Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recording and Reporting Multiple Temporary Differences Lake Company shows the following results of operations on December 31, its first year of operations. 1. Pretax

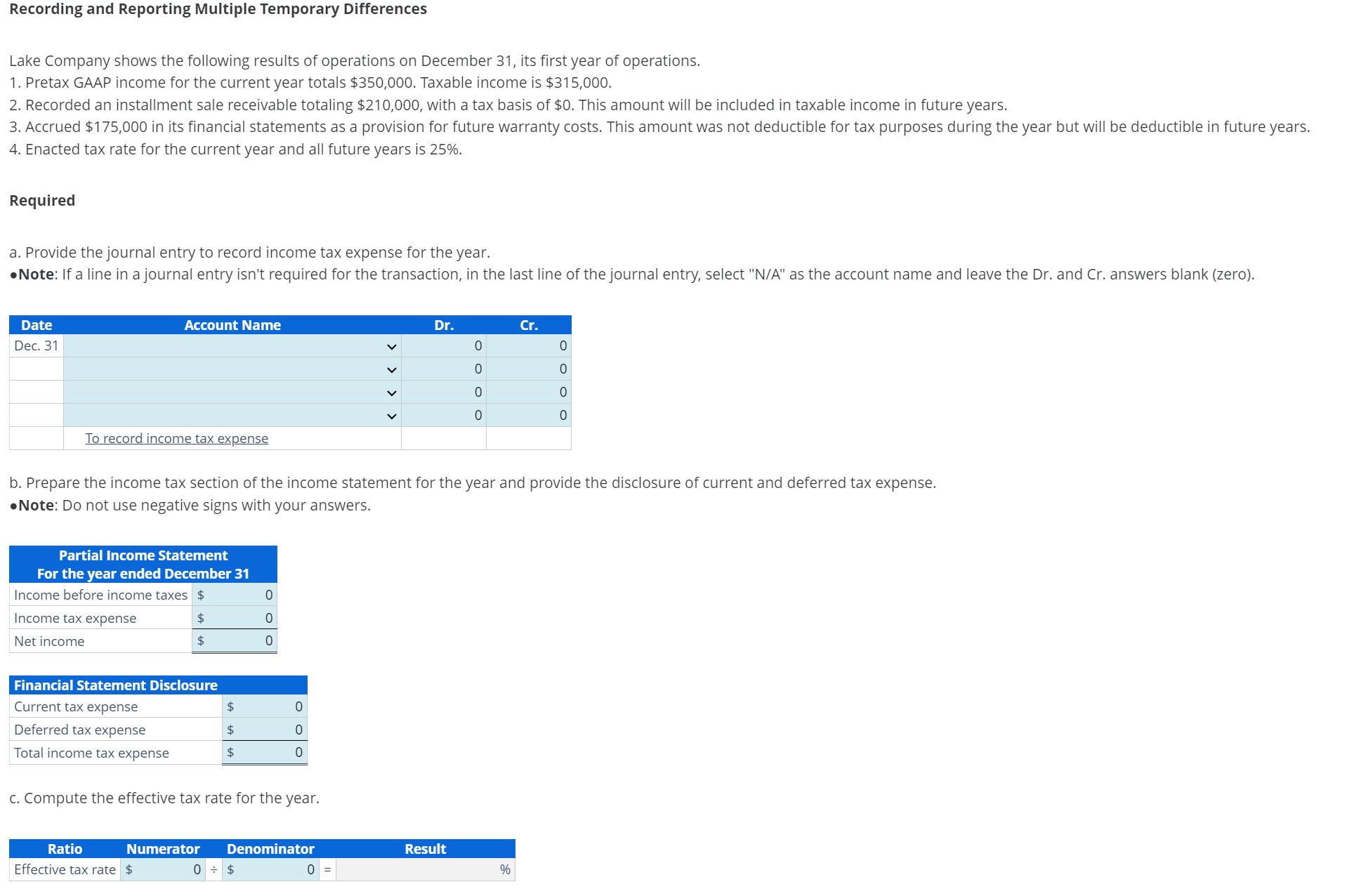

Recording and Reporting Multiple Temporary Differences Lake Company shows the following results of operations on December 31, its first year of operations. 1. Pretax GAAP income for the current year totals $350,000. Taxable income is $315,000. 2. Recorded an installment sale receivable totaling $210,000, with a tax basis of $0. This amount will be included in taxable income in future years. 3. Accrued $175,000 in its financial statements as a provision for future warranty costs. This amount was not deductible for tax purposes during the year but will be deductible in future years. 4. Enacted tax rate for the current year and all future years is 25%. Required a. Provide the journal entry to record income tax expense for the year. Note: If a line in a journal entry isn't required for the transaction, in the last line of the journal entry, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero). Date Dec. 31 Account Name To record income tax expense Partial Income Statement For the year ended December 31 Income before income taxes $ Income tax expense $ Net income $ Financial Statement Disclosure Current tax expense Deferred tax expense Total income tax expense Ratio Effective tax rate $ b. Prepare the income tax section of the income statement for the year and provide the disclosure of current and deferred tax expense. Note: Do not use negative signs with your answers. $ $ $ 0 0 0 c. Compute the effective tax rate for the year. 0 0 0 0 $ Numerator Denominator Dr. 0 0 0 0 0 Result Cr. % 0 0 0 0

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

The image you provided contains an accounting problem that relates to recording and reporting multiple temporary differences as part of income tax expense in financial statements To solve the problem ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started