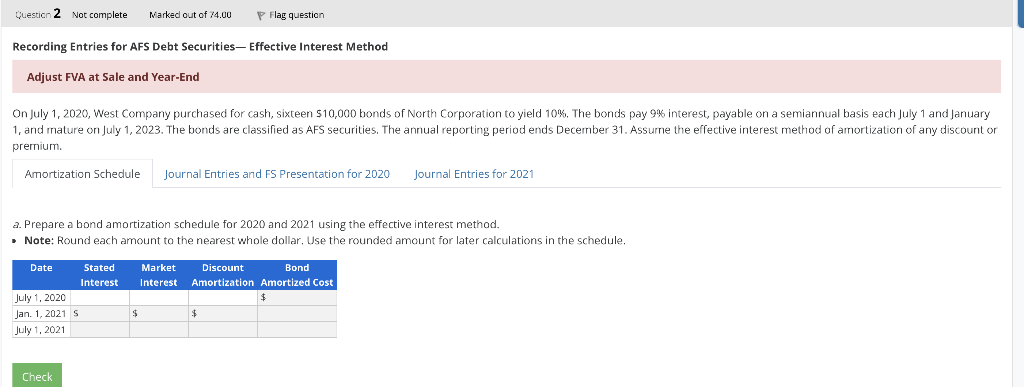

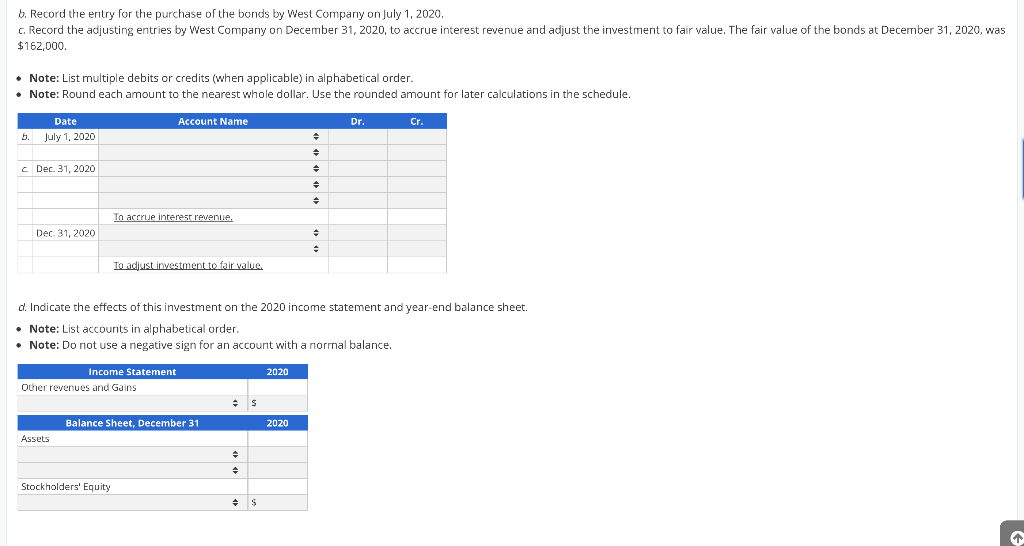

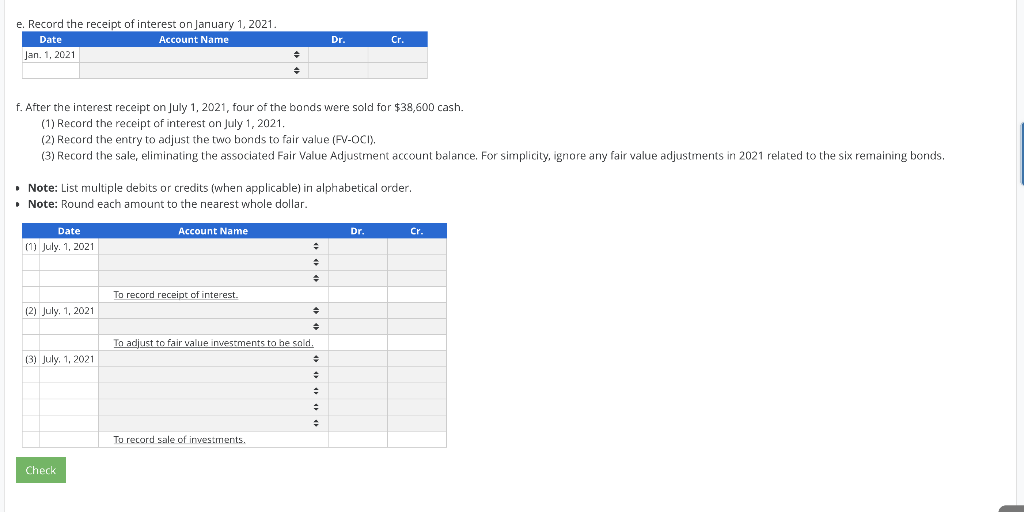

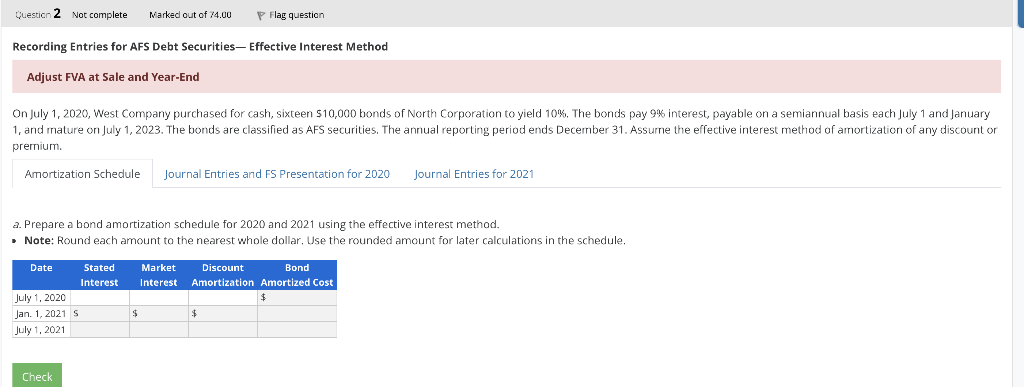

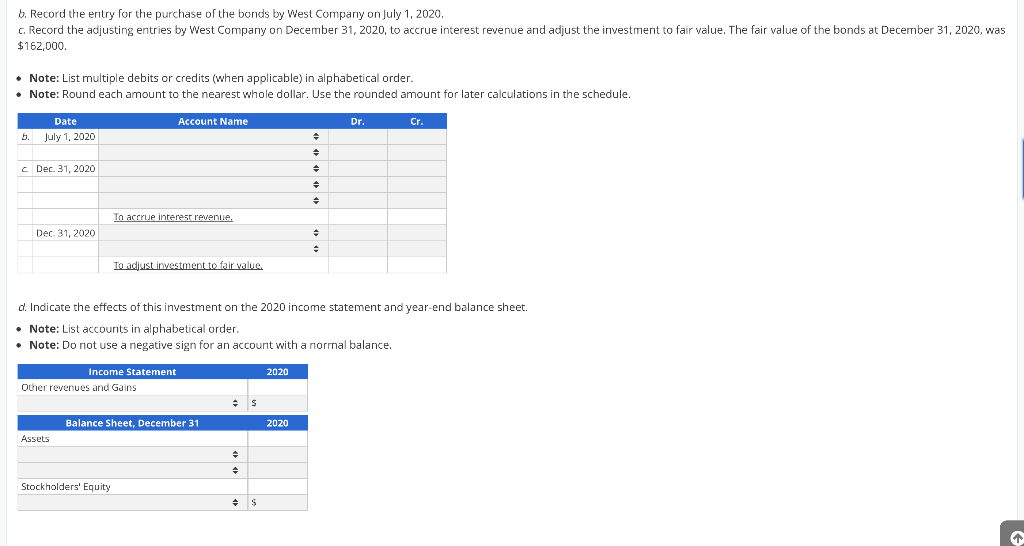

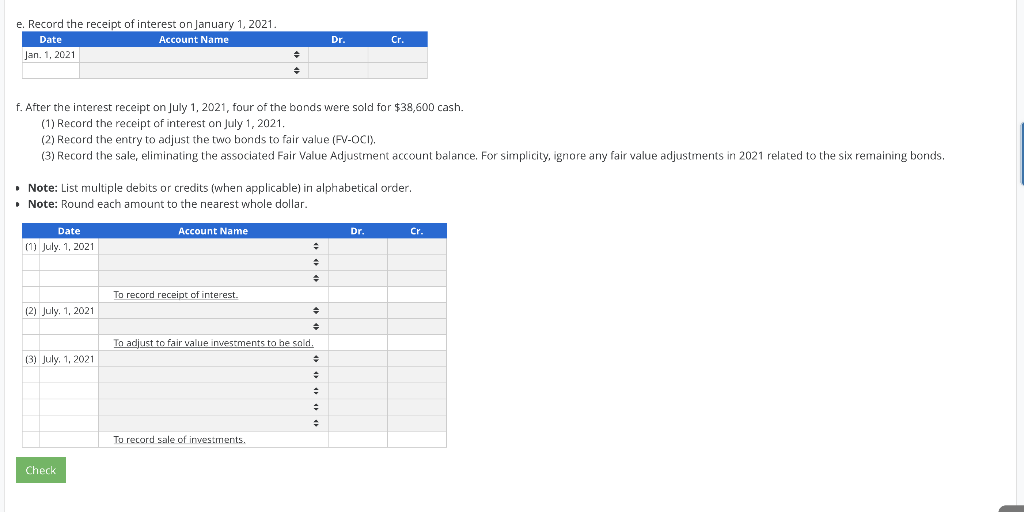

Question 2 Not complete Marked out of 74.00 P Flag question Recording Entries for AFS Debt Securities- Effective Interest Method Adjust FVA at Sale and Year-End On July 1, 2020, West Company purchased for cash, sixteen $10,000 bonds of North Corporation to yield 10%. The bonds pay 9% Interest, payable on a semiannual basis each July 1 and January 1, and mature on July 1, 2023. The bonds are classified as AFS securities. The annual reporting period ends December 31. Assume the effective interest method of amortization of any discount or premium. Amortization Schedule Journal Entries and FS Presentation for 2020 Journal Entries for 2021 a. Prepare a bond amortization schedule for 2020 and 2021 using the effective interest method. Note: Round each amount to the nearest whole dollar, Use the rounded amount for later calculations in the schedule. Market interest Discount Bond Amortization Amortized Cost Date Stated Interest July 1, 2020 Jan. 1.2021 S July 1, 2021 $ Check b. Record the entry for the purchase of the bonds by West Company on July 1, 2020. c. Record the adjusting entries by West Company on December 31, 2020, to accrue interest revenue and adjust the investment to fair value. The fair value of the bonds at December 31, 2020, was $162,000. Note: List multiple debits or credits (when applicable) in alphabetical order. Note: Round each amount to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. Account Name Dr. Cr. Date July 1, 2020 5. C Dec 31, 2020 To accrue interest revenue. Dec 31, 2020 To adjust investment to fair value. d. Indicate the effects of this investment on the 2020 income statement