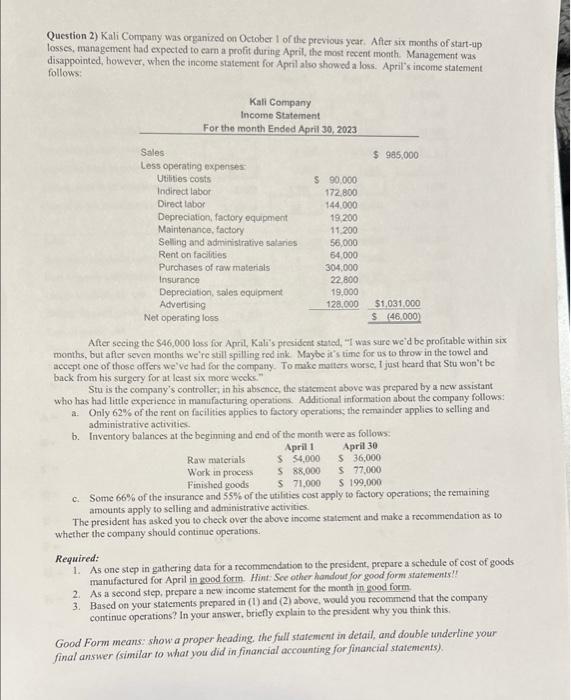

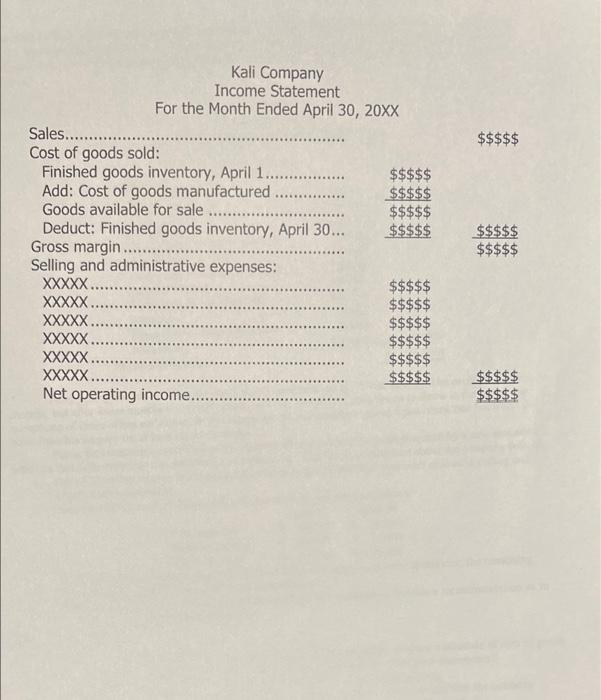

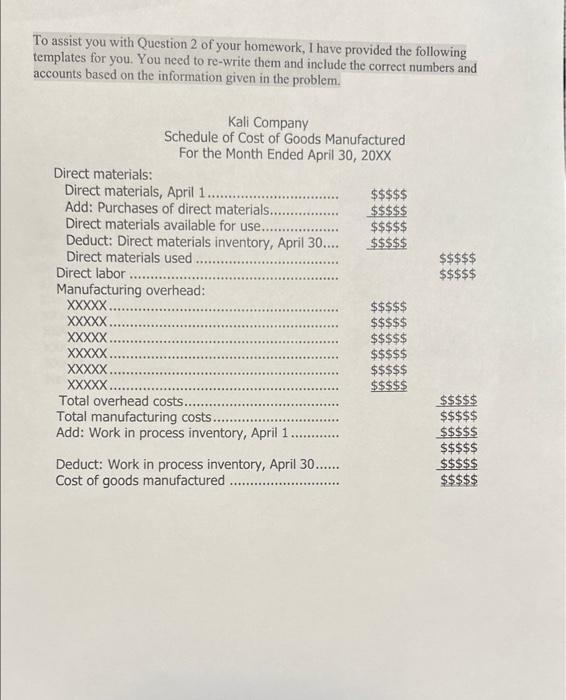

Question 2) Kali Company was organized on October I of the previous year. After six months of start-up losses, management had expected to cam a profit during April, the most recent month. Management was disappointed, however, when the income statement for April also showcd a loss. April's income statement follows: After secing the S46,000 loss for April, Kali's president stated, II was sure we'd be profitable within six months, but after seven months we're still spilling red ink. Maybe it's time for us to throw in the towel and accept one of those offers we've had for the corrpany. To mike matters worse, 1 just heard that Stu won't be back from his surgery for at lesst six more weeks." Stu is the company's controller, in his absence, the statement above was prepared by a new assistant who has had little experience in manufacturing operabions. Additional information about the company follows: a: Only 62% of the rent on facilities applies to factory operations; the remainder applies to selling and administrative activities. b. Inventory balances at the beginning and end of the month were as follows: c. Some 66% of the insurance and 55% of the utilitics cost apply to factory operations; the remaining amounts apply to selling and adminnistrative activitics The president has asked you to check over the above income statement and make a recommendation as to whether the company should contirue operations. Required: 1. As one step in gathering data for a recommendation to the president, prepare a schedule of cost of goods manufactured for April in good form. Hint: See other handost for good form atarements!! 2. As a second step, prepare a new income statement for the month in good form. 3. Based on your statcments prepared in (1) and (2) above, would you recommend that the company continue operations? In your answer, briefly explain to the president why you think this. Good Form means: show a proper heading, the full stafement in detail, and double tanderline your final answer (similar to what you did in financial accounting for finascial statements). Kali Company Income Statement For the Month Ended April 30, 20XX Sales. $$ Cost of goods sold: Finished goods inventory, April 1 Add: Cost of goods manufactured Goods available for sale Selling and administrative expenses: To assist you with Question 2 of your homework, I have provided the following templates for you. You need to re-write them and include the correct