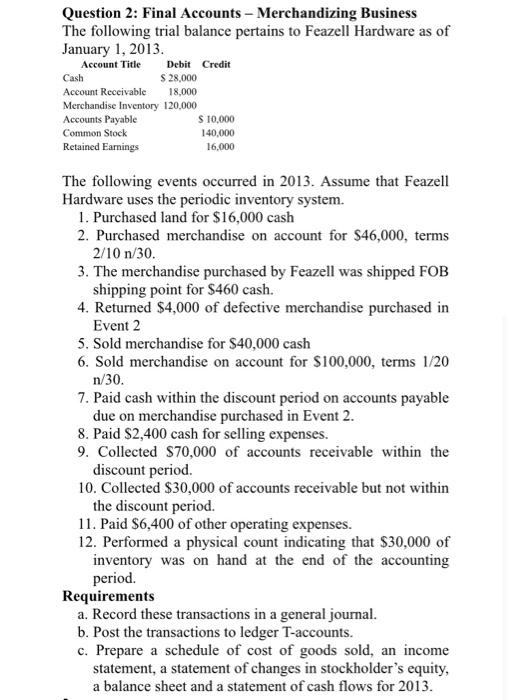

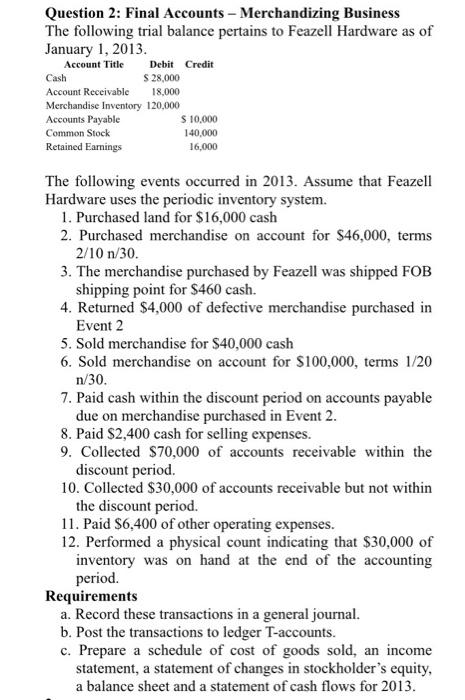

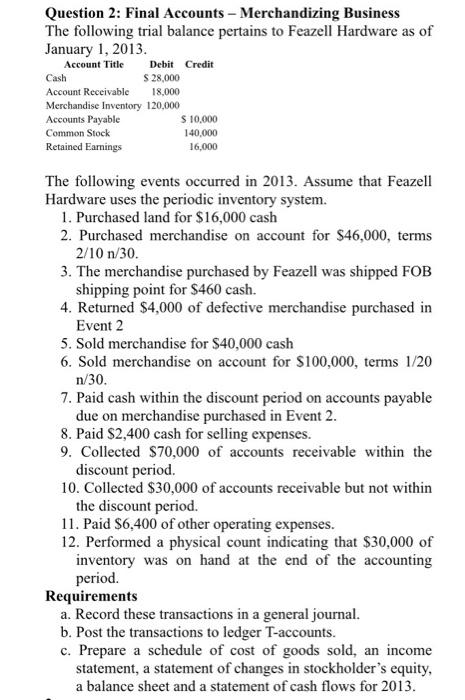

Question 2: Final Accounts - Merchandizing Business The following trial balance pertains to Feazell Hardware as of January 1, 2013 Account Title Debit Credit Cash $ 28,000 Account Receivable 18,000 Merchandise Inventory 120,000 Accounts Payable S 10,000 Common Stock 140,000 Retained Earnings 16,000 The following events occurred in 2013. Assume that Feazell Hardware uses the periodic inventory system. 1. Purchased land for $16,000 cash 2. Purchased merchandise on account for $46,000, terms 2/10 n/30 3. The merchandise purchased by Feazell was shipped FOB shipping point for $460 cash. 4. Returned $4,000 of defective merchandise purchased in Event 2 5. Sold merchandise for $40,000 cash 6. Sold merchandise on account for $100,000, terms 1/20 n/30. 7. Paid cash within the discount period on accounts payable due on merchandise purchased in Event 2. 8. Paid $2,400 cash for selling expenses. 9. Collected $70,000 of accounts receivable within the discount period. 10. Collected $30,000 of accounts receivable but not within the discount period. 11. Paid $6,400 of other operating expenses. 12. Performed a physical count indicating that $30,000 of inventory was on hand at the end of the accounting period. Requirements a. Record these transactions in a general journal. b. Post the transactions to ledger T-accounts. c. Prepare a schedule of cost of goods sold, an income statement, a statement of changes in stockholder's equity, a balance sheet and a statement of cash flows for 2013. Question 2: Final Accounts - Merchandizing Business The following trial balance pertains to Feazell Hardware as of January 1, 2013 Account Title Debit Credit Cash $ 28,000 Account Receivable 18,000 Merchandise Inventory 120,000 Accounts Payable S 10,000 Common Stock 140,000 Retained Earnings 16,000 The following events occurred in 2013. Assume that Feazell Hardware uses the periodic inventory system. 1. Purchased land for $16,000 cash 2. Purchased merchandise on account for $46,000, terms 2/10 n/30. 3. The merchandise purchased by Feazell was shipped FOB shipping point for $460 cash. 4. Returned $4,000 of defective merchandise purchased in Event 2 5. Sold merchandise for $40,000 cash 6. Sold merchandise on account for $100,000, terms 1/20 n/30. 7. Paid cash within the discount period on accounts payable due on merchandise purchased in Event 2. 8. Paid $2,400 cash for selling expenses. 9. Collected $70,000 of accounts receivable within the discount period. 10. Collected $30,000 of accounts receivable but not within the discount period. 11. Paid $6,400 of other operating expenses. 12. Performed a physical count indicating that $30,000 of inventory was on hand at the end of the accounting period. Requirements a. Record these transactions in a general journal. b. Post the transactions to ledger T-accounts. c. Prepare a schedule of cost of goods sold, an income statement, a statement of changes in stockholder's equity, a balance sheet and a statement of cash flows for 2013