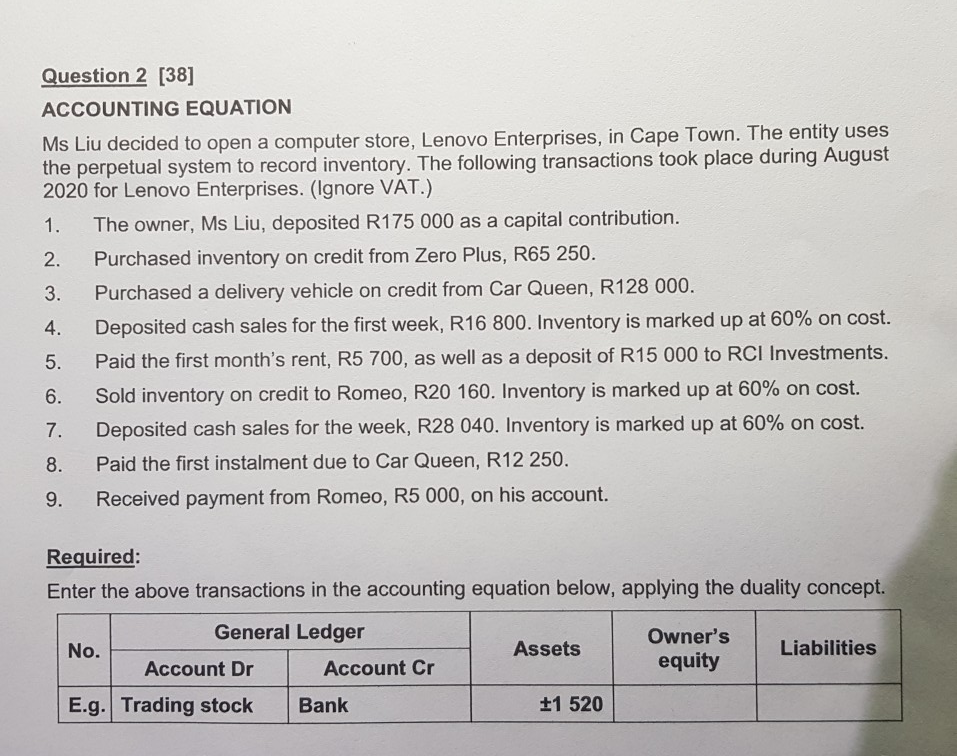

Question 2 [38] ACCOUNTING EQUATION Ms Liu decided to open a computer store, Lenovo Enterprises, in Cape Town. The entity uses the perpetual system to

Question 2 [38] ACCOUNTING EQUATION Ms Liu decided to open a computer store, Lenovo Enterprises, in Cape Town. The entity uses the perpetual system to record inventory. The following transactions took place during August 2020 for Lenovo Enterprises. (Ignore VAT.) 1. The owner, Ms Liu, deposited R175 000 as a capital contribution. 2. Purchased inventory on credit from Zero Plus, R65 250. 3. Purchased a delivery vehicle on credit from Car Queen, R128 000. 4. Deposited cash sales for the first week, R16 800. Inventory is marked up at 60% on cost. 5. Paid the first month's rent, R5 700, as well as a deposit of R15 000 to RCI Investments. 6. Sold inventory on credit to Romeo, R20 160. Inventory is marked up at 60% on cost. 7. Deposited cash sales for the week, R28 040. Inventory is marked up at 60% on cost. 8. Paid the first instalment due to Car Queen, R12 250. 9. Received payment from Romeo, R5 000, on his account. Required: Enter the above transactions in the accounting equation below, applying the duality concept. No. General Ledger Account Dr Account Cr Assets Owner's equity Liabilities E.g. Trading stock Bank +1 520

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started