Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 AF Ltd has requested your help in preparing their financial statements as they are unsure of the new requirements of NZ IFRS

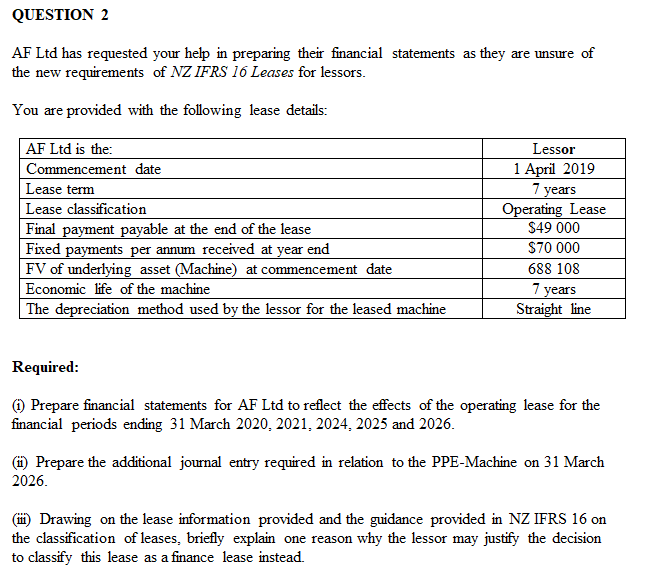

QUESTION 2 AF Ltd has requested your help in preparing their financial statements as they are unsure of the new requirements of NZ IFRS 16 Leases for lessors. You are provided with the following lease details: AF Ltd is the: Commencement date Lease term Lease classification Final payment payable at the end of the lease Fixed payments per annum received at year end FV of underlying asset (Machine) at commencement date Economic life of the machine The depreciation method used by the lessor for the leased machine Lessor 1 April 2019 7 years Operating Lease $49 000 $70 000 688 108 7 years Straight line Required: (i) Prepare financial statements for AF Ltd to reflect the effects of the operating lease for the financial periods ending 31 March 2020, 2021, 2024, 2025 and 2026. (ii) Prepare the additional journal entry required in relation to the PPE-Machine on 31 March 2026. Drawing on the lease information provided and the guidance provided in NZ IFRS 16 on the classification of leases, briefly explain one reason why the lessor may justify the decision to classify this lease as a finance lease instead.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started