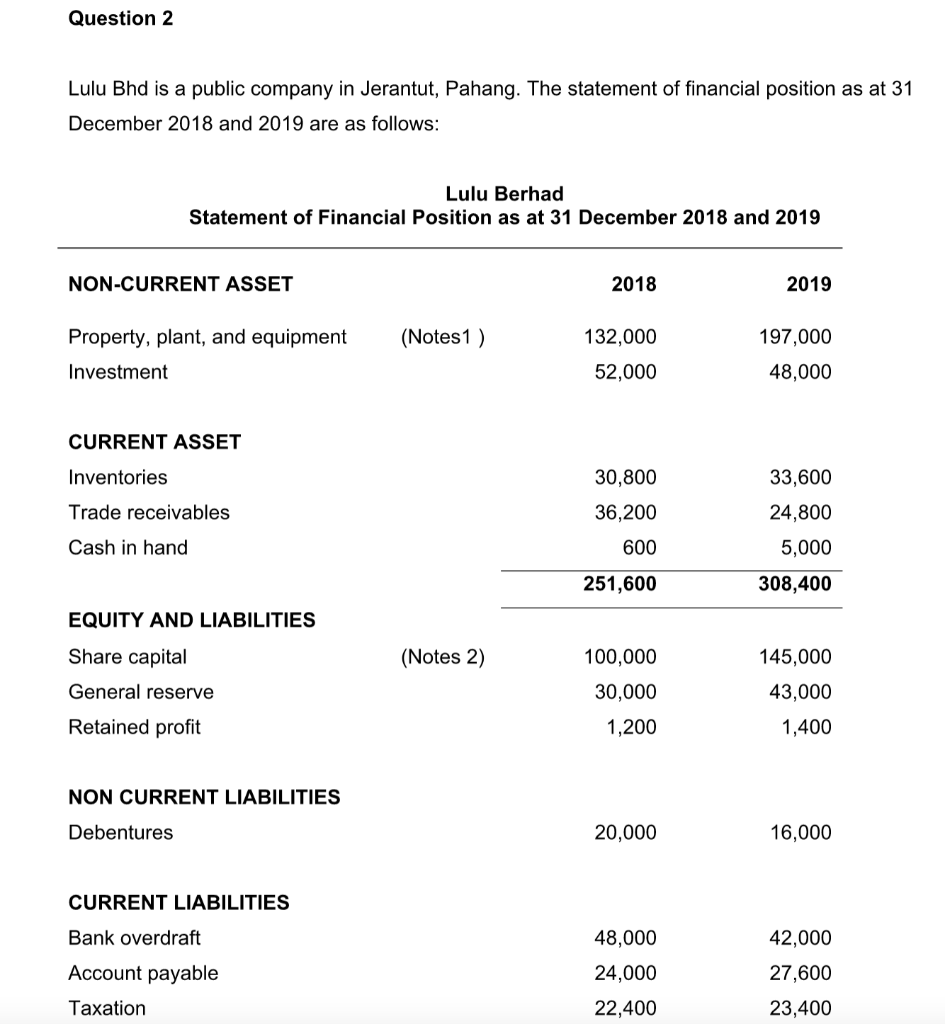

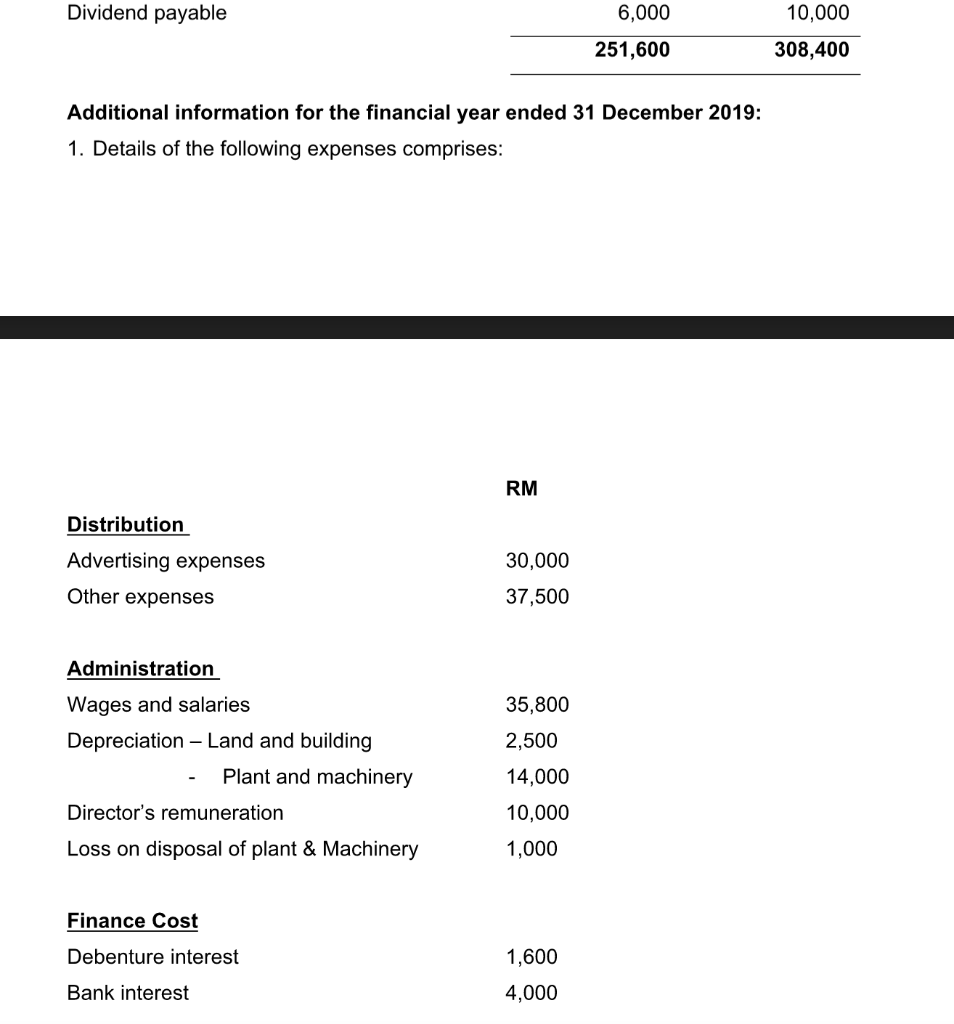

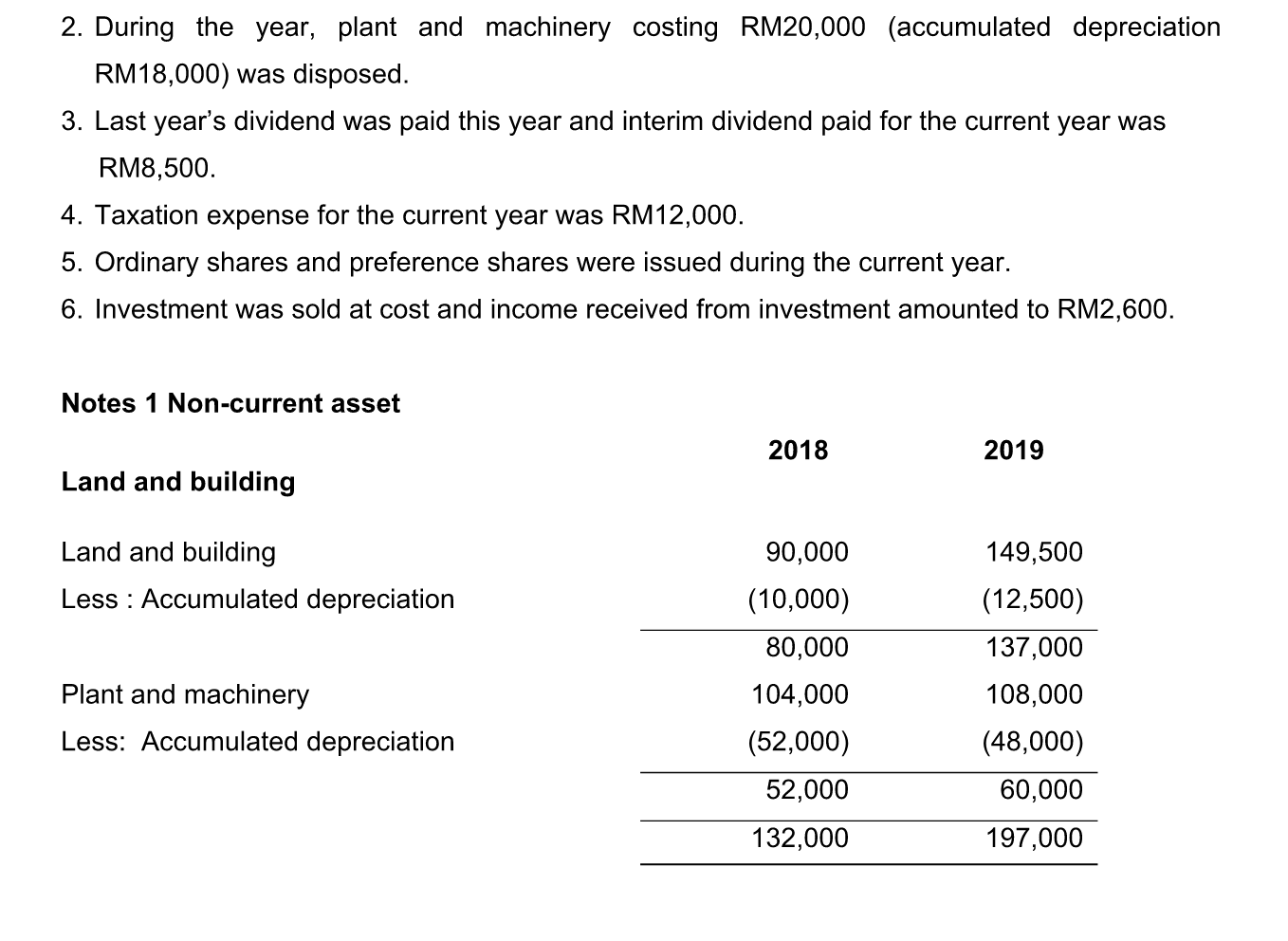

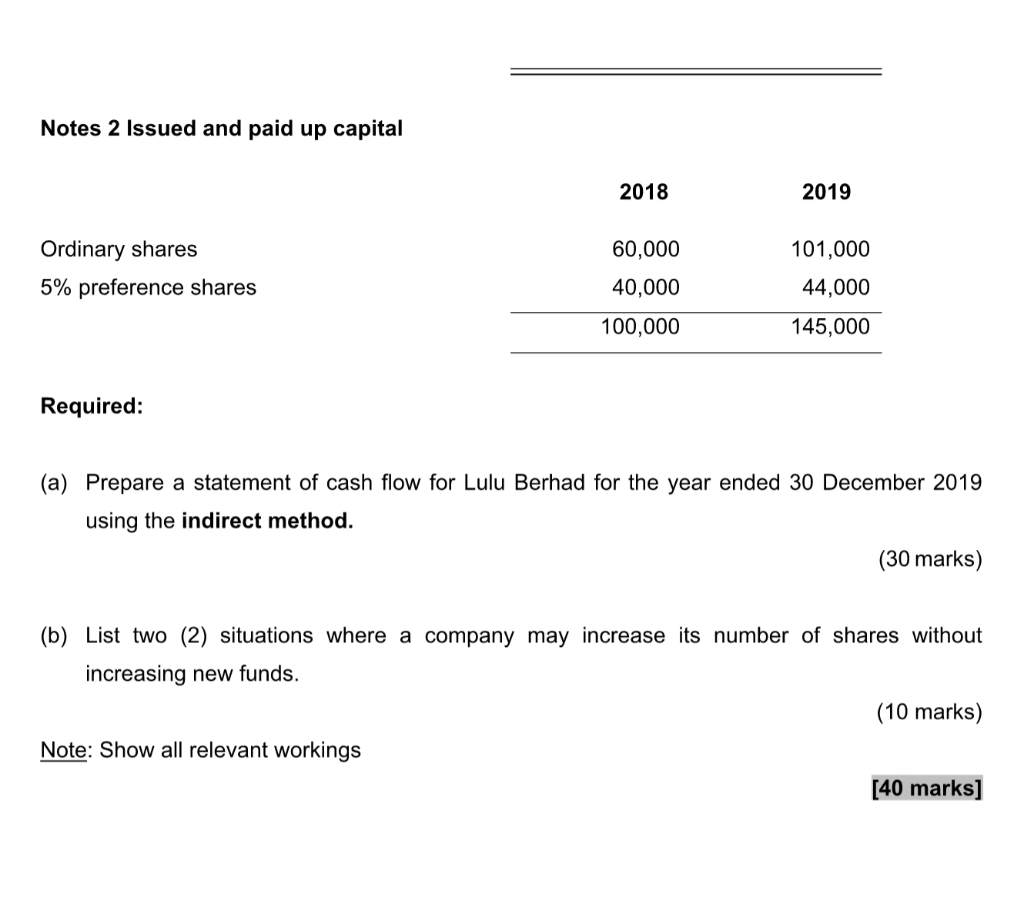

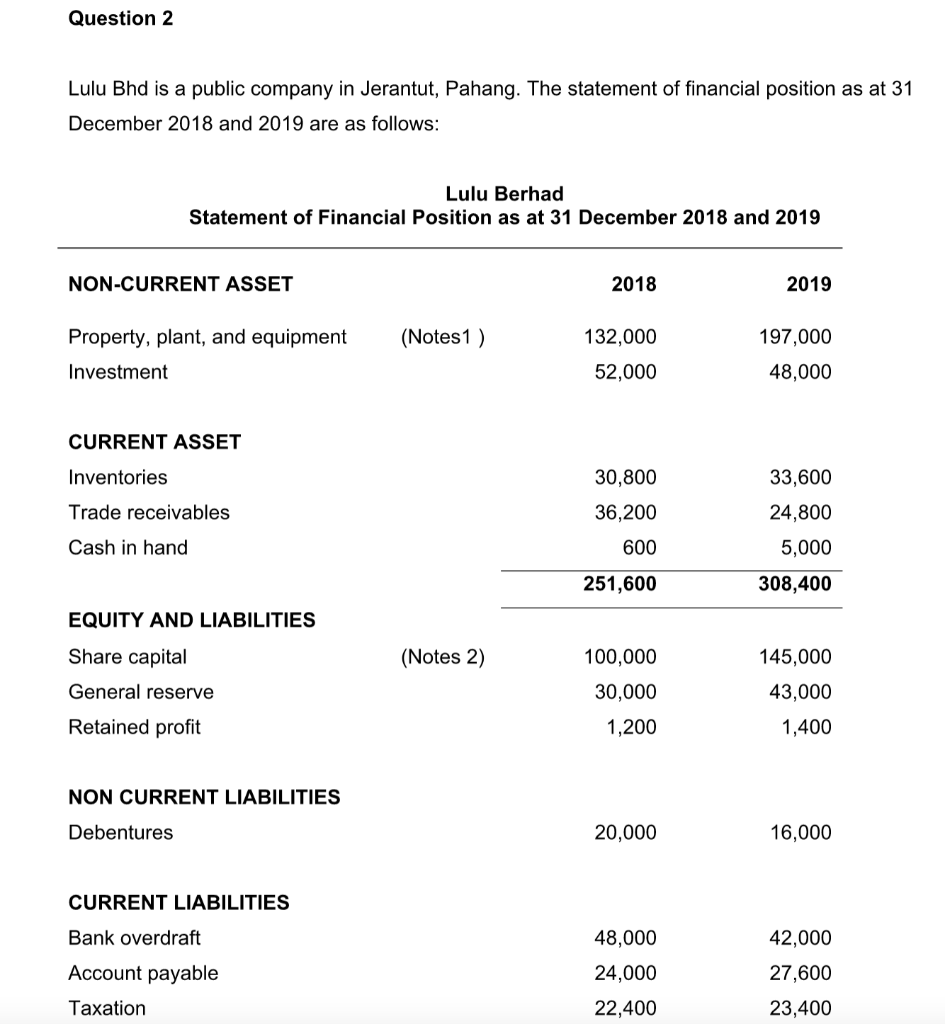

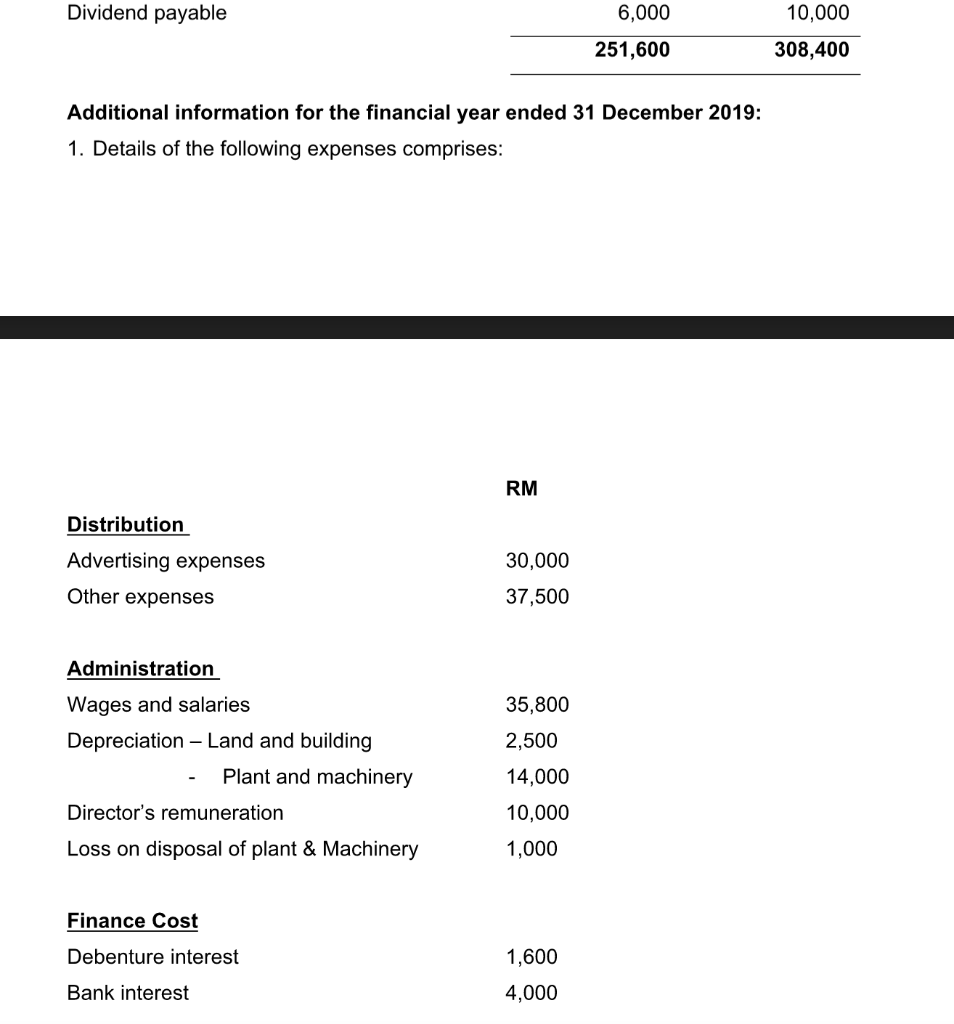

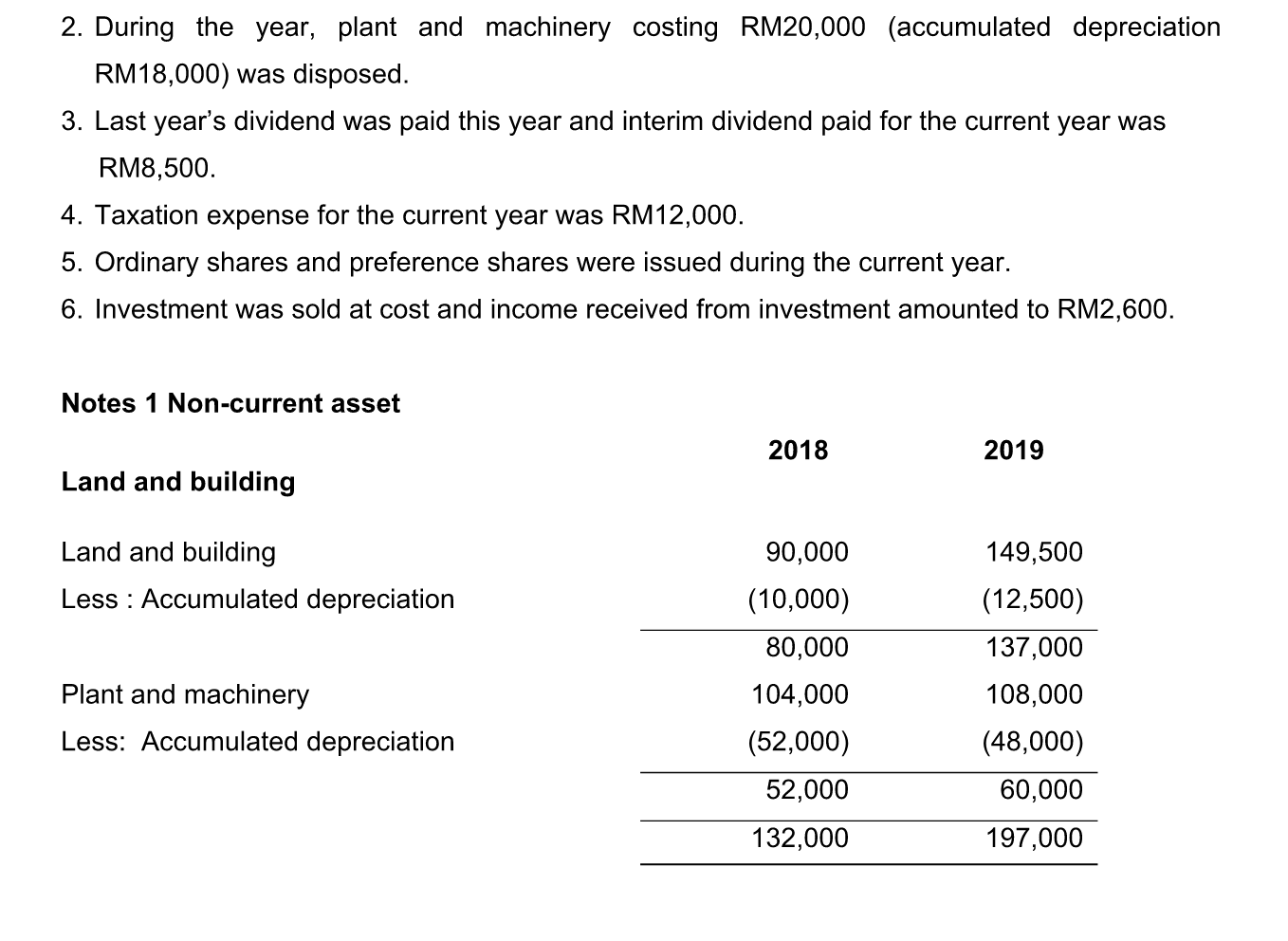

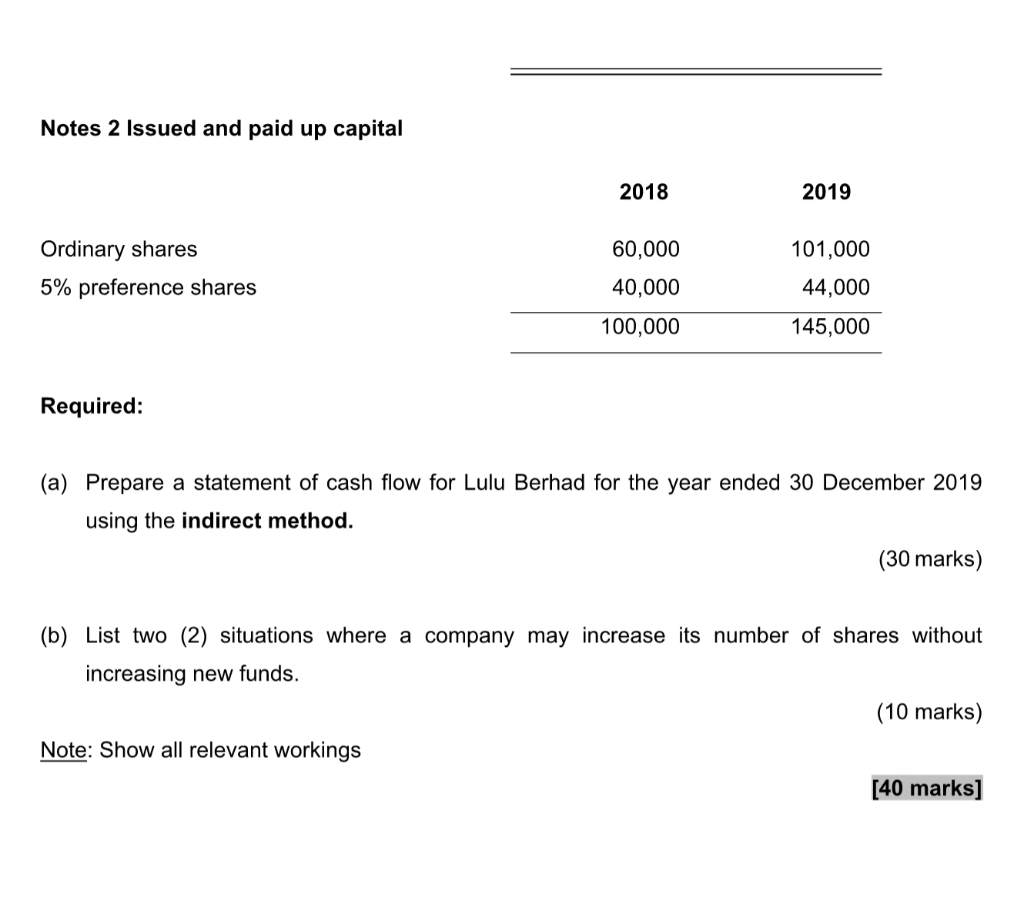

