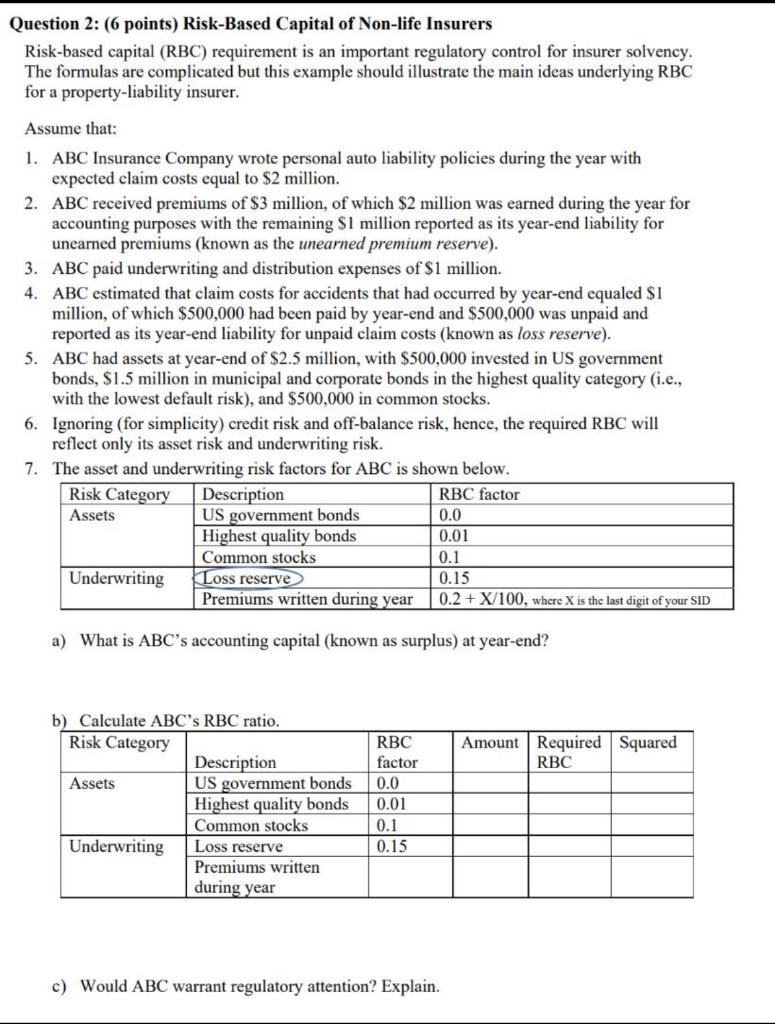

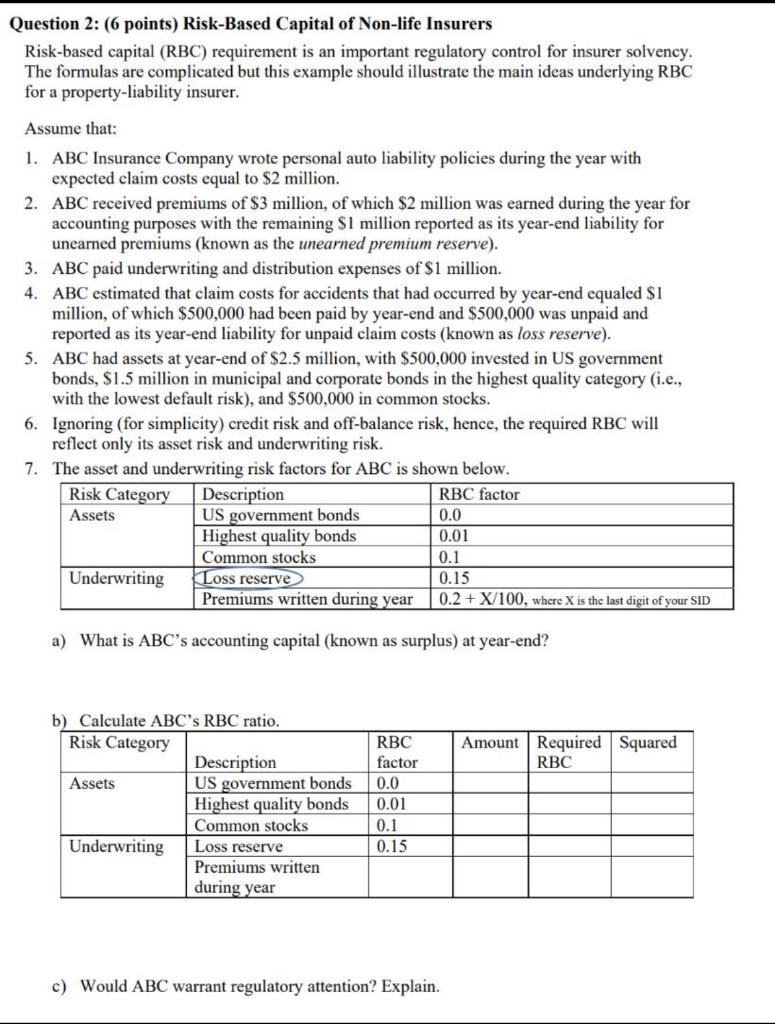

Question 2: (6 points) Risk-Based Capital of Non-life Insurers Risk-based capital (RBC) requirement is an important regulatory control for insurer solvency. The formulas are complicated but this example should illustrate the main ideas underlying RBC for a property-liability insurer. Assume that: 1. ABC Insurance Company wrote personal auto liability policies during the year with expected claim costs equal to $2 million. 2. ABC received premiums of $3 million, of which $2 million was earned during the year for accounting purposes with the remaining $1 million reported as its year-end liability for unearned premiums (known as the unearned premium reserve). 3. ABC paid underwriting and distribution expenses of $1 million. 4. ABC estimated that claim costs for accidents that had occurred by year-end equaled $1 million, of which $500,000 had been paid by year-end and $500,000 was unpaid and reported as its year-end liability for unpaid claim costs (known as loss reserve). 5. ABC had assets at year-end of $2.5 million, with $500,000 invested in US government bonds, $1.5 million in municipal and corporate bonds in the highest quality category (i.e., with the lowest default risk), and $500,000 in common stocks. 6. Ignoring (for simplicity) credit risk and off-balance risk, hence, the required RBC will reflect only its asset risk and underwriting risk. 7. The asset and underwriting risk factors for ABC is shown below. a) What is ABC's accounting capital (known as surplus) at year-end? c) Would