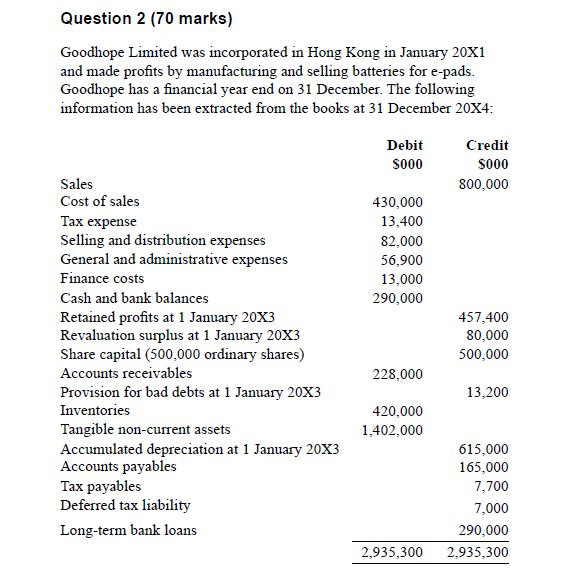

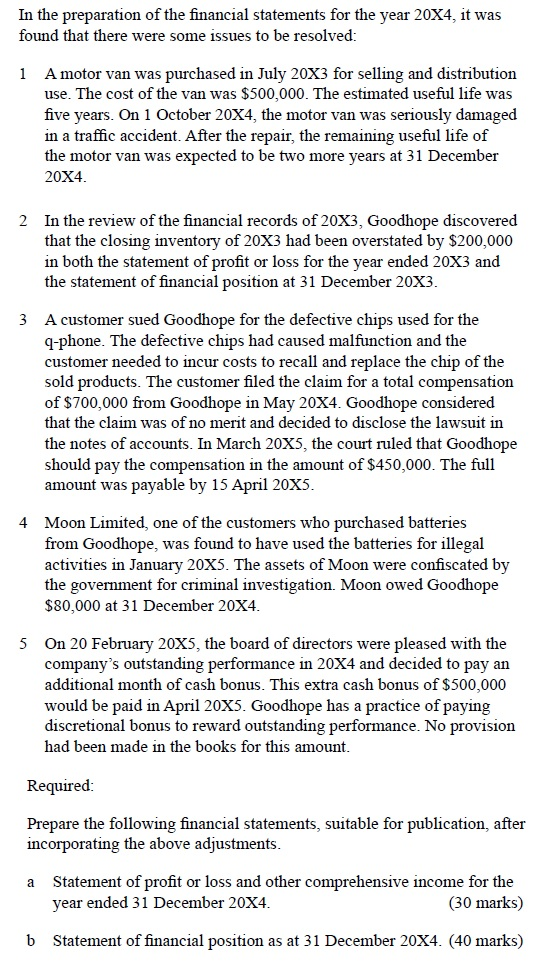

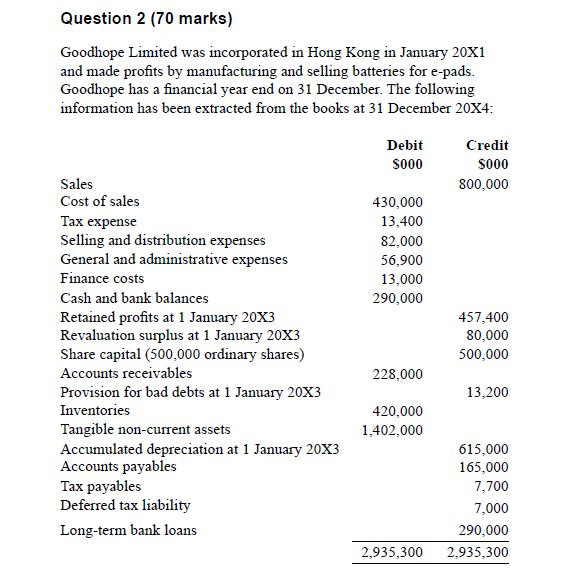

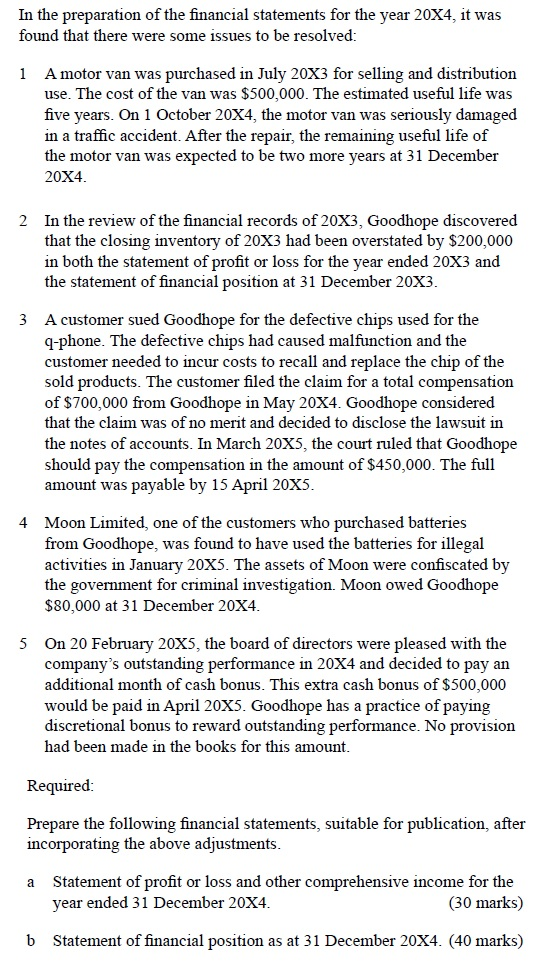

Question 2 (70 marks) Goodhope Limited was incorporated in Hong Kong in January 20X1 and made profits by manufacturing and selling batteries for e-pads. Goodhope has a financial year end on 31 December. The following information has been extracted from the books at 31 December 20X4: Debit S000 Credit 9000 800,000 430,000 13,400 82,000 56,900 13,000 290,000 Sales Cost of sales Tax expense Selling and distribution expenses General and administrative expenses Finance costs Cash and bank balances Retained profits at 1 January 20X3 Revaluation surplus at 1 January 20X3 Share capital (500,000 ordinary shares) Accounts receivables Provision for bad debts at 1 January 20X3 Inventories Tangible non-current assets Accumulated depreciation at 1 January 20X3 Accounts payables Tax payables Deferred tax liability Long-term bank loans 457,400 80,000 500,000 228,000 13,200 420,000 1,402.000 615,000 165,000 7,700 7,000 290.000 2,935,300 2,935,300 In the preparation of the financial statements for the year 20X4, it was found that there were some issues to be resolved: 1 A motor van was purchased in July 20X3 for selling and distribution use. The cost of the van was $500,000. The estimated useful life was five years. On 1 October 20X4, the motor van was seriously damaged in a traffic accident. After the repair, the remaining useful life of the motor van was expected to be two more years at 31 December 20X4. 