Answered step by step

Verified Expert Solution

Question

1 Approved Answer

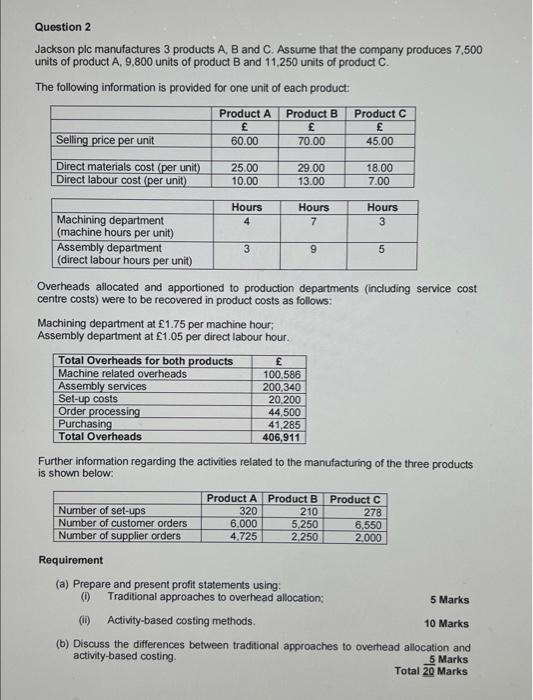

Question 2 Jackson plc manufactures 3 products A, B and C. Assume that the company produces 7,500 units of product A, 9,800 units of product

Question 2 Jackson plc manufactures 3 products A, B and C. Assume that the company produces 7,500 units of product A, 9,800 units of product B and 11,250 units of product C. The following information is provided for one unit of each product: Product A Product B 60.00 70.00 Selling price per unit Direct materials cost (per unit) Direct labour cost (per unit) Machining department (machine hours per unit) Assembly department (direct labour hours per unit) 25.00 10.00 Hours 4 3 Machining department at 1.75 per machine hour; Assembly department at 1.05 per direct labour hour. Total Overheads for both products Machine related overheads Assembly services Set-up costs Order processing Purchasing Total Overheads Number of set-ups Number of customer orders Number of supplier orders 29.00 13.00 Hours 7 100,586 200,340 20,200 44,500 41,285 406,911 9 Overheads allocated and apportioned to production departments (including service cost centre costs) were to be recovered in product costs as follows: Requirement (a) Prepare and present profit statements using: Product C 45.00 Product A Product B 320 210 6,000 5,250 4,725 2,250 18.00 7.00 Hours 3 Further information regarding the activities related to the manufacturing of the three products is shown below: 5 Product C 278 6,550 2,000 (i) Traditional approaches to overhead allocation; (ii) Activity-based costing methods. (b) Discuss the differences between traditional approaches to overhead allocation and activity-based costing. 5 Marks Total 20 Marks 5 Marks 10 Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started