numbers and accounts based on the information given in the problem. Question 2) Kali Company was organized on October I of the previous year. After six months of start-up losses, management had expected to cam a profit during April, the most recent month. Management was disappointed, however, when the income statement for April also showcd a loss. April's income statement follows: After secing the S46,000 loss for April, Kali's president stated, II was sure we'd be profitable within six months, but after seven months we're still spilling red ink. Maybe it's time for us to throw in the towel and accept one of those offers we've had for the corrpany. To mike matters worse, 1 just heard that Stu won't be back from his surgery for at lesst six more weeks." Stu is the company's controller, in his absence, the statement above was prepared by a new assistant who has had little experience in manufacturing operabions. Additional information about the company follows: a: Only 62% of the rent on facilities applies to factory operations; the remainder applies to selling and administrative activities. b. Inventory balances at the beginning and end of the month were as follows: c. Some 66% of the insurance and 55% of the utilitics cost apply to factory operations; the remaining amounts apply to selling and adminnistrative activitics The president has asked you to check over the above income statement and make a recommendation as to whether the company should contirue operations. Required: 1. As one step in gathering data for a recommendation to the president, prepare a schedule of cost of goods manufactured for April in good form. Hint: See other handost for good form atarements!! 2. As a second step, prepare a new income statement for the month in good form. 3. Based on your statcments prepared in (1) and (2) above, would you recommend that the company continue operations? In your answer, briefly explain to the president why you think this. Good Form means: show a proper heading, the full stafement in detail, and double tanderline your final answer (similar to what you did in financial accounting for finascial statements). Kali Company Income Statement For the Month Ended April 30, 20XX Sales. $$ Cost of goods sold: Finished goods inventory, April 1 Add: Cost of goods manufactured Goods available for sale Selling and administrative expenses: To assist you with Question 2 of your homework, I have provided the following templates for you. You need to re-write them and include the correct numbers and accounts based on the information given in the