QUESTION 2:

Great Adventures Problem AP2-1 Part 1

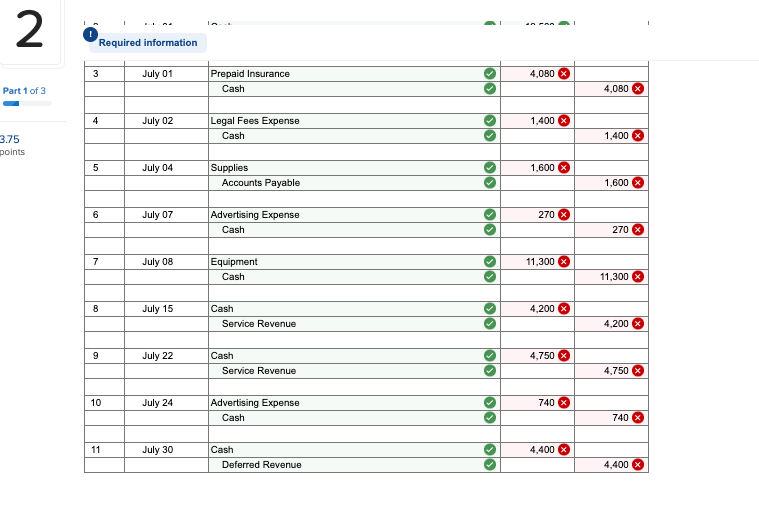

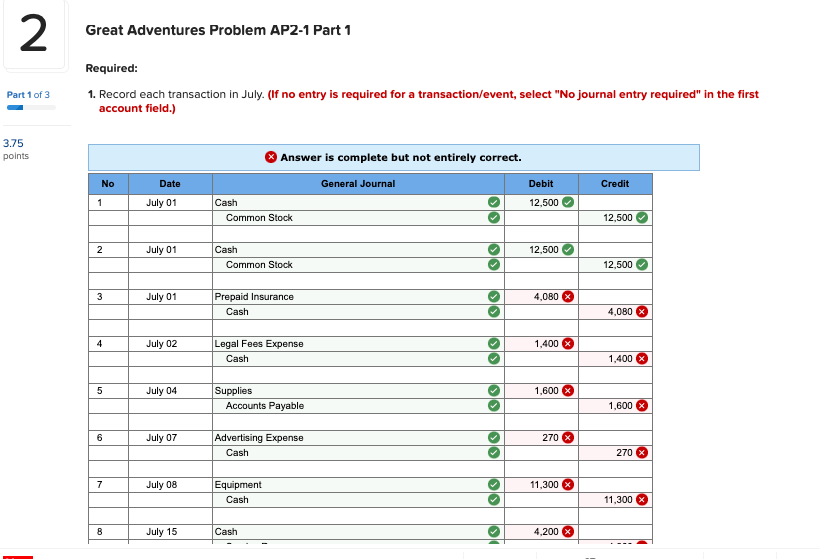

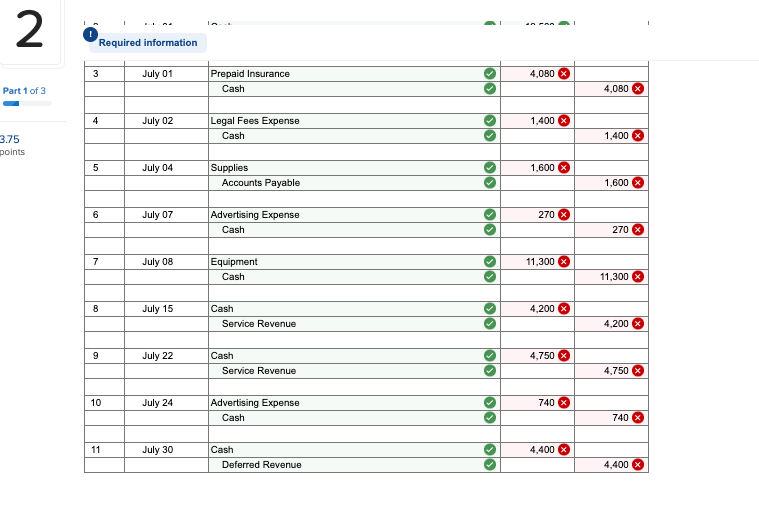

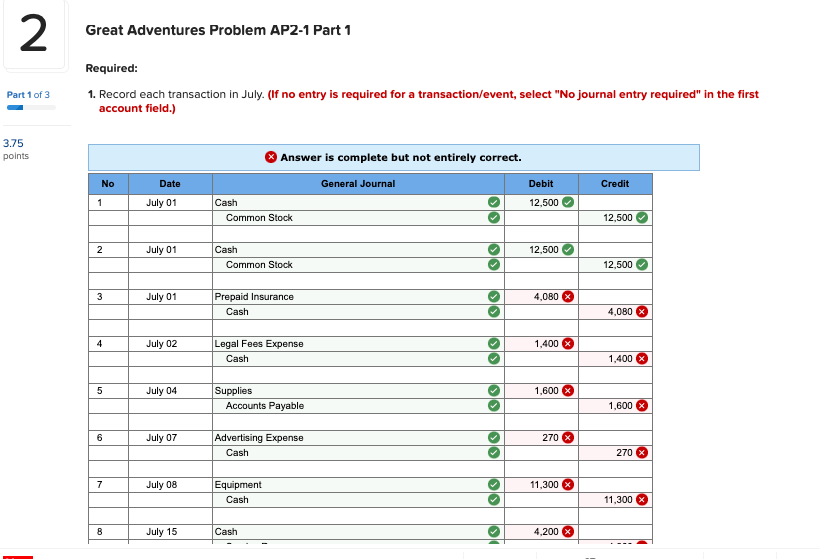

- Record each transaction in July. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Required:

- Record each transaction in July. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

