Answered step by step

Verified Expert Solution

Question

1 Approved Answer

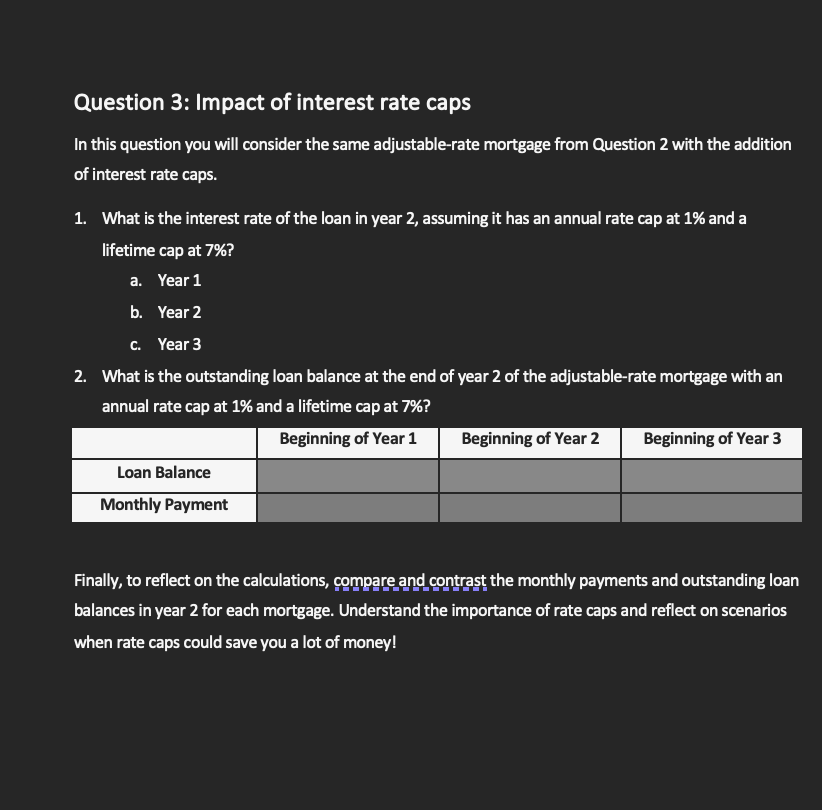

Question 2 : Forecasting ARM rates Question 3 : Impact of interest rate caps In this question you will consider the same adjustable - rate

Question : Forecasting ARM rates Question : Impact of interest rate caps

In this question you will consider the same adjustablerate mortgage from Question with the addition

of interest rate caps.

What is the interest rate of the loan in year assuming it has an annual rate cap at and a

lifetime cap at

a Year

b Year

c Year

What is the outstanding loan balance at the end of year of the adjustablerate mortgage with an

annual rate cap at and a lifetime cap at

Finally, to reflect on the calculations, compare and contrast the monthly payments and outstanding loan

balances in year for each mortgage. Understand the importance of rate caps and reflect on scenarios

when rate caps could save you a lot of money! Question : Forecasting ARM rates

Adjustablerate mortgage amortized over years, with an LTV of and a teaser rate. The

margin rate for this loan is and the index rate is Assume the index rate increases to

at the beginning of year Early repayment charges apply within the first years of the loan at of the

outstanding balance. The property you're looking at is priced at $ignore acquisition fees

What is the interest rate on this loan in the following years:

a Year

b Year

c Year

To fill in the table, calculate the monthly payment and the outstanding loan balance of the ARM at

the beginning of year year and year

Calculate the repayment charges if the property was sold after years.

Adjustablerate mortgage amortized over years, with an LTV of and a teaser rate. The margin rate for this loan is and the index rate is Assume the index rate increases to at the beginning of year Early repayment charges apply within the first years of the loan at of the outstanding balance. The property youre looking at is priced at $ignore acquisition fees

What is the interest rate on this loan in the following years:

a Year

b Year

c Year

To fill in the table, calculate the monthly payment and the outstanding loan balance of the ARM at the beginning of year year and year

Beginning of Year Beginning of Year Beginning of Year

Loan Balance

Monthly Payment

Calculate the repayment charges if the property was sold after years.

Question : Impact of interest rate caps

In this question you will consider the same adjustablerate mortgage from Question with the addition of interest rate caps.

What is the interest rate of the loan in year assuming it has an annual rate cap at and a lifetime cap at

a Year

b Year

c Year

What is the outstanding loan balance at the end of year of the adjustablerate mortgage with an annual rate cap at and a lifetime cap at

Beginning of Year Beginning of Year Beginning of Year

Loan Balance

Monthly Payment

Finally, to reflect on the calculations, compare and contrast the monthly payments and outstanding loan balances in year for each mortgage. Understand the importance of rate caps and reflect on scenarios when rate caps could save you a lot of money!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started