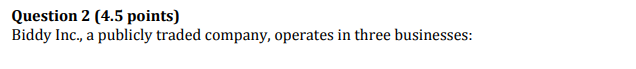

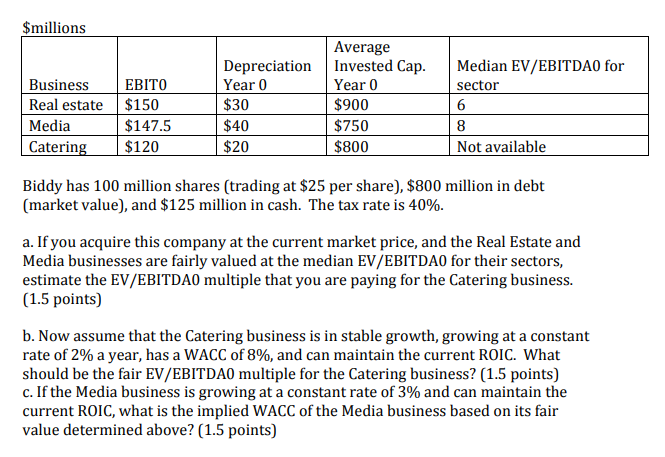

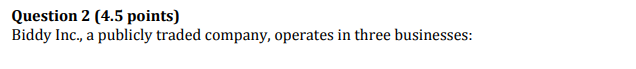

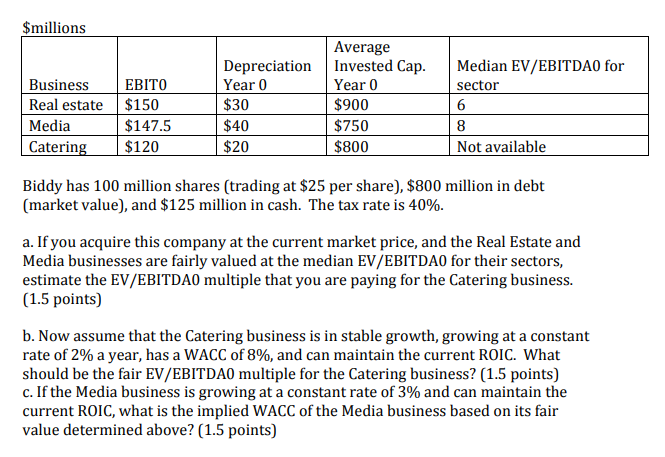

Question 2 (4.5 points) Biddy Inc., a publicly traded company, operates in three businesses: $millions Business EBITO Real estate $150 Media $147.5 Catering $120 Depreciation Year 0 $30 $40 $20 Average Invested Cap. Year 0 $900 $750 $800 Median EV/EBITDAO for sector 6 8 Not available Biddy has 100 million shares (trading at $25 per share), $800 million in debt (market value), and $125 million in cash. The tax rate is 40%. a. If you acquire this company at the current market price, and the Real Estate and Media businesses are fairly valued at the median EV/EBITDA0 for their sectors, estimate the EV/EBITDAO multiple that you are paying for the Catering business. (1.5 points) b. Now assume that the Catering business is in stable growth, growing at a constant rate of 2% a year, has a WACC of 8%, and can maintain the current ROIC. What should be the fair EV/EBITDAO multiple for the Catering business? (1.5 points) c. If the Media business is growing at a constant rate of 3% and can maintain the current ROIC, what is the implied WACC of the Media business based on its fair value determined above? (1.5 points) Question 2 (4.5 points) Biddy Inc., a publicly traded company, operates in three businesses: $millions Business EBITO Real estate $150 Media $147.5 Catering $120 Depreciation Year 0 $30 $40 $20 Average Invested Cap. Year 0 $900 $750 $800 Median EV/EBITDAO for sector 6 8 Not available Biddy has 100 million shares (trading at $25 per share), $800 million in debt (market value), and $125 million in cash. The tax rate is 40%. a. If you acquire this company at the current market price, and the Real Estate and Media businesses are fairly valued at the median EV/EBITDA0 for their sectors, estimate the EV/EBITDAO multiple that you are paying for the Catering business. (1.5 points) b. Now assume that the Catering business is in stable growth, growing at a constant rate of 2% a year, has a WACC of 8%, and can maintain the current ROIC. What should be the fair EV/EBITDAO multiple for the Catering business? (1.5 points) c. If the Media business is growing at a constant rate of 3% and can maintain the current ROIC, what is the implied WACC of the Media business based on its fair value determined above? (1.5 points)