Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question #2 (below) *Thank you to those who help me answer these questions.* Required information [The following information applies to the questions displayed below.] The

Question #2 (below)

*Thank you to those who help me answer these questions.*

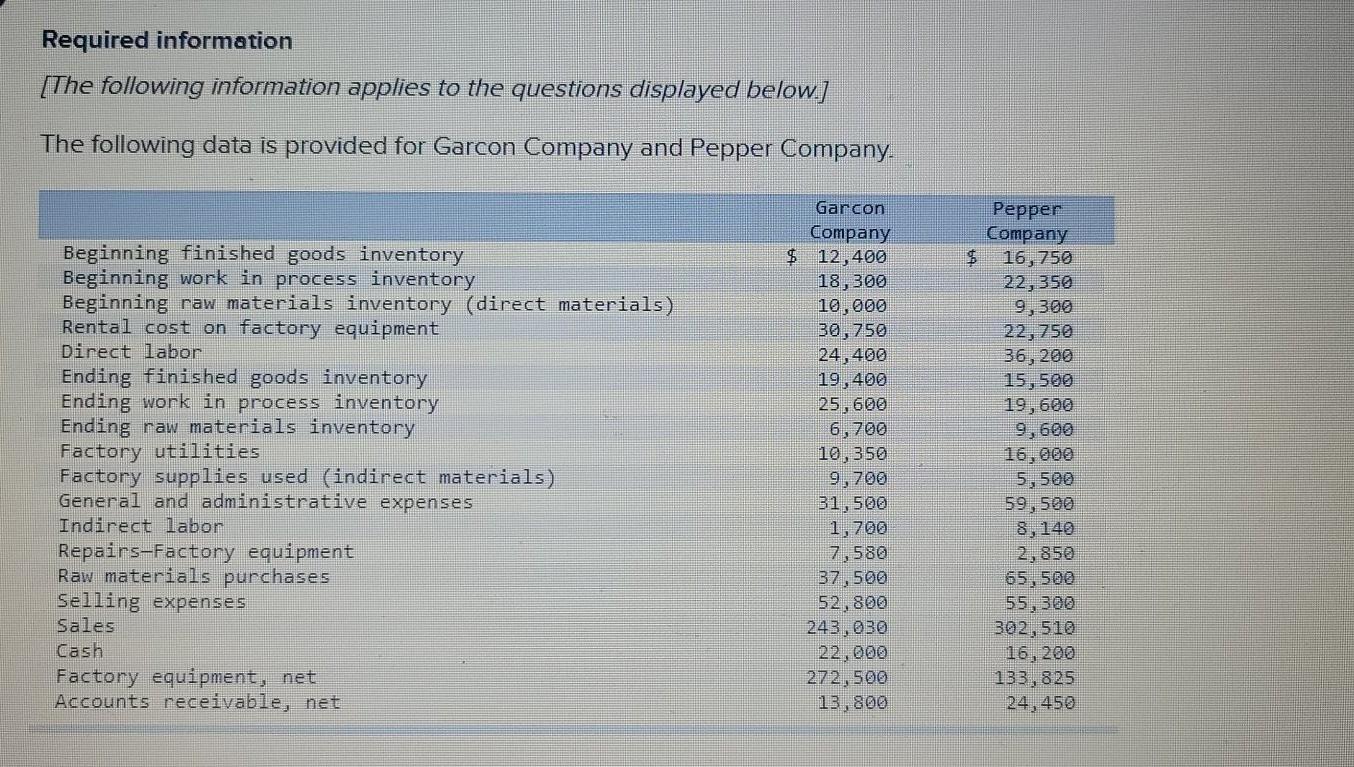

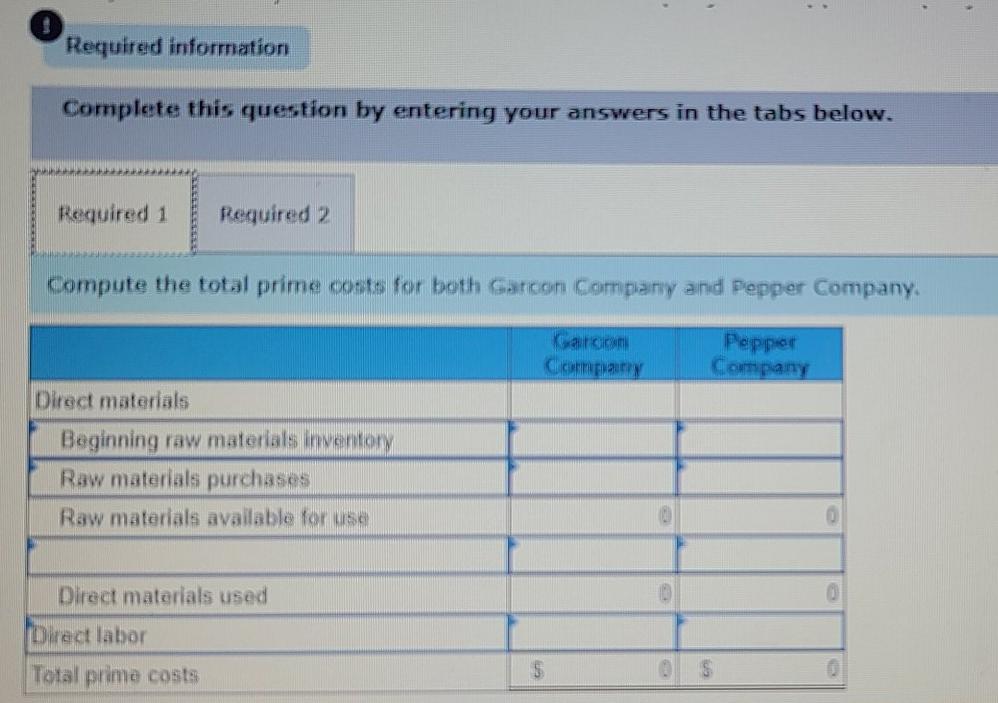

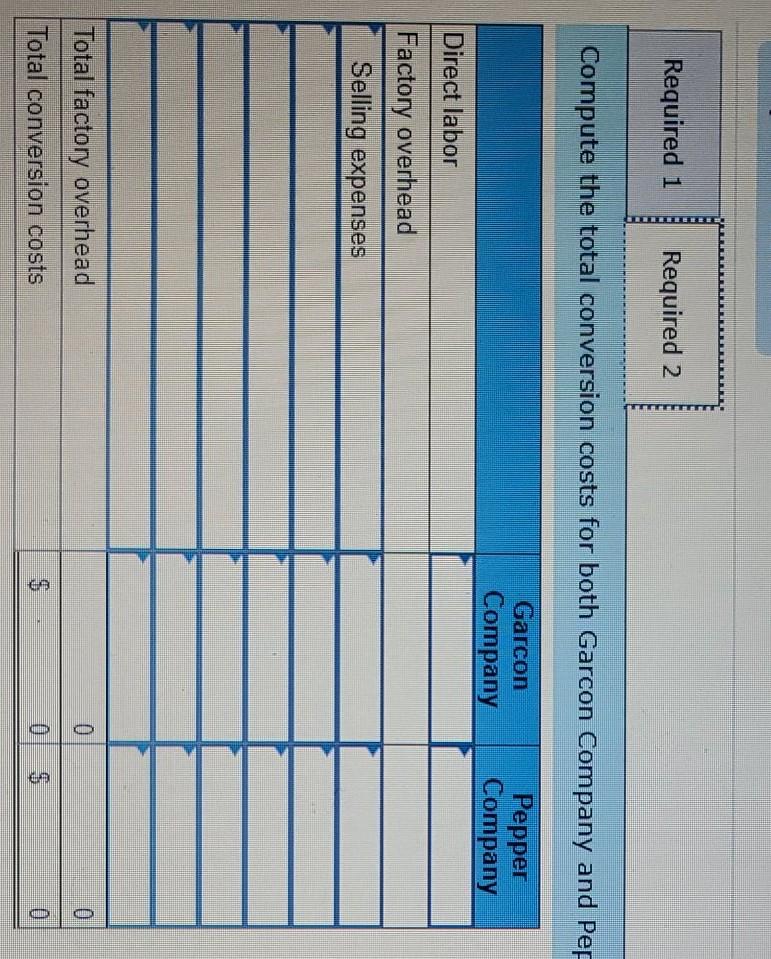

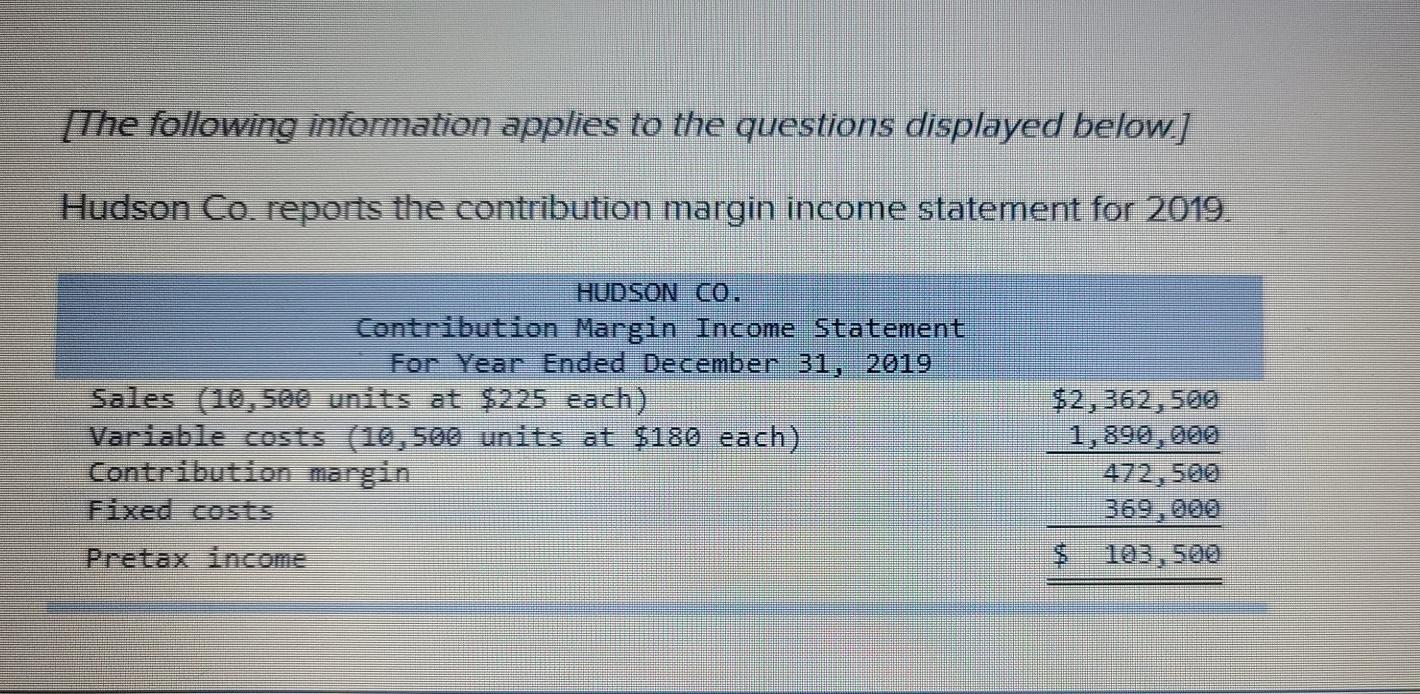

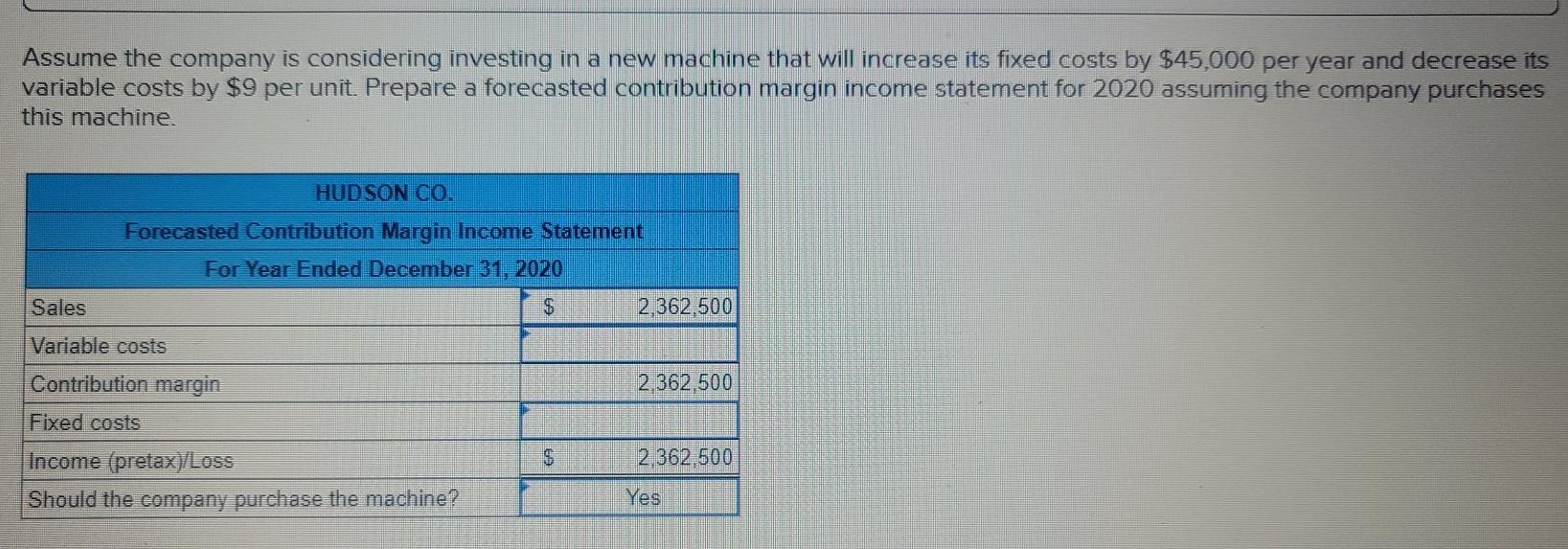

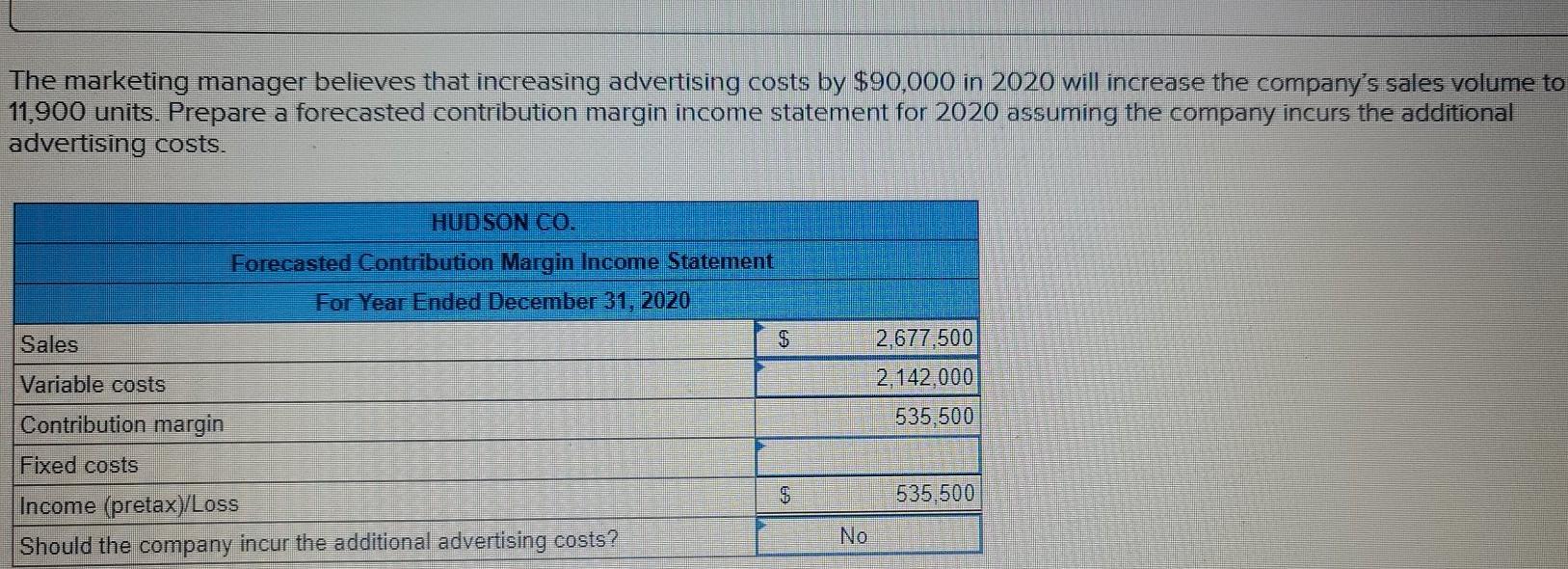

Required information [The following information applies to the questions displayed below.] The following data is provided for Garcon Company