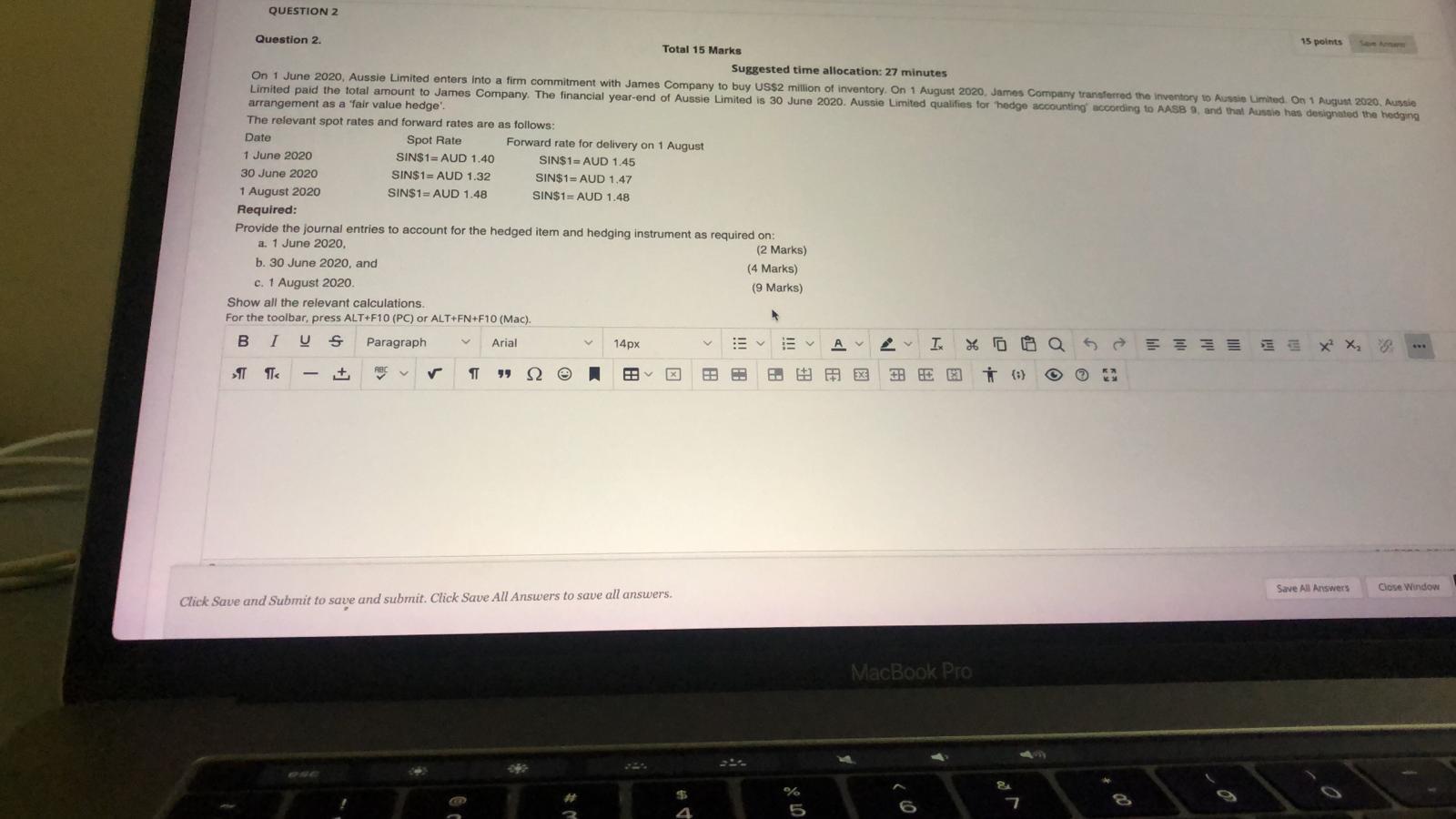

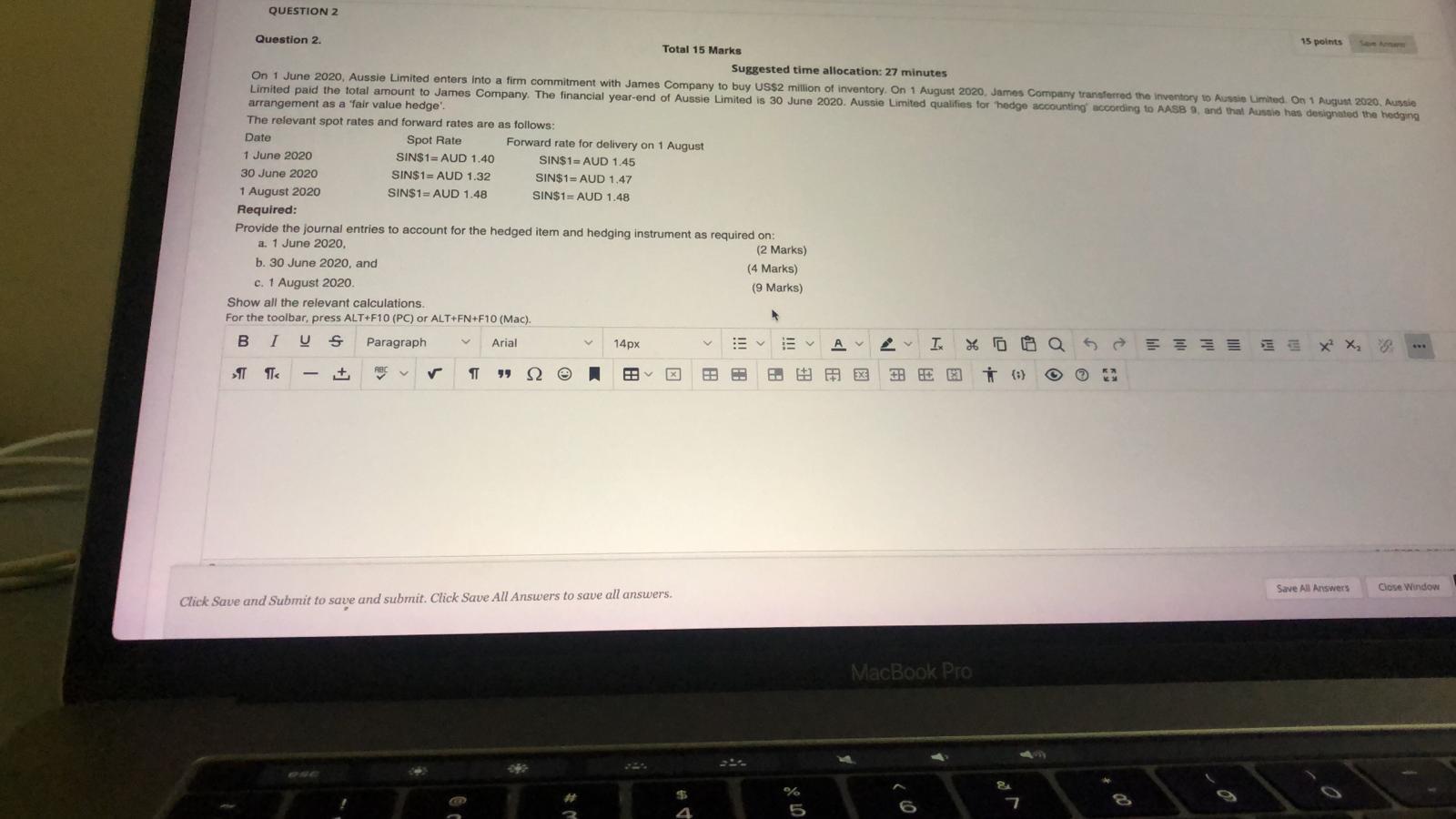

QUESTION 2 Question 2. 15 points Total 15 Marks Suggested time allocation: 27 minutes On 1 June 2020, Aussie Limited enters into firm commitment with James Company to buy US$2 million of inventory. On 1 August 2020, James Company transferred the inventory to Aussie Limited on 1 August 2020. Aussie Limited paid the total amount to James Company. The financial year-end of Aussie Limited is 30 June 2020. Aussie Limited qualifies for hedge accounting according to AASB 9, and that Austin has designated the hedging arrangement as a 'fair value hedge' The relevant spot rates and forward rates are as follows: Date Spot Rate Forward rate for delivery on 1 August 1 June 2020 SIN$1= AUD 1.40 SIN$1= AUD 1.45 30 June 2020 SIN$1 - AUD 1.32 SIN$1= AUD 1.47 1 August 2020 SIN$1 = AUD 1.48 SIN$1=AUD 1.48 Required: Provide the journal entries to account for the hedged item and hedging instrument as required on: a. 1 June 2020, (2 Marks) b. 30 June 2020, and (4 Marks) c. 1 August 2020 (9 Marks) Show all the relevant calculations For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B 1 US Paragraph Arial 14px T % x x TTT ABC v TT 99 av EX ta (:) Save All Answers Close Window Click Save and Submit to save and submit. Click Save All Answers to save all answers. MacBook Pro % 5 QUESTION 2 Question 2. 