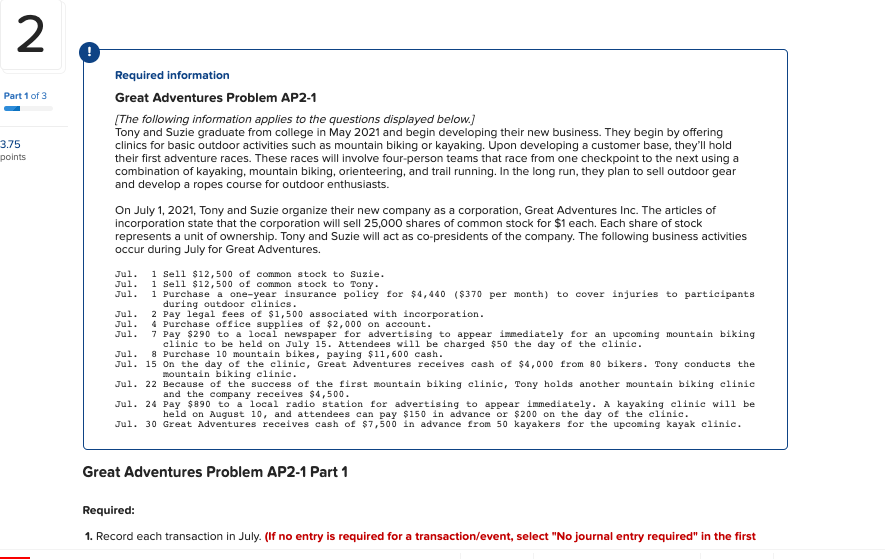

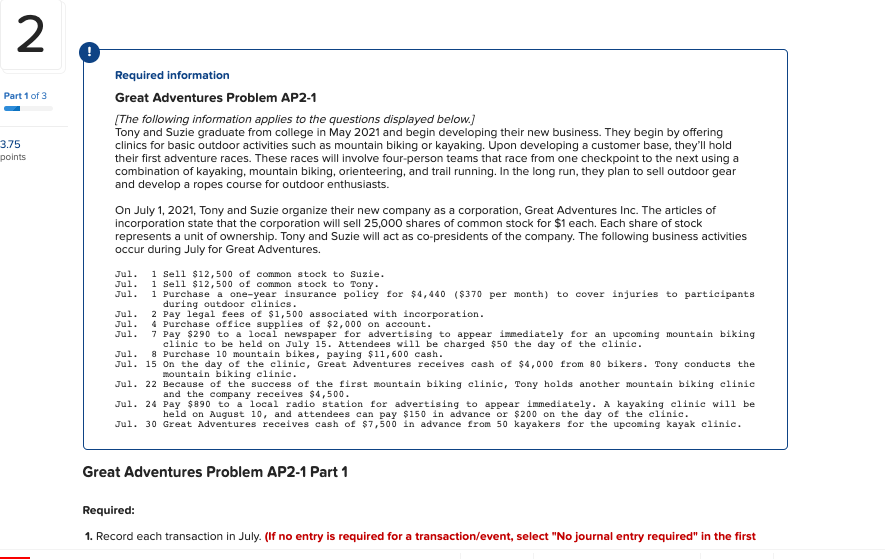

2 Part 1 of 3 3.75 points Required information Great Adventures Problem AP2-1 [The following information applies to the questions displayed below.) Tony and Suzie graduate from college in May 2021 and begin developing their new business. They begin by offering clinics for basic outdoor activities such as mountain biking or kayaking. Upon developing a customer base, they'll hold their first adventure races. These races will involve four-person teams that race from one checkpoint to the next using a combination of kayaking, mountain biking, orienteering, and trail running. In the long run, they plan to sell outdoor gear and develop a ropes course for outdoor enthusiasts. On July 1, 2021, Tony and Suzie organize their new company as a corporation, Great Adventures Inc. The articles of incorporation state that the corporation will sell 25,000 shares of common stock for $1 each. Each share of stock represents a unit of ownership. Tony and Suzie will act as co-presidents of the company. The following business activities occur during July for Great Adventures. Jul. 1 Sell $12,500 of common stock to Suzie. Jul. 1 Sell $12,500 of common stock to Tony. Jul. i Purchase a one-year insurance policy for $4,440 ($370 per month) to cover injuries to participants during outdoor clinics. Jul. 2 Pay legal fees of $1,500 associated with incorporation. Jul. 4 Purchase office supplies of $2,000 on account. Jul. 7 Pay $290 to a local newspaper for advertising to appear immediately for an upcoming mountain biking clinic to be held on July 15. Attendees will be charged $50 the day of the clinic. Jul. & Purchase 10 mountain bikes, paying $11,600 cash. Jul. 15 on the day of the clinic, Great Adventures receives