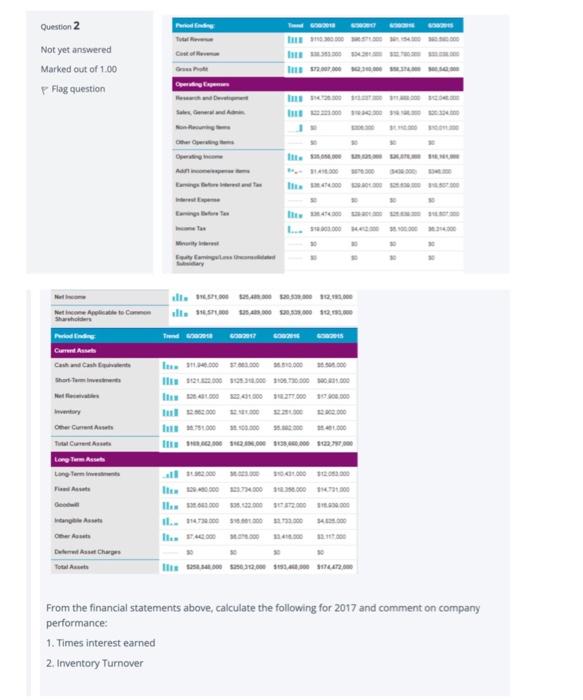

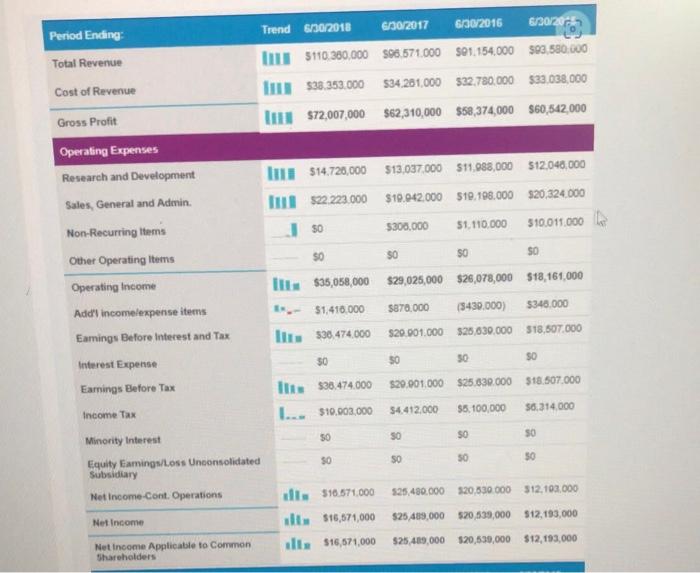

Question 2 Not yet answered Marked out of 1.00 Flag question From the financial statements above, calculate the following for 2017 and comment on company performance: 1. Times interest earned 2. Ifventory Turnover Period Ending: Total Revenue Cost of Revenue |III $33.353.000$34.261,000$32,780,000$33,038,000 Gross Profit IIII $72,007,000$62,310,000$53,374,000$60,542,000 Operating Expenses Research and Development Sales, General and Admin. Non-Recurring ttems Other Operating lterns Operating Income Add" incomelexpense items Eamings Before interest and Tax Interest Expense Earnings Before Tax Income Tax Minority Interest Equity Eamingaloss Unoonsolidated I..- $1.410.000$370.000($430.000)$340.000 Subsidiary Netincome-Cont.OperationsIfl$16.571,000525,480,000$20,530,000$12,103,000 Shareholders Shareholders Short-Tem Investments J/ 5121.322.0005125,318.0005100.730,000500,031,000 Net Receivables 11ner 526.481.000522.431.000$18.277.000517.006.000 Inventory fli: 52.002.00052.181.00052.51.00052.002.000 Other Current Assets Total Current Assets \begin{tabular}{|l|l|l|l|} \hline 1169,662,000 & 5162,696,000 & $139,660,000 & 5122,797,000 \end{tabular} Long-Term Assets Long-Term investments Fixed Assets Goodwil Bn 535,083.000505.122.000$17.972.000$10.030.000 Intangible Assets Other Assets Deferred Asset Charges 50 50. 30 50 Total Assets \begin{tabular}{|l|l|l|l|l|} \hline Ifle & 5258,849,000 & $250,212,000 & $193,468,000 & $174,472,000 \end{tabular} Question 2 Not yet answered Marked out of 1.00 Flag question From the financial statements above, calculate the following for 2017 and comment on company performance: 1. Times interest earned 2. Ifventory Turnover Period Ending: Total Revenue Cost of Revenue |III $33.353.000$34.261,000$32,780,000$33,038,000 Gross Profit IIII $72,007,000$62,310,000$53,374,000$60,542,000 Operating Expenses Research and Development Sales, General and Admin. Non-Recurring ttems Other Operating lterns Operating Income Add" incomelexpense items Eamings Before interest and Tax Interest Expense Earnings Before Tax Income Tax Minority Interest Equity Eamingaloss Unoonsolidated I..- $1.410.000$370.000($430.000)$340.000 Subsidiary Netincome-Cont.OperationsIfl$16.571,000525,480,000$20,530,000$12,103,000 Shareholders Shareholders Short-Tem Investments J/ 5121.322.0005125,318.0005100.730,000500,031,000 Net Receivables 11ner 526.481.000522.431.000$18.277.000517.006.000 Inventory fli: 52.002.00052.181.00052.51.00052.002.000 Other Current Assets Total Current Assets \begin{tabular}{|l|l|l|l|} \hline 1169,662,000 & 5162,696,000 & $139,660,000 & 5122,797,000 \end{tabular} Long-Term Assets Long-Term investments Fixed Assets Goodwil Bn 535,083.000505.122.000$17.972.000$10.030.000 Intangible Assets Other Assets Deferred Asset Charges 50 50. 30 50 Total Assets \begin{tabular}{|l|l|l|l|l|} \hline Ifle & 5258,849,000 & $250,212,000 & $193,468,000 & $174,472,000 \end{tabular}