ABC warrant regulatory attention? Explain. Question 2: (6 points) Risk-Based Capital of Non-life Insurers Risk-based capital (RBC) requirement is an important regulatory control for insurer solvency. The formulas are complicated but this example should illustrate the main ideas underlying RBC for a property-liability insurer. Assume that: 1. ABC Insurance Company wrote personal auto liability policies during the year with expected claim costs equal to $2 million. 2. ABC received premiums of $3 million, of which $2 million was earned during the year for accounting purposes with the remaining $1 million reported as its year-end liability for unearned premiums (known as the unearned premium reserve). 3. ABC paid underwriting and distribution expenses of $1 million. 4. ABC estimated that claim costs for accidents that had occurred by year-end equaled $1 million, of which $500,000 had been paid by year-end and $500,000 was unpaid and reported as its year-end liability for unpaid claim costs (known as loss reserve). 5. ABC had assets at year-end of $2.5 million, with $500,000 invested in US government bonds, $1.5 million in municipal and corporate bonds in the highest quality category (i.e., with the lowest default risk), and $500,000 in common stocks. 6. Ignoring (for simplicity) credit risk and off-balance risk, hence, the required RBC will reflect only its asset risk and underwriting risk. 7. The asset and underwriting risk factors for ABC is shown below. a) What is ABC's accounting capital (known as surplus) at year-end? c) Would ABC warrant regulatory attention? Explain