d

d

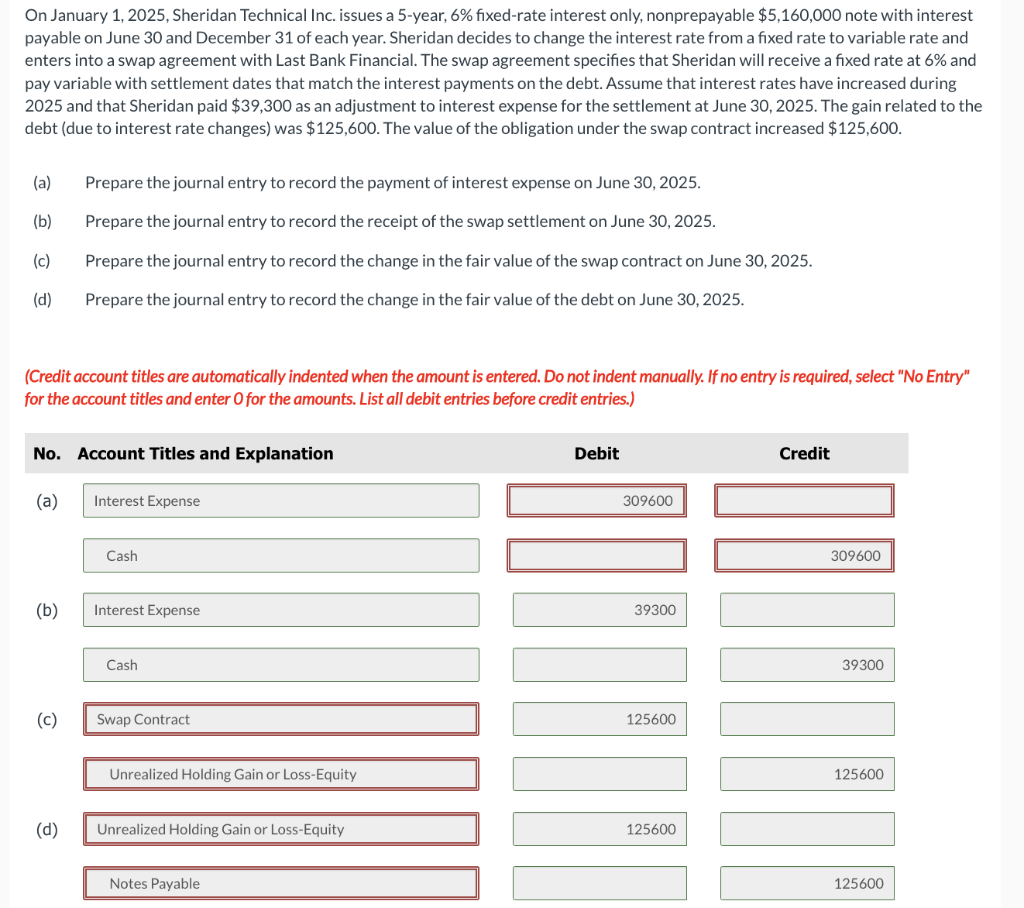

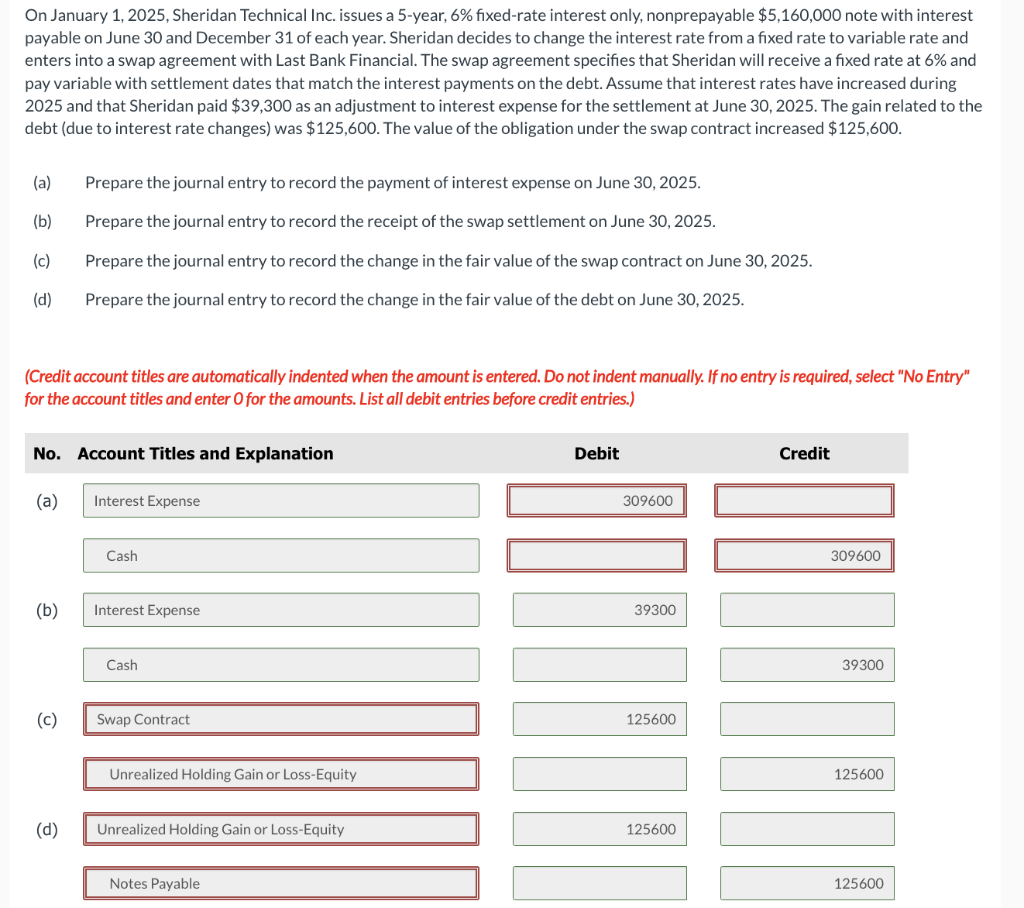

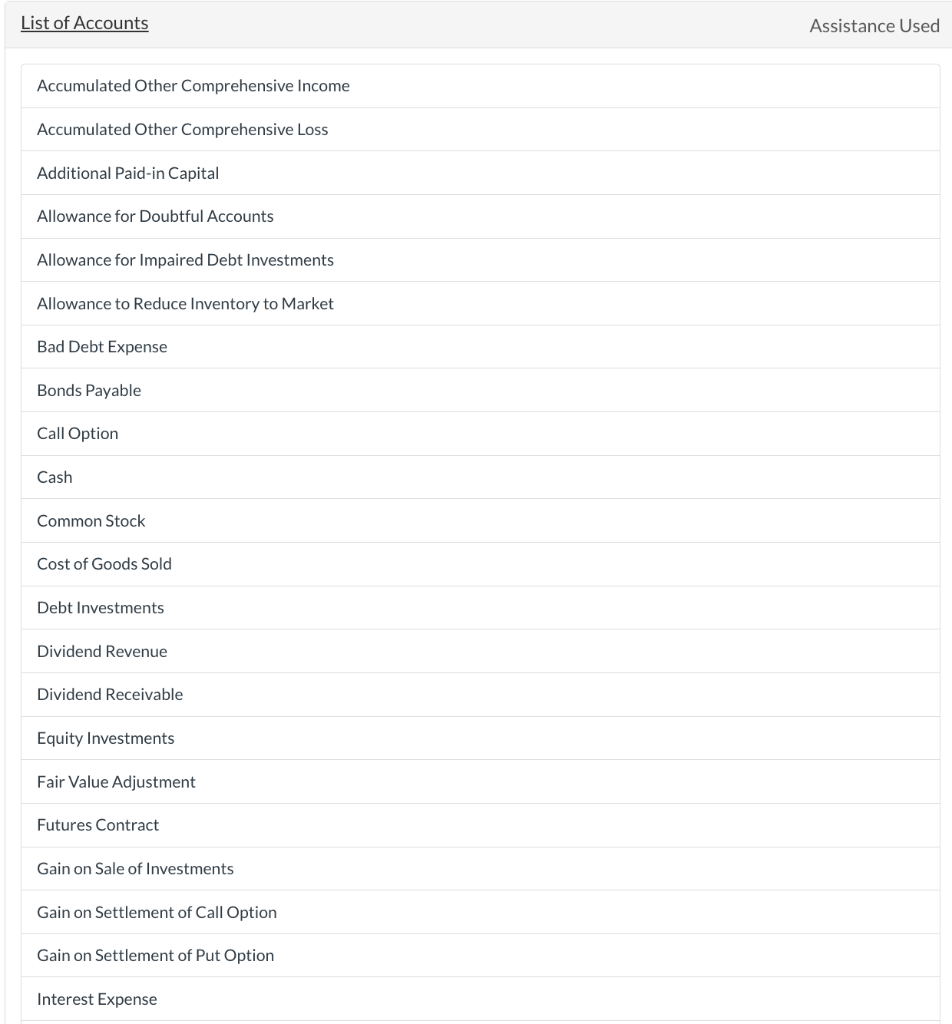

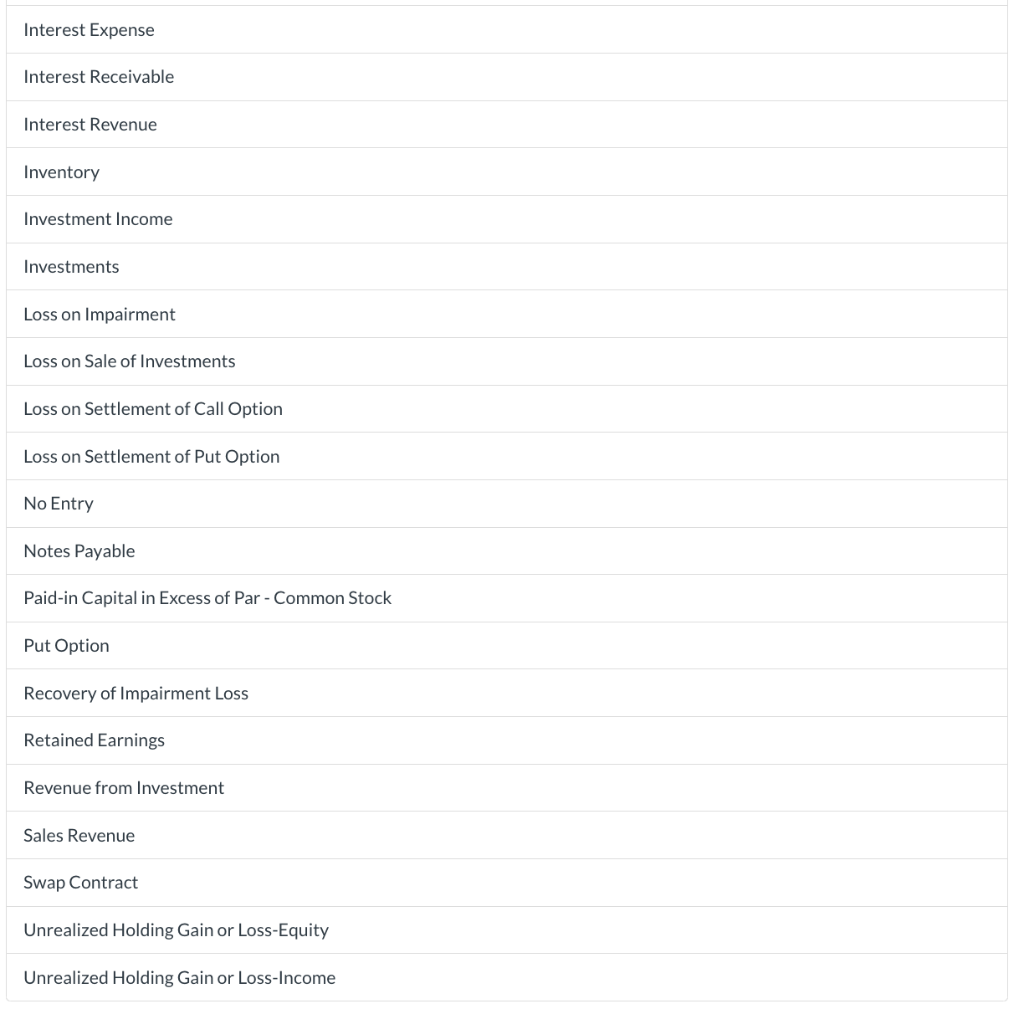

On January 1, 2025, Sheridan Technical Inc. issues a 5-year, 6\% fixed-rate interest only, nonprepayable $5,160,000 note with interest payable on June 30 and December 31 of each year. Sheridan decides to change the interest rate from a fixed rate to variable rate and enters into a swap agreement with Last Bank Financial. The swap agreement specifies that Sheridan will receive a fixed rate at 6% and pay variable with settlement dates that match the interest payments on the debt. Assume that interest rates have increased during 2025 and that Sheridan paid $39,300 as an adjustment to interest expense for the settlement at June 30,2025 . The gain related to the debt (due to interest rate changes) was $125,600. The value of the obligation under the swap contract increased $125,600. (a) Prepare the journal entry to record the payment of interest expense on June 30, 2025. (b) Prepare the journal entry to record the receipt of the swap settlement on June 30, 2025. (c) Prepare the journal