15 points Total 15 Marks Suggested time allocation: 27 minutes On 1 June 2020, Aussie Limited enters into firm commitment with James Company to buy US$2 million of inventory. On 1 August 2020, James Company transferred the inventory to Aussie Limited on 1 August 2020. Aussie Limited paid the total amount to James Company. The financial year-end of Aussie Limited is 30 June 2020. Aussie Limited qualifies for hedge accounting according to AASB 9, and that Austin has designated the hedging arrangement as a 'fair value hedge' The relevant spot rates and forward rates are as follows: Date Spot Rate Forward rate for delivery on 1 August 1 June 2020 SIN$1= AUD 1.40 SIN$1= AUD 1.45 30 June 2020 SIN$1 - AUD 1.32 SIN$1= AUD 1.47 1 August 2020 SIN$1 = AUD 1.48 SIN$1=AUD 1.48 Required: Provide the journal entries to account for the hedged item and hedging instrument as required on: a. 1 June 2020, (2 Marks) b. 30 June 2020, and (4 Marks) c. 1 August 2020 (9 Marks) Show all the relevant calculations For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B 1 US Paragraph Arial 14px T % x x TTT ABC v TT 99 av EX ta (:) Save All Answers Close Window Click Save and Submit to save and submit. Click Save All Answers to save all answers. MacBook Pro % 5