Answered step by step

Verified Expert Solution

Question

1 Approved Answer

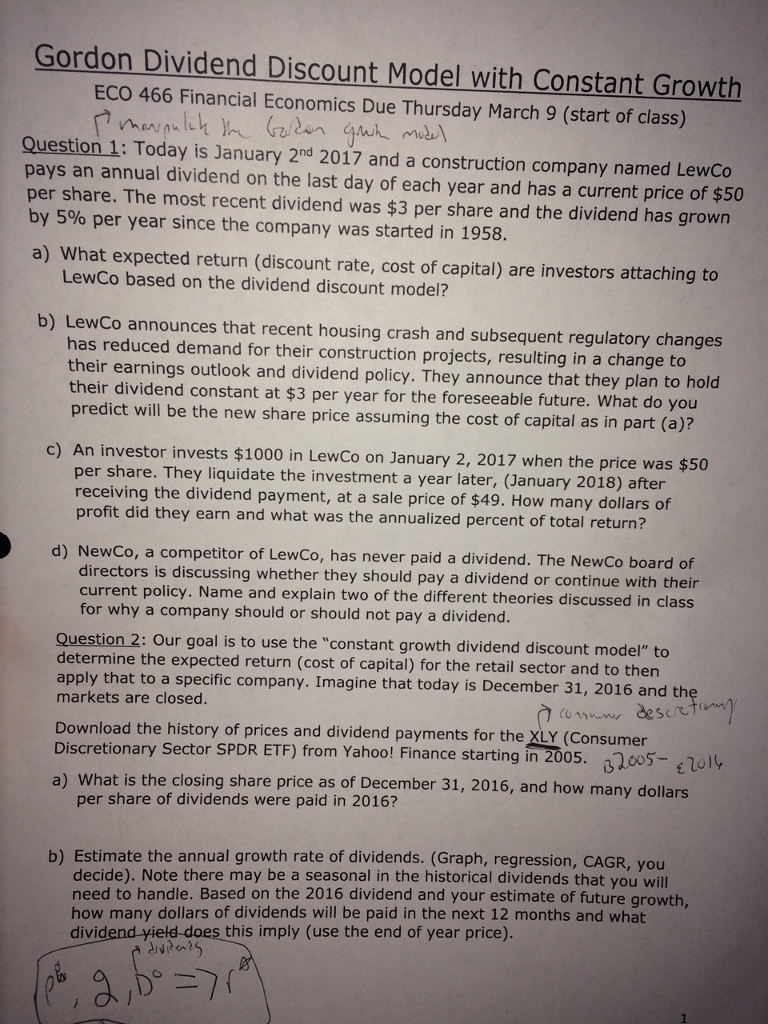

Question 2, parts A and B please. Today is January 2^nd 2017 and a construction company named Lew Co pays an annual dividend on the

Question 2, parts A and B please.

Today is January 2^nd 2017 and a construction company named Lew Co pays an annual dividend on the last day of each year and has a current price of $50 per share. The most recent dividend was $3 per share and the dividend has grown by 5% per year since the company was started in 1958. What expected return (discount rate, cost of capital) are investors attaching to Lew Co based on the dividend discount model? Lew Co announces that recent housing crash and subsequent regulatory changes has reduced demand for their construction projects, resulting in a change to their earnings outlook and dividend policy. They announce that they plan to hold their dividend constant at $3 per year for the foreseeable future. What do you predict will be the new share price assuming the cost of capital as in part (a)? An investor invests $1000 in Lew Co on January 2, 2017 when the price was $50 per share. They liquidate the investment a year later, (January 2018) after receiving the dividend payment, at a sale price of $49. How many dollars of profit did they earn and what was the annualized percent of total return? New Co, a competitor of Lew Co, has never paid a dividend. The New Co board of directors is discussing whether they should pay a dividend or continue with their current policy. Name and explain two of the different theories discussed in class for why a company should or should not pay a dividend. Our goal is to use the "constant growth dividend discount model" to determine the expected return (cost of capital) for the retail sector and to then apply that to a specific company. Imagine that today is December 31, 2016 and the markets are closed. Download the history of prices and dividend payments for the XLY (Consumer Discretionary Sector SPDR ETF) from Yahoo! Finance starting in 2005. What is the closing share price as of December 31, 2016, and how many dollars per share of dividends were paid in 2016? Estimate the annual growth rate of dividends. (Graph, regression, CAGR, you decide). Note there may be a seasonal in the historical dividends that you will need to handle. Based on the 2016 dividend and your estimate of future growth, how many dollars of dividends will be paid in the next 12 months and what dividend yield does this imply (use the end of year price). Today is January 2^nd 2017 and a construction company named Lew Co pays an annual dividend on the last day of each year and has a current price of $50 per share. The most recent dividend was $3 per share and the dividend has grown by 5% per year since the company was started in 1958. What expected return (discount rate, cost of capital) are investors attaching to Lew Co based on the dividend discount model? Lew Co announces that recent housing crash and subsequent regulatory changes has reduced demand for their construction projects, resulting in a change to their earnings outlook and dividend policy. They announce that they plan to hold their dividend constant at $3 per year for the foreseeable future. What do you predict will be the new share price assuming the cost of capital as in part (a)? An investor invests $1000 in Lew Co on January 2, 2017 when the price was $50 per share. They liquidate the investment a year later, (January 2018) after receiving the dividend payment, at a sale price of $49. How many dollars of profit did they earn and what was the annualized percent of total return? New Co, a competitor of Lew Co, has never paid a dividend. The New Co board of directors is discussing whether they should pay a dividend or continue with their current policy. Name and explain two of the different theories discussed in class for why a company should or should not pay a dividend. Our goal is to use the "constant growth dividend discount model" to determine the expected return (cost of capital) for the retail sector and to then apply that to a specific company. Imagine that today is December 31, 2016 and the markets are closed. Download the history of prices and dividend payments for the XLY (Consumer Discretionary Sector SPDR ETF) from Yahoo! Finance starting in 2005. What is the closing share price as of December 31, 2016, and how many dollars per share of dividends were paid in 2016? Estimate the annual growth rate of dividends. (Graph, regression, CAGR, you decide). Note there may be a seasonal in the historical dividends that you will need to handle. Based on the 2016 dividend and your estimate of future growth, how many dollars of dividends will be paid in the next 12 months and what dividend yield does this imply (use the end of year price)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started