Answered step by step

Verified Expert Solution

Question

1 Approved Answer

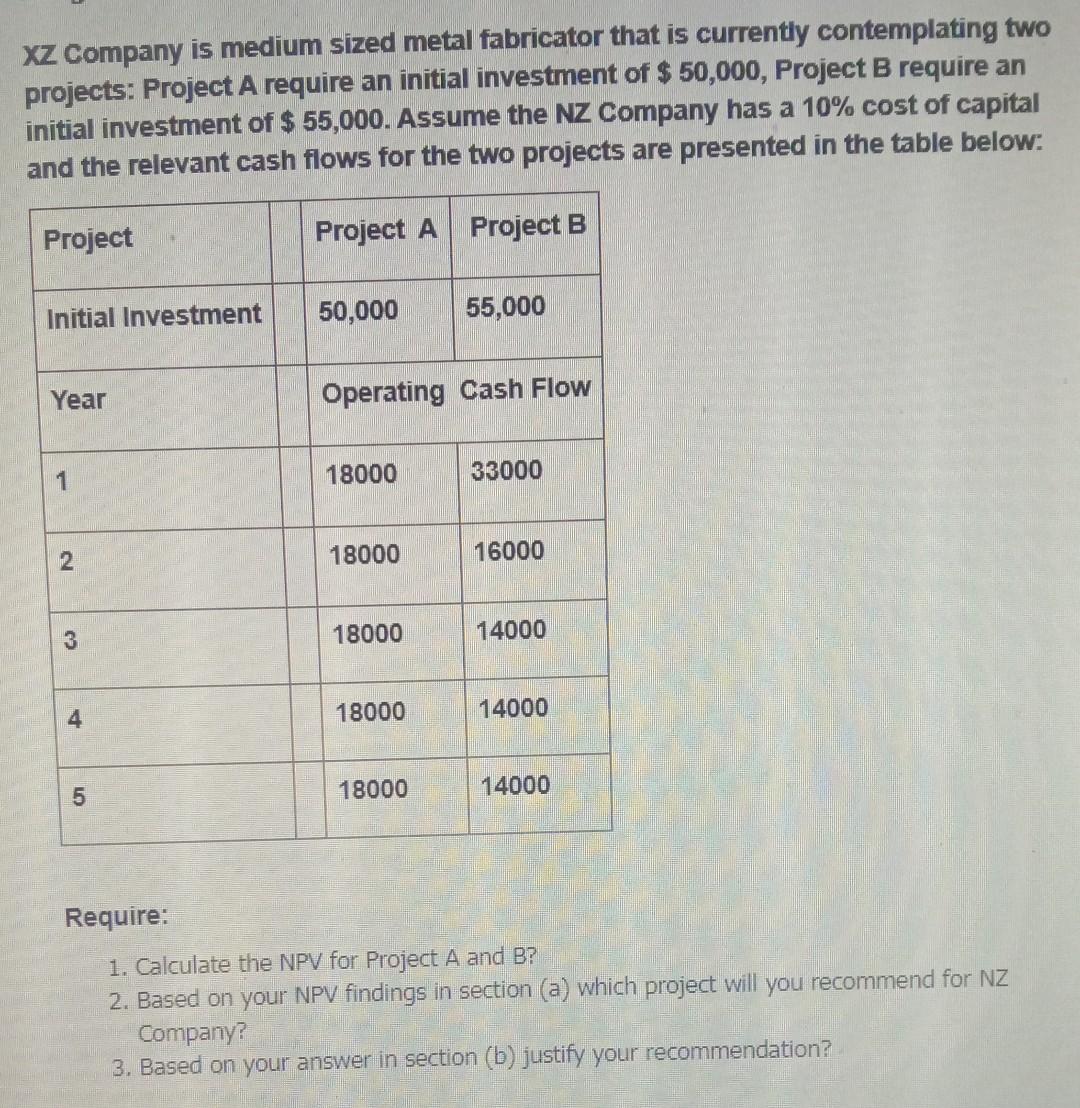

Xz Company is medium sized metal fabricator that is currently contemplating two projects: Project A require an initial investment of $50,000, Project B require an

Xz Company is medium sized metal fabricator that is currently contemplating two projects: Project A require an initial investment of $50,000, Project B require an initial investment of $55,000. Assume the NZ Company has a 10% cost of capital and the relevant cash flows for the two projects are presented in the table below: Require: 1. Calculate the NPV for Project A and B? 2. Based on your NPV findings in section (a) which project will you recommend for NZ Company? 3. Based on your answer in section (b) justify your recommendation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started