Question

Question #2. (Answer d - i please as they all correlate with each other) Assume that there are two economies (Washington and California), two goods

Question #2. (Answer d - i please as they all correlate with each other)

Assume that there are two economies (Washington and California), two goods (apples and iPods), and two factors (land and labor). The return to land T is the rental rate r and the return to labor L is the wage rate w. Washington is land-abundant, while California is labor-abundant. Apple production is land-intensive, while iPod production is labor-intensive. Let the relative price of apples be p = Papple / Pipod.

Need help understanding how to plot the lines on the diagram. Please explain the answers.

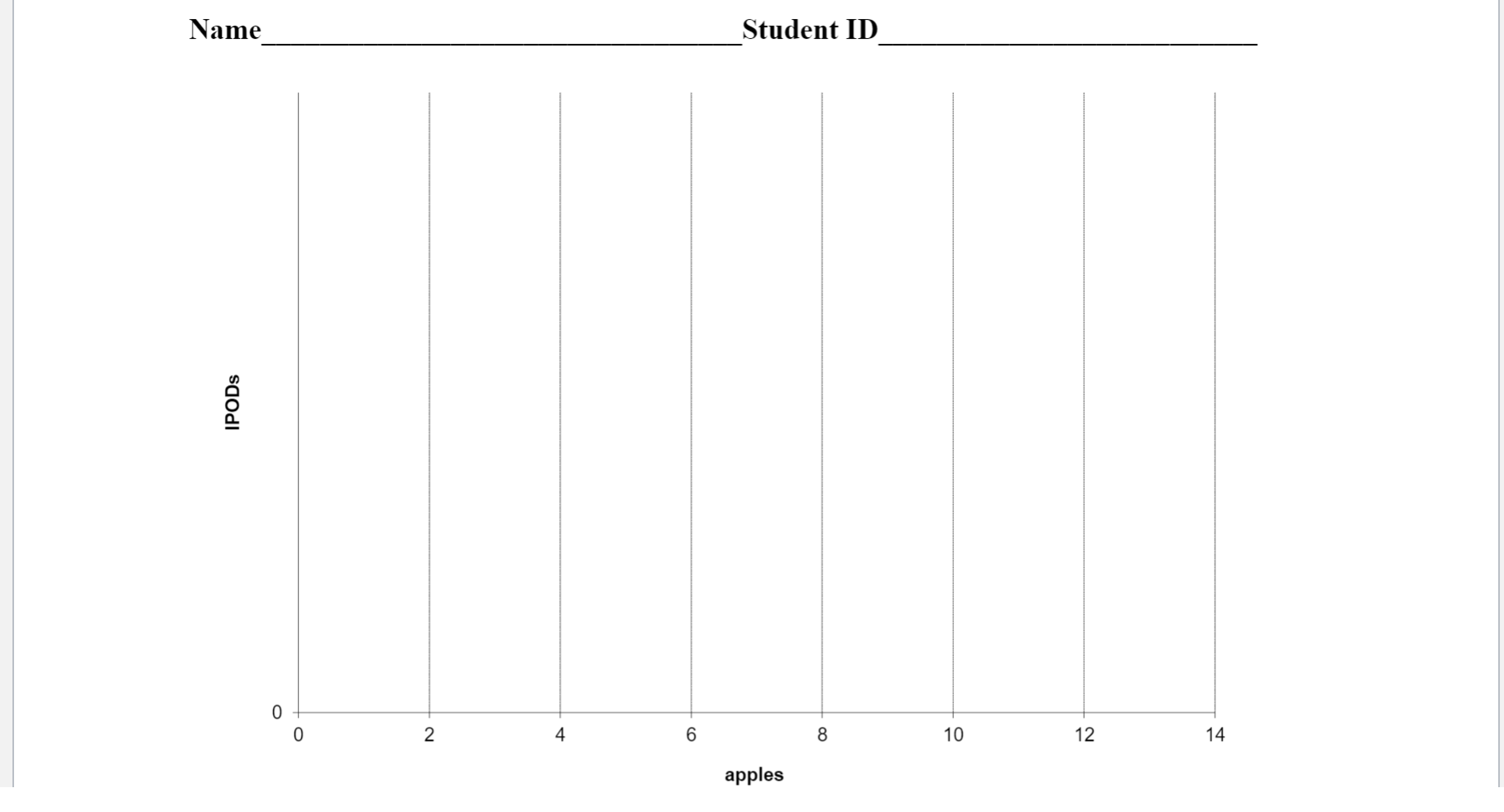

d. Assume that Washington can produce a maximum of 12 apples OR a maximum of 4 iPods. In the above graph, draw the production possibility schedule for Washington (with increasing opportunity cost).

e. Assume that California can produce a maximum of 8 apples OR a maximum of 12 iPods. In the above graph, draw the production possibility schedule for California (with increasing opportunity cost).

f. Assume that under autarky that each country produces and consumes at the intersection of the production possibilities schedules. Indicate this point with an A.

g. Using the above diagram, draw in the world relative price line under trade. Indicate the trade equilibrium for Washington with a T and California

with a T'

h. Under trade, explain which country is producing more apples and fewer iPods and which country is producing more iPods and fewer apples.

i.Explain why the result in part h is consistent with the Heckscher-Ohlin Theorem.

Name Student ID IPODs 0 2 4 6 8 10 12 14 apples Name Student ID IPODs 0 2 4 6 8 10 12 14 applesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started