Question 2 Lulu Bhd is a public company in Jerantut, Pahang. The statement of financial position as at 31 December 2018 and 2019 are as follows: Lulu Berhad Statement of Financial Position as at 31 December 2018 and 2019 NON-CURRENT ASSET 2018 2019 (Notes1 ) Property, plant, and equipment Investment 132,000 52,000 197,000 48,000 CURRENT ASSET Inventories 30,800 Trade receivables 36,200 33,600 24,800 5,000 308,400 Cash in hand 600 251,600 EQUITY AND LIABILITIES (Notes 2) Share capital General reserve 100,000 30,000 145,000 43,000 1,400 Retained profit 1,200 NON CURRENT LIABILITIES Debentures 20,000 16,000 CURRENT LIABILITIES 42,000 Bank overdraft Account payable Taxation 48,000 24,000 22,400 27,600 23,400 Dividend payable 6,000 10,000 251,600 308,400 Additional information for the financial year ended 31 December 2019: 1. Details of the following expenses comprises: RM Distribution Advertising expenses Other expenses 30,000 37,500 35,800 2,500 Administration Wages and salaries Depreciation - Land and building Plant and machinery Director's remuneration Loss on disposal of plant & Machinery 14,000 10,000 1,000 Finance Cost Debenture interest 1,600 4,000 Bank interest 2. During the year, plant and machinery costing RM20,000 (accumulated depreciation RM18,000) was disposed. 3. Last year's dividend was paid this year and interim dividend paid for the current year was RM8,500. 4. Taxation expense for the current year was RM12,000. 5. Ordinary shares and preference shares were issued during the current year. 6. Investment was sold at cost and income received from investment amounted to RM2,600. Notes 1 Non-current asset 2018 2019 Land and building Land and building Less : Accumulated depreciation 90,000 (10,000) 80,000 104,000 (52,000) 52,000 132,000 149,500 (12,500) 137,000 108,000 (48,000) Plant and machinery Less: Accumulated depreciation 60,000 197,000 Notes 2 Issued and paid up capital 2018 2019 Ordinary shares 5% preference shares 60,000 40,000 100,000 101,000 44,000 145,000 Required: (a) Prepare a statement of cash flow for Lulu Berhad for the year ended 30 December 2019 using the indirect method. (30 marks) (b) List two (2) situations where a company may increase its number of shares without increasing new funds. (10 marks) Note: Show all relevant workings [40 marks]