and year-end balance sheet. Note: List accounts in alphabetical order. Note: Do not use a negative sign for an account with a normal balance, 2020 Income Statement Other revenues and Gains S Balance Sheet, December 31 2020 Assets Stockholders' Equity e. Record the receipt of interest on January 1, 2021. Date Account Name Jan. 1, 2021 Dr. Cr. f. After the interest receipt on July 1, 2021, four of the bonds were sold for $38,600 cash. (1) Record the receipt of interest on July 1, 2021. (2) Record the entry to adjust the two bonds to fair value (FV-OCI). (3) Record the sale, eliminating the associated Fair Value Adjustment account balance. For simplicity, ignore any fair value adjustments in 2021 related to the six remaining bonds, Note: List multiple debits or credits (when applicable) in alphabetical order. Note: Round each amount to the nearest whole dollar. Account Name Dr. Cr. Date (1) July 1, 2021 To record receipt of interest. (2) July 1, 2021 To adjust to fair value investments to be sold. (3) July 1, 2021 To record sale of investments. Check Question 2 Not complete Marked out of 74.00 P Flag question Recording Entries for AFS Debt Securities- Effective Interest Method Adjust FVA at Sale and Year-End On July 1, 2020, West Company purchased for cash, sixteen $10,000 bonds of North Corporation to yield 10%. The bonds pay 9% Interest, payable on a semiannual basis each July 1 and January 1, and mature on July 1, 2023. The bonds are classified as AFS securities. The annual reporting period ends December 31. Assume the effective interest method of amortization of any discount or premium. Amortization Schedule Journal Entries and FS Presentation for 2020 Journal Entries for 2021 a. Prepare a bond amortization schedule for 2020 and 2021 using the effective interest method. Note: Round each amount to the nearest whole dollar, Use the rounded amount