entry to record the change in the fair value of the swap contract on June 30,2025. (d) Prepare the journal entry to record the change in the fair value of the debt on June 30, 2025. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) List of Accounts Assistance Used Accumulated Other Comprehensive Income Accumulated Other Comprehensive Loss Additional Paid-in Capital Allowance for Doubtful Accounts Allowance for Impaired Debt Investments Allowance to Reduce Inventory to Market Bad Debt Expense Bonds Payable Call Option Cash Common Stock Cost of Goods Sold Debt Investments Dividend Revenue Dividend Receivable Equity Investments Fair Value Adjustment Futures Contract Gain on Sale of Investments Gain on Settlement of Call Option Gain on Settlement of Put Option Interest Expense Interest Expense Interest Receivable Interest Revenue Inventory Investment Income Investments Loss on Impairment Loss on Sale of Investments Loss on Settlement of Call Option Loss on Settlement of Put Option No Entry Notes Payable Paid-in Capital in Excess of Par - Common Stock Put Option Recovery of Impairment Loss Retained Earnings Revenue from Investment Sales Revenue Swap Contract Unrealized Holding Gain or Loss-Equity Unrealized Holding Gain or Loss-Income On January 1, 2025, Sheridan Technical Inc. issues a 5-year, 6\% fixed-rate interest only, nonprepayable $5,160,000 note with interest payable on June 30 and December 31 of each year. Sheridan decides to change the interest rate from a fixed rate to variable rate and enters into a swap agreement with Last Bank Financial. The swap agreement specifies that Sheridan will receive a fixed rate at 6% and pay variable with settlement dates that match the interest payments on the debt. Assume that interest rates have increased during 2025 and that Sheridan paid $39,300 as an adjustment to interest expense for the settlement at June 30,2025 . The gain related to the debt (due to interest rate changes) was $125,600. The value of the obligation under the swap contract increased $125,600. (a) Prepare the journal entry to record the payment of interest expense on June 30, 2025. (b) Prepare the journal entry to record the receipt of the swap settlement on June 30, 2025. (c) Prepare the journal entry to record the change in the fair value of the swap contract on June 30,2025. (d) Prepare the journal entry to record the change in the fair value of the debt on June 30, 2025. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) List of Accounts Assistance Used Accumulated Other Comprehensive Income Accumulated Other Comprehensive Loss Additional Paid-in Capital Allowance for Doubtful Accounts Allowance for Impaired Debt Investments Allowance to Reduce Inventory to Market Bad Debt Expense Bonds Payable Call Option Cash Common Stock Cost of Goods Sold Debt Investments Dividend Revenue Dividend Receivable Equity Investments Fair Value Adjustment Futures Contract Gain on Sale of Investments Gain on Settlement of Call Option Gain on Settlement of Put Option Interest Expense Interest Expense Interest Receivable Interest Revenue Inventory Investment Income Investments Loss on Impairment Loss on Sale of Investments Loss on Settlement of Call Option Loss on Settlement of Put Option No Entry Notes Payable Paid-in Capital in Excess of Par - Common Stock Put Option Recovery of Impairment Loss Retained Earnings Revenue from Investment Sales Revenue Swap Contract Unrealized Holding Gain or Loss-Equity Unrealized Holding Gain or Loss-Income

d

d