2 In the review of the financial records of 20X3, Goodhope discovered that the closing inventory of 20X3 had been overstated by $200,000 in both the statement of profit or loss for the year ended 20X3 and the statement of financial position at 31 December 20X3. 3 A customer sued Goodhope for the defective chips used for the q-phone. The defective chips had caused malfunction and the customer needed to incur costs to recall and replace the chip of the sold products. The customer filed the claim for a total compensation of $700,000 from Goodhope in May 20X4. Goodhope considered that the claim was of no merit and decided to disclose the lawsuit in the notes of accounts. In March 20X5, the court ruled that Goodhope should pay the compensation in the amount of $450,000. The full amount was payable by 15 April 20X5. 4 Moon Limited, one of the customers who purchased batteries from Goodhope, was found to have used the batteries for illegal activities in January 20X5. The assets of Moon were confiscated by the government for criminal investigation. Moon owed Goodhope $80,000 at 31 December 20X4. 5 On 20 February 20X5, the board of directors were pleased with the company's outstanding performance in 20X4 and decided to pay an additional month of cash bonus. This extra cash bonus of $500,000 would be paid in April 20X5. Goodhope has a practice of paying discretional bonus to reward outstanding performance. No provision had been made in the books for this amount. Required: Prepare the following financial statements, suitable for publication, after incorporating the above adjustments. a Statement of profit or loss and other comprehensive income for the year ended 31 December 20X4. (30 marks) b Statement of financial position as at 31 December 20X4. (40 marks)