cash of $4,000 from 80 bikers. Tony conducts the mountain biking clinic. Jul. 22 Because of the success of the first mountain biking clinic, Tony holds another mountain biking clinic and the company receives $4,500. Jul. 24 Pay $890 to a local radio station for advertising to appear immediately. A kayaking clinic will be held on August 10, and attendees can pay $150 in advance or $200 on the day of the elinie. Jul. 30 Great Adventures receives cash of $7,500 in advance from 50 kayakers for the upcoming kayak clinic. Great Adventures Problem AP2-1 Part 1 Required: 1. Record each transaction in July. (If no entry is required for a transaction/event, select "No journal entry required" in the first 2 Required information 3 July 01 4,080 Prepaid Insurance Cash Olo Part 1 of 3 4,080 X 4 July 02 1,400 Legal Fees Expense Cash OO 1.400 X 3.75 points 5 July 04 1,600 x Supplies Accounts Payable OO 1,600 X 6 July 07 270 Advertising Expense Cash OO 270 7 July 08 11,300 Equipment Cash OO 11,300 x 8 July 15 4,200 Cash Service Revenue lolo 4,200 x 9 July 22 4,750 X Cash Service Revenue OO 4,750 10 July 24 Advertising Expense Cash lo 740 X 740 11 July 30 4,400 Cash Deferred Revenue OO 4,400 x 2 Great Adventures Problem AP2-1 Part 1 Required: 1. Record each transaction in July (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Part 1 of 3 3.75 points Answer is complete but not entirely correct. No Date General Journal Debit Credit 1 July 01 12,500 Cash Common Stock 12,500 2 July 01 12,500 Cash Common Stock OO 12,500 3 July 01 4,080 X Prepaid Insurance Cash go 4,080 4 July 02 1,400 Legal Fees Expense Cash OO 1,400 5 July 04 1,600 Supplies Accounts Payable go 1.600 x 6 July 07 270 Advertising Expense Cash OO 270 X 7 July 08 Equipment Cash OS 11,300 11,300 8 July 15 Cash . 4,200