and Pepper Company. Beginning finished goods inventory Beginning work in process inventory Beginning raw materials inventory (direct materials) Rental cost on factory equipment Direct labor Ending finished goods inventory Ending work in process inventory Ending raw materials inventory Factory utilities Factory supplies used (indirect materials) General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Factory equipment, net Accounts receivable, net Garcon Company $ 12,400 18,300 10,000 30, 750 24,400 19,400 25,600 6,700 10, 350 9, 700 31,500 1,700 7,580 37,500 52,800 243,030 22,000 272,500 13,800 Pepper Company $ 16,750 22,350 9, 300 22,750 36, 200 15,500 19,600 9,600 16,800 5, 580 59,500 8,140 2,850 65,500 55,300 302, 510 16, 200 133,825 24,450 Required information Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the total prime costs for both Garcon Company and Pepper Company. Kauno Company Pepper Company Direct materials Beginning raw materials inventory Raw materials purchases Raw materials available for use Direct materials used Dract labor Total prime costs 5 S Required 1 Required 2 Compute the total conversion costs for both Garcon Company and Pep Garcon Company Pepper Company Direct labor Factory overhead Selling expenses Total factory overhead 0 0 Total conversion costs $ 0 GE 0 [The following information applies to the questions displayed below.) Hudson Co. reports the contribution margin income statement for 2019. HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (10,580 units at $225 each) Variable costs (10,500 units at $180 each) Contribution margin Fixed costs Pretax income $2,362,500 1,890,000 472,500 369,800 $ 103,520 Assume the company is considering investing in a new machine that will increase its fixed costs by $45,000 per year and decrease its variable costs by $9 per unit. Prepare a forecasted contribution margin income statement for 2020 assuming the company purchases this machine. HUDSON CO. Forecasted Contribution Margin Income Statement For Year Ended December 31, 2020 Sales $ 2,362,500 Variable costs Contribution margin 2.362,500 Fixed costs Income (pretax)/Loss $ 2 362,500 Should the company purchase the machine? Yes The marketing manager believes that increasing advertising costs by $90,000 in 2020 will increase the company's sales volume to 11,900 units. Prepare a forecasted contribution margin income statement for 2020 assuming the company incurs the additional advertising costs. HUDSON CO. Forecasted Contribution Margin Income Statement For Year Ended December 31, 2020 S Sales Variable costs 2,677.500 2,142,000 535,500 Contribution margin Fixed costs Income (pretax)/Loss Should the company incur the additional advertising costs? 535,500 NoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started