Question

Question 2 Incorrect Mark 0.00 out of 5.56 Recording Income Tax Expense Alexa Inc. recorded the following deferred tax amounts. Dec. 31, Year 1

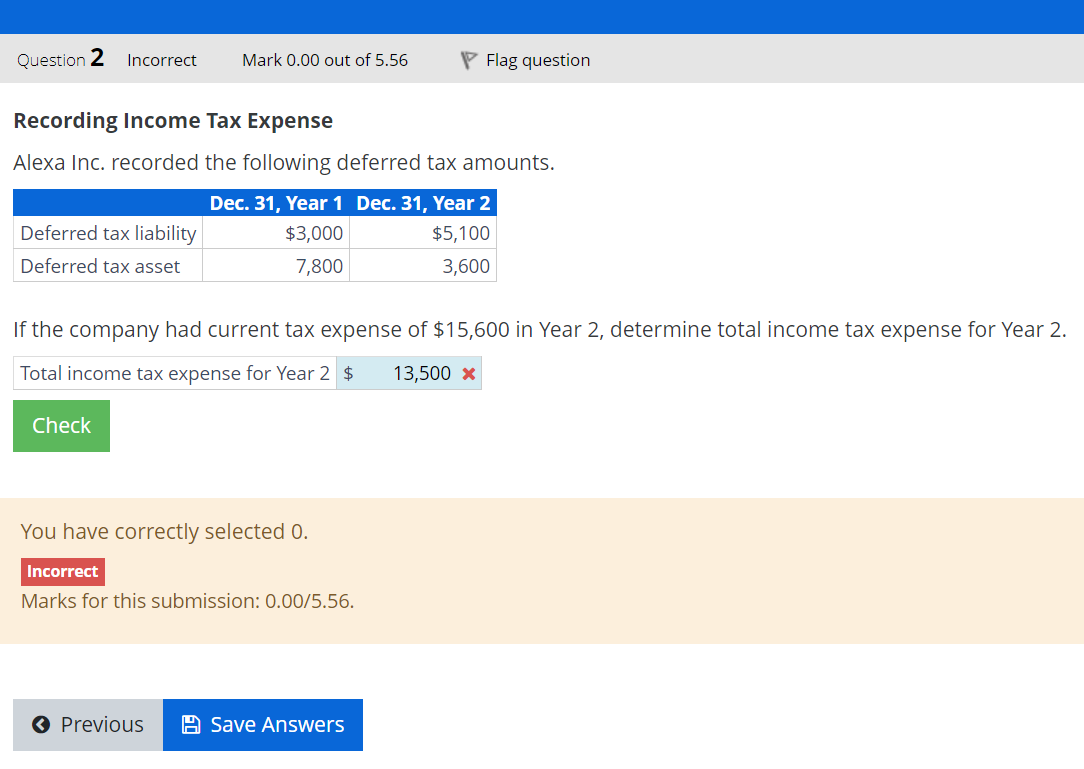

Question 2 Incorrect Mark 0.00 out of 5.56 Recording Income Tax Expense Alexa Inc. recorded the following deferred tax amounts. Dec. 31, Year 1 Dec. 31, Year 2 $3,000 $5,100 7,800 3,600 Deferred tax liability Deferred tax asset If the company had current tax expense of $15,600 in Year 2, determine total income tax expense for Year 2. Total income tax expense for Year 2 $ 13,500 x Check You have correctly selected 0. Incorrect Marks for this submission: 0.00/5.56. Flag question Previous Save Answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image provided seems to be a screenshot of a quiz or tutorial question regarding the recording o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Interpreting and Analyzing Financial Statements

Authors: Karen P. Schoenebeck, Mark P. Holtzman

6th edition

132746247, 978-0132746243

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App