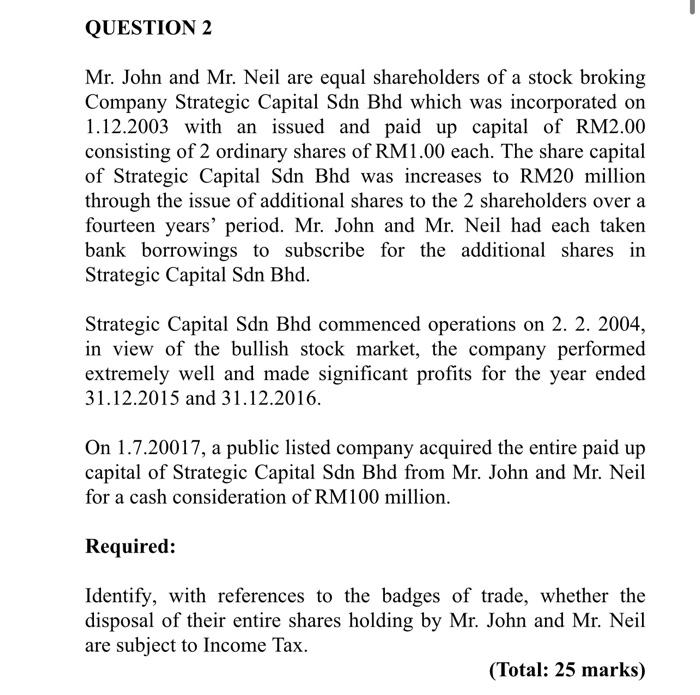

QUESTION 2 Mr. John and Mr. Neil are equal shareholders of a stock broking Company Strategic Capital Sdn Bhd which was incorporated on 1.12.2003 with an issued and paid up capital of RM2.00 consisting of 2 ordinary shares of RM1.00 each. The share capital of Strategic Capital Sdn Bhd was increases to RM20 million through the issue of additional shares to the 2 shareholders over a fourteen years' period. Mr. John and Mr. Neil had each taken bank borrowings to subscribe for the additional shares in Strategic Capital Sdn Bhd. Strategic Capital Sdn Bhd commenced operations on 2. 2. 2004, in view of the bullish stock market, the company performed extremely well and made significant profits for the year ended 31.12.2015 and 31.12.2016. On 1.7.20017, a public listed company acquired the entire paid up capital of Strategic Capital Sdn Bhd from Mr. John and Mr. Neil for a cash consideration of RM100 million. Required: Identify, with references to the badges of trade, whether the disposal of their entire shares holding by Mr. John and Mr. Neil are subject to Income Tax. (Total: 25 marks) QUESTION 2 Mr. John and Mr. Neil are equal shareholders of a stock broking Company Strategic Capital Sdn Bhd which was incorporated on 1.12.2003 with an issued and paid up capital of RM2.00 consisting of 2 ordinary shares of RM1.00 each. The share capital of Strategic Capital Sdn Bhd was increases to RM20 million through the issue of additional shares to the 2 shareholders over a fourteen years' period. Mr. John and Mr. Neil had each taken bank borrowings to subscribe for the additional shares in Strategic Capital Sdn Bhd. Strategic Capital Sdn Bhd commenced operations on 2. 2. 2004, in view of the bullish stock market, the company performed extremely well and made significant profits for the year ended 31.12.2015 and 31.12.2016. On 1.7.20017, a public listed company acquired the entire paid up capital of Strategic Capital Sdn Bhd from Mr. John and Mr. Neil for a cash consideration of RM100 million. Required: Identify, with references to the badges of trade, whether the disposal of their entire shares holding by Mr. John and Mr. Neil are subject to Income Tax. (Total: 25 marks)