Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 Lancer Corporation Bhd. manufactures light duty machinery that has two divisions, Division A and Division B. Division A produces machine parts to be

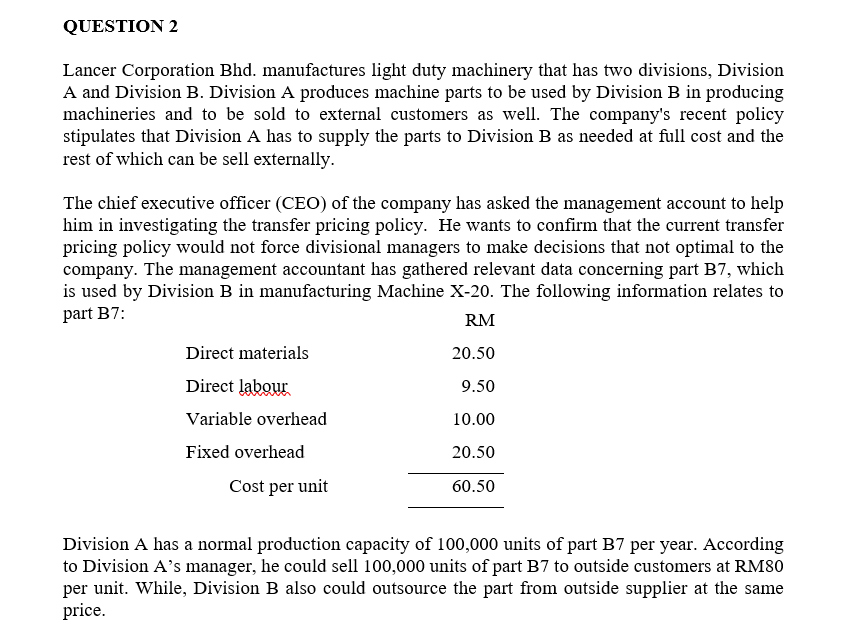

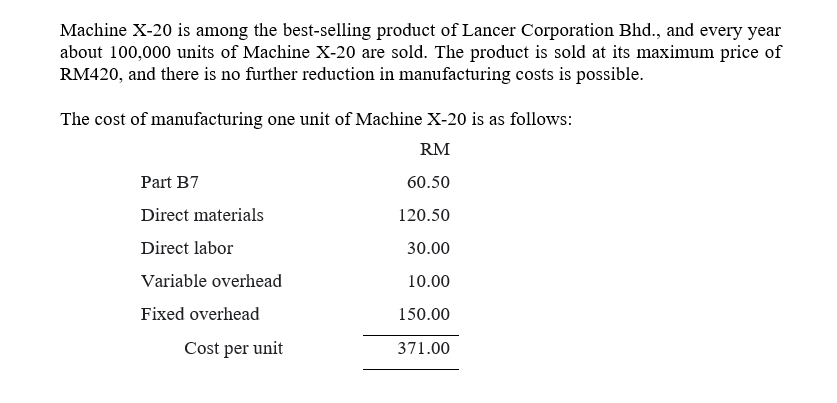

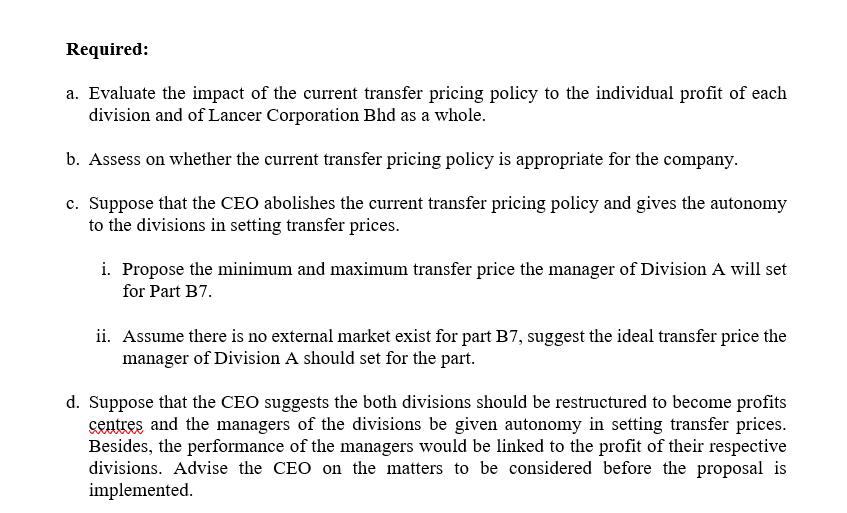

QUESTION 2 Lancer Corporation Bhd. manufactures light duty machinery that has two divisions, Division A and Division B. Division A produces machine parts to be used by Division B in producing machineries and to be sold to external customers as well. The company's recent policy stipulates that Division A has to supply the parts to Division B as needed at full cost and the rest of which can be sell externally. The chief executive officer (CEO) of the company has asked the management account to help him in investigating the transfer pricing policy. He wants to confirm that the current transfer pricing policy would not force divisional managers to make decisions that not optimal to the company. The management accountant has gathered relevant data concerning part B7, which is used by Division B in manufacturing Machine X-20. The following information relates to part B7: RM Direct materials 20.50 Direct labour 9.50 Variable overhead 10.00 Fixed overhead 20.50 Cost per unit 60.50 Division A has a normal production capacity of 100,000 units of part B7 per year. According to Division A's manager, he could sell 100,000 units of part B7 to outside customers at RM80 per unit. While, Division B also could outsource the part from outside supplier at the same price. Machine X-20 is among the best-selling product of Lancer Corporation Bhd., and every year about 100,000 units of Machine X-20 are sold. The product is sold at its maximum price of RM420, and there is no further reduction in manufacturing costs is possible. The cost of manufacturing one unit of Machine X-20 is as follows: RM Part B7 60.50 Direct materials 120.50 Direct labor 30.00 Variable overhead 10.00 Fixed overhead 150.00 Cost per unit 371.00 Required: a. Evaluate the impact of the current transfer pricing policy to the individual profit of each division and of Lancer Corporation Bhd as a whole. b. Assess on whether the current transfer pricing policy is appropriate for the company. c. Suppose that the CEO abolishes the current transfer pricing policy and gives the autonomy to the divisions in setting transfer prices. i. Propose the minimum and maximum transfer price the manager of Division A will set for Part B7. ii. Assume there is no external market exist for part B7, suggest the ideal transfer price the manager of Division A should set for the part. d. Suppose that the CEO suggests the both divisions should be restructured to become profits centres and the managers of the divisions be given autonomy in setting transfer prices. Besides, the performance of the managers would be linked to the profit of their respective divisions. Advise the CEO on the matters to be considered before the proposal is implemented

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started