Answered step by step

Verified Expert Solution

Question

1 Approved Answer

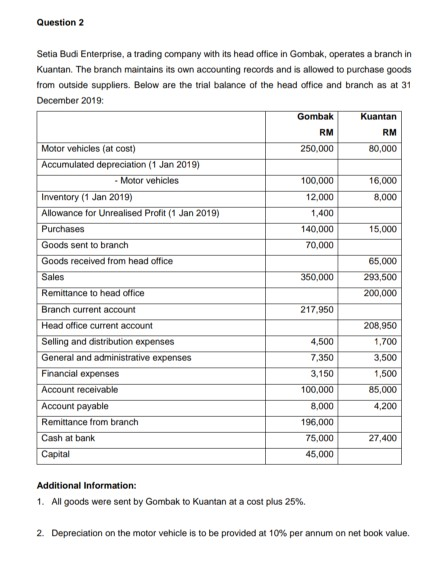

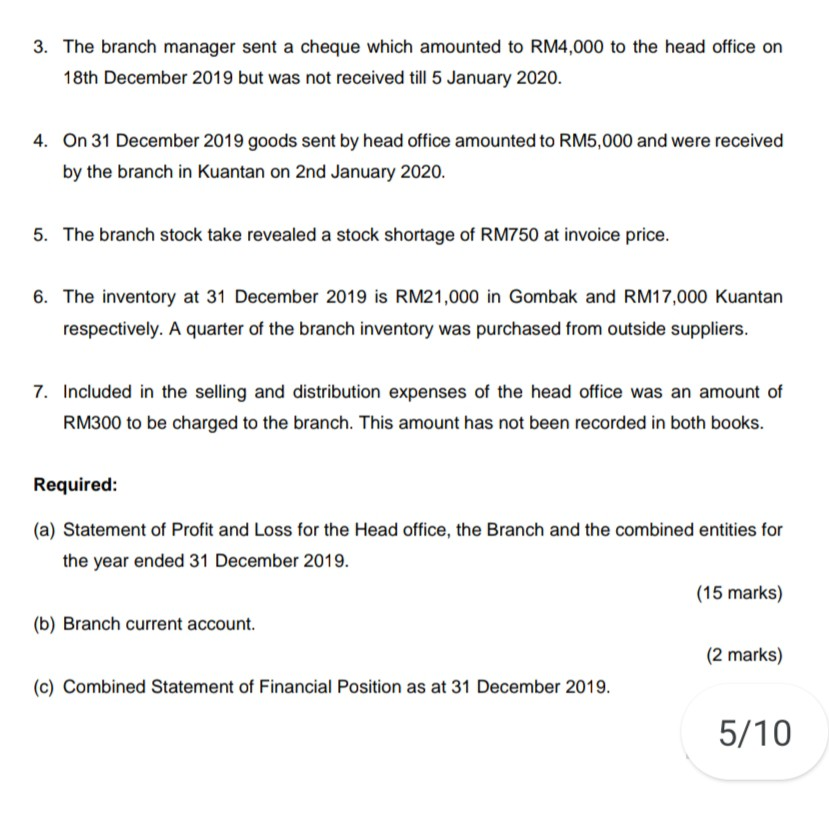

Question 2 Setia Budi Enterprise, a trading company with its head office in Gombak, operates a branch in Kuantan. The branch maintains its own accounting

Question 2 Setia Budi Enterprise, a trading company with its head office in Gombak, operates a branch in Kuantan. The branch maintains its own accounting records and is allowed to purchase goods from outside suppliers. Below are the trial balance of the head office and branch as at 31 December 2019 Gombak Kuantan RM RM Motor vehicles (at cost) 250,000 80,000 Accumulated depreciation (1 Jan 2019) - Motor vehicles 100,000 16,000 Inventory (1 Jan 2019) 12,000 8,000 Allowance for Unrealised Profit (1 Jan 2019) 1,400 Purchases 140,000 15,000 Goods sent to branch 70,000 Goods received from head office 65,000 Sales 350,000 293,500 Remittance to head office 200,000 Branch current account 217,950 Head office current account 208,950 Selling and distribution expenses 4,500 1,700 General and administrative expenses 7,350 3,500 Financial expenses 3,150 1,500 Account receivable 100,000 85,000 Account payable 8,000 4,200 Remittance from branch 196,000 Cash at bank 75,000 27,400 Capital 45,000 Additional Information: 1. All goods were sent by Gombak to Kuantan at a cost plus 25%. 2. Depreciation on the motor vehicle is to be provided at 10% per annum on net book value. 3. The branch manager sent a cheque which amounted to RM4,000 to the head office on 18th December 2019 but was not received till 5 January 2020. 4. On 31 December 2019 goods sent by head office amounted to RM5,000 and were received by the branch in Kuantan on 2nd January 2020. 5. The branch stock take revealed a stock shortage of RM750 at invoice price. 6. The inventory at 31 December 2019 is RM21,000 in Gombak and RM17,000 Kuantan respectively. A quarter of the branch inventory was purchased from outside suppliers. 7. Included in the selling and distribution expenses of the head office was an amount of RM300 to be charged to the branch. This amount has not been recorded in both books. Required: (a) Statement of Profit and Loss for the Head office, the Branch and the combined entities for the year ended 31 December 2019. (15 marks) (b) Branch current account. (2 marks) (c) Combined Statement of Financial Position as at 31 December 2019. 5/10 Question 2 Setia Budi Enterprise, a trading company with its head office in Gombak, operates a branch in Kuantan. The branch maintains its own accounting records and is allowed to purchase goods from outside suppliers. Below are the trial balance of the head office and branch as at 31 December 2019 Gombak Kuantan RM RM Motor vehicles (at cost) 250,000 80,000 Accumulated depreciation (1 Jan 2019) - Motor vehicles 100,000 16,000 Inventory (1 Jan 2019) 12,000 8,000 Allowance for Unrealised Profit (1 Jan 2019) 1,400 Purchases 140,000 15,000 Goods sent to branch 70,000 Goods received from head office 65,000 Sales 350,000 293,500 Remittance to head office 200,000 Branch current account 217,950 Head office current account 208,950 Selling and distribution expenses 4,500 1,700 General and administrative expenses 7,350 3,500 Financial expenses 3,150 1,500 Account receivable 100,000 85,000 Account payable 8,000 4,200 Remittance from branch 196,000 Cash at bank 75,000 27,400 Capital 45,000 Additional Information: 1. All goods were sent by Gombak to Kuantan at a cost plus 25%. 2. Depreciation on the motor vehicle is to be provided at 10% per annum on net book value. 3. The branch manager sent a cheque which amounted to RM4,000 to the head office on 18th December 2019 but was not received till 5 January 2020. 4. On 31 December 2019 goods sent by head office amounted to RM5,000 and were received by the branch in Kuantan on 2nd January 2020. 5. The branch stock take revealed a stock shortage of RM750 at invoice price. 6. The inventory at 31 December 2019 is RM21,000 in Gombak and RM17,000 Kuantan respectively. A quarter of the branch inventory was purchased from outside suppliers. 7. Included in the selling and distribution expenses of the head office was an amount of RM300 to be charged to the branch. This amount has not been recorded in both books. Required: (a) Statement of Profit and Loss for the Head office, the Branch and the combined entities for the year ended 31 December 2019. (15 marks) (b) Branch current account. (2 marks) (c) Combined Statement of Financial Position as at 31 December 2019. 5/10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started