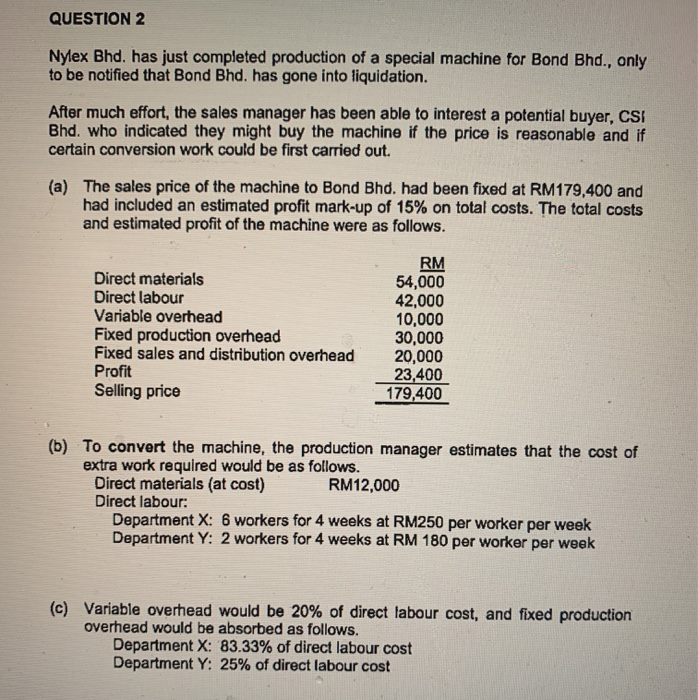

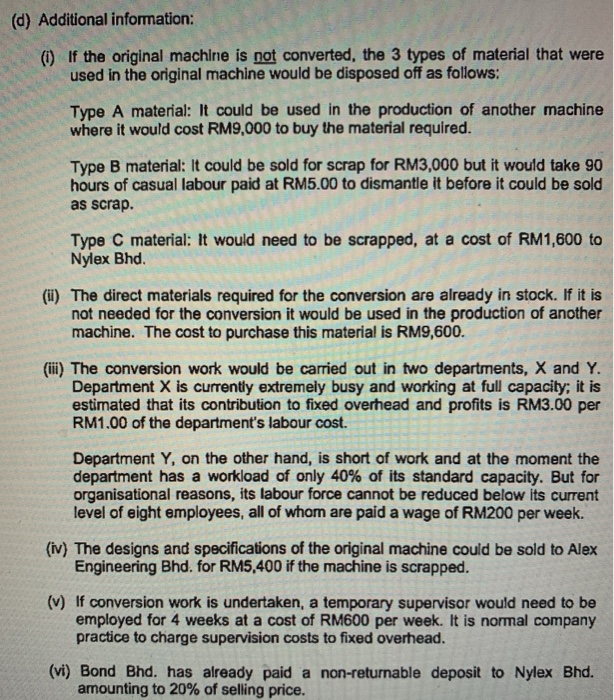

QUESTION 2 Nylex Bhd. has just completed production of a special machine for Bond Bhd., only to be notified that Bond Bhd. has gone into liquidation. After much effort, the sales manager has been able to interest a potential buyer, CSI Bhd. who indicated they might buy the machine if the price is reasonable and if certain conversion work could be first carried out. (a) The sales price of the machine to Bond Bhd. had been fixed at RM179,400 and had included an estimated profit mark-up of 15% on total costs. The total costs and estimated profit of the machine were as follows. Direct materials Direct labour Variable overhead Fixed production overhead Fixed sales and distribution overhead Profit Selling price RM 54,000 42,000 10,000 30,000 20,000 23,400 179,400 (b) To convert the machine, the production manager estimates that the cost of extra work required would be as follows. Direct materials (at cost) RM12,000 Direct labour: Department X: 6 workers for 4 weeks at RM250 per worker per week Department Y: 2 workers for 4 weeks at RM 180 per worker per week (c) Variable overhead would be 20% of direct labour cost, and fixed production overhead would be absorbed as follows. Department X: 83.33% of direct labour cost Department Y: 25% of direct labour cost (d) Additional information: () If the original machine is not converted, the 3 types of material that were used in the original machine would be disposed off as follows: Type A material: It could be used in the production of another machine where it would cost RM9,000 to buy the material required. Type B material: It could be sold for scrap for RM3,000 but it would take 90 hours of casual labour paid at RM5.00 to dismantle it before it could be sold as scrap. Type C material: It would need to be scrapped, at a cost of RM1,600 to Nylex Bhd. (ii) The direct materials required for the conversion are already in stock. If it is not needed for the conversion it would be used in the production of another machine. The cost to purchase this material is RM9,600. (iii) The conversion work would be carried out in two departments, X and Y. Department X is currently extremely busy and working at full capacity; it is estimated that its contribution to fixed overhead and profits is RM3.00 per RM1.00 of the department's labour cost. Department Y, on the other hand, is short of work and at the moment the department has a workload of only 40% of its standard capacity. But for organisational reasons, its labour force cannot be reduced below its current level of eight employees, all of whom are paid a wage of RM200 per week. (iv) The designs and specifications of the original machine could be sold to Alex Engineering Bhd. for RM5,400 if the machine is scrapped. (V) If conversion work is undertaken, a temporary supervisor would need to be employed for 4 weeks at a cost of RM600 per week. It is normal company practice to charge supervision costs to fixed overhead. (vi) Bond Bhd. has already paid a non-returnable deposit to Nylex Bhd. amounting to 20% of selling price. Required: a) Calculate the minimum price that Nylex Bhd. should accept from CSI Bhd. for the converted machine. (12 marks) b) Explain why you include each of the items in your calculation in part (a) above. (6 marks) (Total: 18 marks)