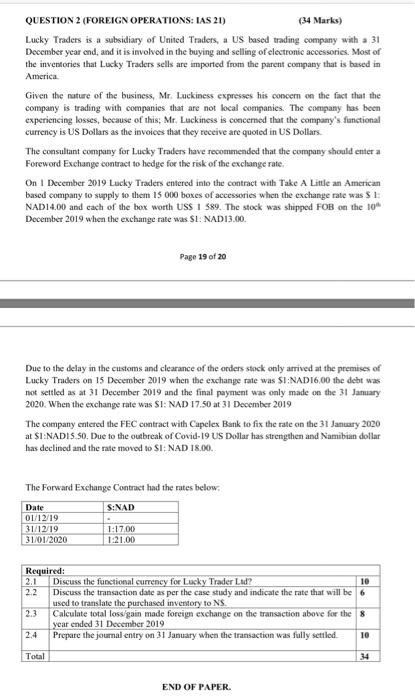

QUESTION 2 (FOREIGN OPERATIONS: IAS 21) (34 Marks) Lucky Traders is a subsidiary of United Traders, a US based trading company with a 31 December year end, and it is involved in the buying and selling of electronic accessories. Most of the inventories that Lucky Traders sells are imported from the parent company that is based in America Given the nature of the business, Mr. Luckiness expresses his concem on the fact that the company is trading with companies that are not local companies. The company has been experiencing losses, because of this: Mr. Luckiness is concerned that the company's functional currency is US Dollars as the invoices that they receive are quoted in US Dollars. The consultant company for Lucky Traders have recommended that the company should enter a Foreword Exchange contract to hedge for the risk of the exchange rate. On 1 December 2019 Lucky Traders entered into the contract with Take A Little an American based company to supply to them 15 000 boxes of accessories when the exchange rate was $ 1: NAD14.00 and each of the box worth USS 1 589. The stock was shipped FOB on the 10% December 2019 when the exchange rate was $I: NAD13.00. Page 19 of 20 Due to the delay in the customs and clearance of the orders stock only arrived at the premises of Lucky Traders on 15 December 2019 when the exchange rate was SI:NAD 16.00 the debt was not settled as at 31 December 2019 and the final payment was only made on the 31 January 2020. When the exchange rate was SI: NAD 17.50 at 31 December 2019 The company entered the FEC contract with Capelex Bank to fix the rate on the 31 January 2020 at $1:NADIS.50. Due to the outbreak of Cavid-19 US Dollar has strengthen and Namibian dollar has declined and the rate moved to $I: NAD 18.00. The Forward Exchange Contract had the rates below: Date S:NAD 01/12/19 31/12/19 1:17.00 31/01/2020 1:21.00 Required: 2.1 Discuss the functional currency for Lucky Trader Lid? 10 2.2 Discuss the transaction date as per the case study and indicate the rate that will be 6 used to translate the purchased inventory to NS. 2.3 Calculate total loss/gain made foreign exchange on the transaction above for the 8 year ended 31 December 2019 2.4 Prepare the journal entry on 31 January when the transaction was fully settled. 10 Total END OF PAPER