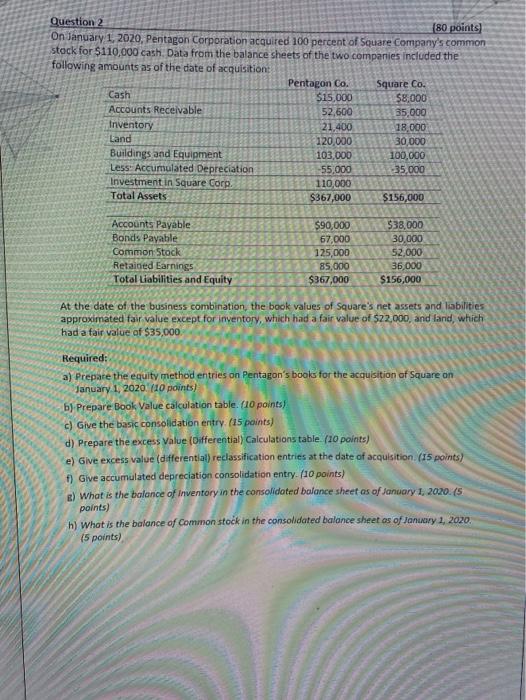

Question 2 (80 points) On January 1, 2020, Pentagon Corporation acquired 100 percent of Square Company's common stack for $110,000 cash Data from the balance sheets of the two companies included the following amounts as of the date of acquisition Pentagon Co. Square Co. Cash $15,000 $8,000 Accounts Receivable 52,600 35,000 Inventory 21,400 18.000 Land 120,000 30,000 Buildings and Equipment 103,000 100,000 Less: Accumulated Depreciation 55,000 35 000 Investment in Square Corp. 110,000 Total Assets $367,000 $156,000 Accounts Payable Bonds Payable Common Stock Retained Earnings Total Liabilities and Equity $90,000 67,000 125,000 85,000 $367,000 $38,000 30,000 52.000 36,000 $156,000 At the date of the business combination, the book values of Square's net assets and liabilities approximated fair value except for inventory, which had a fair value of $22,000, and farid, which had a fair value of $35,000 Required: a) Prepare the equity method entries on Pentagon's books for the acquisition of Square on January 1, 2020 110 points) b) Prepare Book Value calculation table. (10 points) c) Give the basic consolidation entry (15 points) d) Prepare the excess Value (Oifferential) Calculations table. (10 points) e) Give excess value (differential) reclassification entries at the date of acquisition. (15 points) f) Give accumulated depreciation consolidation entry. (10 points) c) What is the balance of inventory in the consolidated balance sheet as of January 1, 2020. (5 points) h) What is the balance of common stock in the consolidated balance sheet as of January 1, 2020. (5 points) Question 2 (80 points) On January 1, 2020, Pentagon Corporation acquired 100 percent of Square Company's common stack for $110,000 cash Data from the balance sheets of the two companies included the following amounts as of the date of acquisition Pentagon Co. Square Co. Cash $15,000 $8,000 Accounts Receivable 52,600 35,000 Inventory 21,400 18.000 Land 120,000 30,000 Buildings and Equipment 103,000 100,000 Less: Accumulated Depreciation 55,000 35 000 Investment in Square Corp. 110,000 Total Assets $367,000 $156,000 Accounts Payable Bonds Payable Common Stock Retained Earnings Total Liabilities and Equity $90,000 67,000 125,000 85,000 $367,000 $38,000 30,000 52.000 36,000 $156,000 At the date of the business combination, the book values of Square's net assets and liabilities approximated fair value except for inventory, which had a fair value of $22,000, and farid, which had a fair value of $35,000 Required: a) Prepare the equity method entries on Pentagon's books for the acquisition of Square on January 1, 2020 110 points) b) Prepare Book Value calculation table. (10 points) c) Give the basic consolidation entry (15 points) d) Prepare the excess Value (Oifferential) Calculations table. (10 points) e) Give excess value (differential) reclassification entries at the date of acquisition. (15 points) f) Give accumulated depreciation consolidation entry. (10 points) c) What is the balance of inventory in the consolidated balance sheet as of January 1, 2020. (5 points) h) What is the balance of common stock in the consolidated balance sheet as of January 1, 2020. (5 points)