for later calculations in the schedule. Market interest Discount Bond Amortization Amortized Cost Date Stated Interest July 1, 2020 Jan. 1.2021 S July 1, 2021 $ Check b. Record the entry for the purchase of the bonds by West Company on July 1, 2020. c. Record the adjusting entries by West Company on December 31, 2020, to accrue interest revenue and adjust the investment to fair value. The fair value of the bonds at December 31, 2020, was $162,000. Note: List multiple debits or credits (when applicable) in alphabetical order. Note: Round each amount to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. Account Name Dr. Cr. Date July 1, 2020 5. C Dec 31, 2020 To accrue interest revenue. Dec 31, 2020 To adjust investment to fair value. d. Indicate the effects of this investment on the 2020 income statement and year-end balance sheet. Note: List accounts in alphabetical order. Note: Do not use a negative sign for an account with a normal balance, 2020 Income Statement Other revenues and Gains S Balance Sheet, December 31 2020 Assets Stockholders' Equity e. Record the receipt of interest on January 1, 2021. Date Account Name Jan. 1, 2021 Dr. Cr. f. After the interest receipt on July 1, 2021, four of the bonds were sold for $38,600 cash. (1) Record the receipt of interest on July 1, 2021. (2) Record the entry to adjust the two bonds to fair value (FV-OCI). (3) Record the sale, eliminating the associated Fair Value Adjustment account balance. For simplicity, ignore any fair value adjustments in 2021 related to the six remaining bonds, Note: List multiple debits or credits (when applicable) in alphabetical order. Note: Round each amount to the nearest whole dollar. Account Name Dr. Cr. Date (1) July 1, 2021 To record receipt of interest. (2) July 1, 2021 To adjust to fair value investments to be sold. (3) July 1, 2021 To record sale of investments. Check