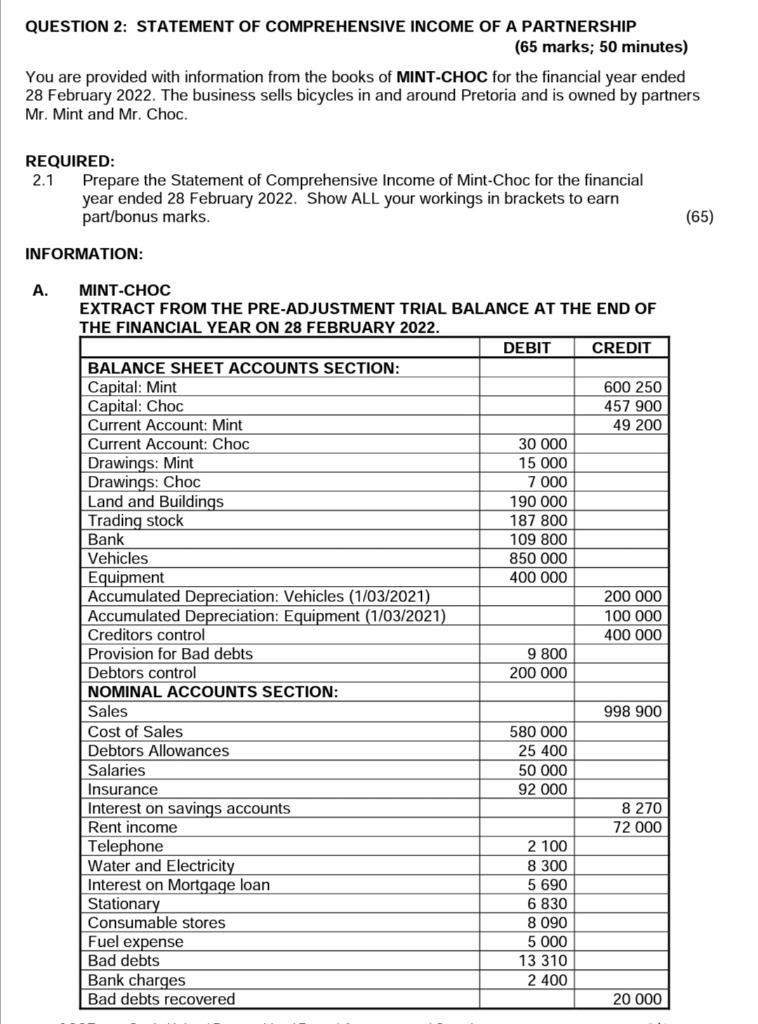

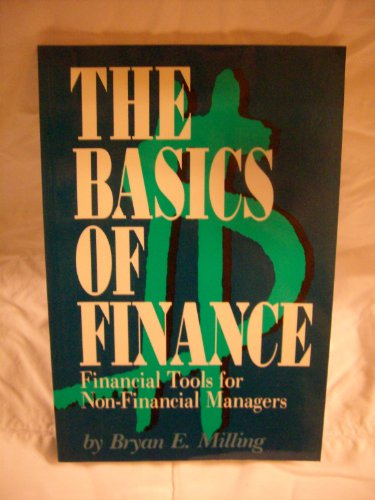

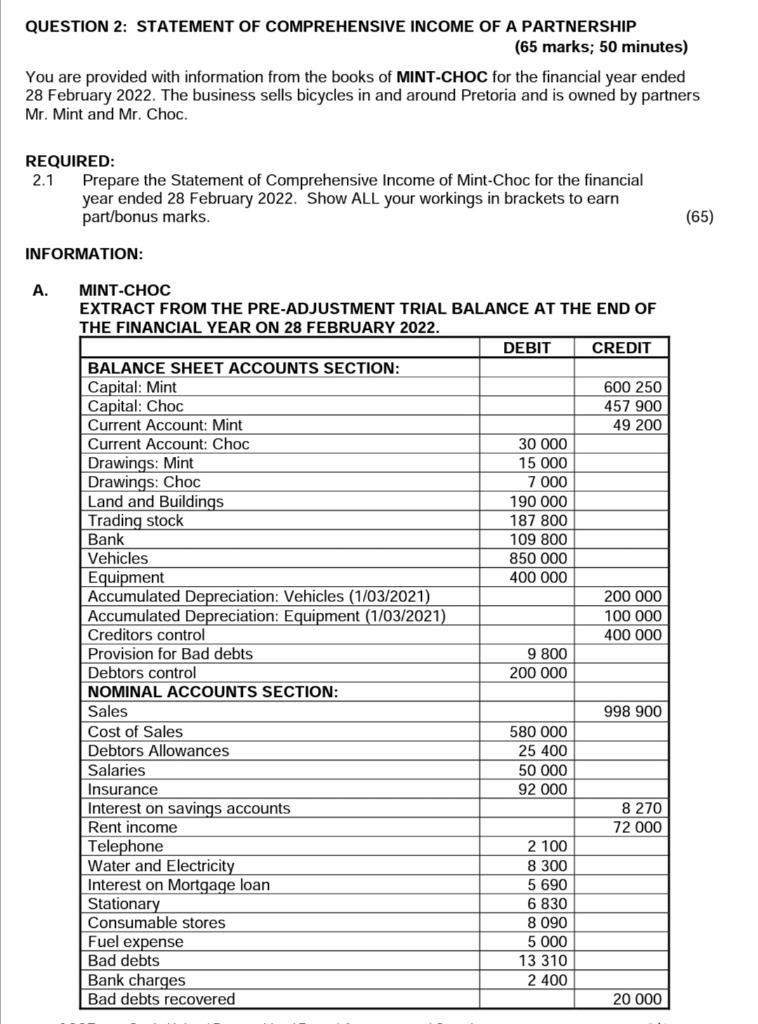

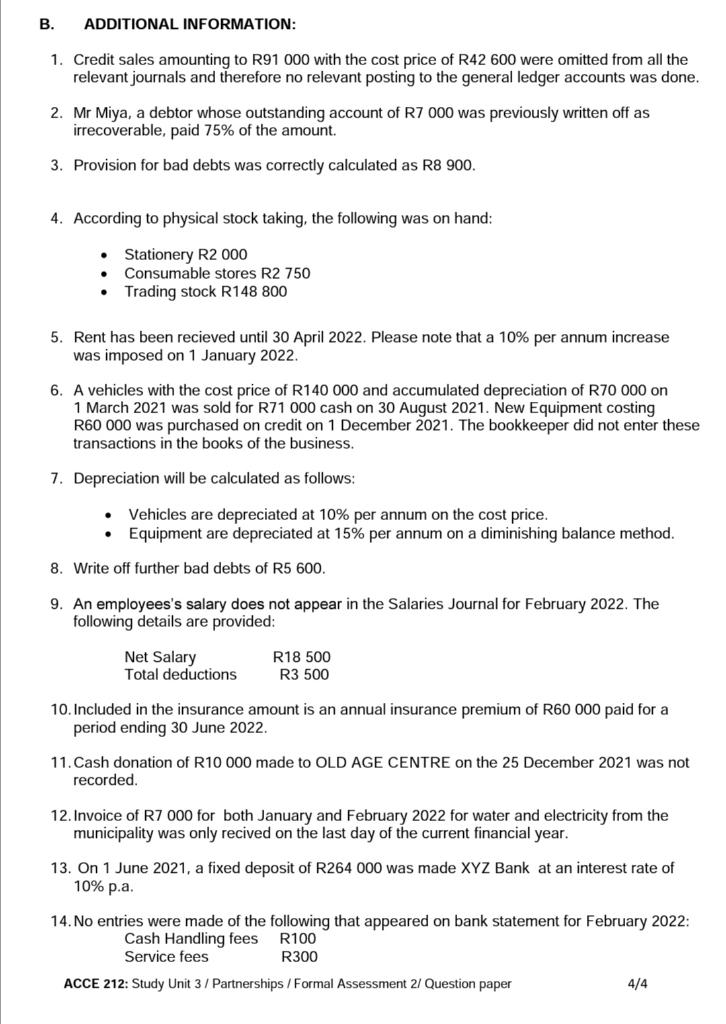

QUESTION 2: STATEMENT OF COMPREHENSIVE INCOME OF A PARTNERSHIP (65 marks; 50 minutes) You are provided with information from the books of MINT-CHOC for the financial year ended 28 February 2022. The business sells bicycles in and around Pretoria and is owned by partners Mr. Mint and Mr. Choc. REQUIRED: 2.1 Prepare the Statement of Comprehensive Income of Mint-Choc for the financial year ended 28 February 2022. Show ALL your workings in brackets to earn part/bonus marks. (65) INFORMATION: A. MINT-CHOC EXTRACT FROM THE PRE-ADJUSTMENT TRIAL BALANCE AT THE END OF THE FINANCIAL YEAR ON 28 FEBRUARY 2022. DEBIT CREDIT BALANCE SHEET ACCOUNTS SECTION: Capital: Mint 600 250 Capital: Choc 457 900 Current Account: Mint 49 200 Current Account: Choc 30 000 Drawings: lint 15 000 Drawings: Choc 7 000 Land and Buildings 190 000 Trading stock 187 800 Bank 109 800 Vehicles 850 000 Equipment 400 000 Accumulated Depreciation: Vehicles (1/03/2021) 200 000 Accumulated Depreciation: Equipment (1/03/2021) 100 000 Creditors control 400 000 Provision for Bad debts 9 800 Debtors control 200 000 NOMINAL ACCOUNTS SECTION: Sales 998 900 Cost of Sales 580 000 Debtors Allowances 25 400 Salaries 50 000 Insurance 92 000 Interest on savings accounts 8 270 Rent income 72 000 Telephone 2 100 Water and Electricity 8 300 Interest on Mortgage loan 5 690 Stationary 6830 Consumable stores 8 090 Fuel expense 5 000 Bad debts 13 310 Bank charges 2 400 Bad debts recovered 20 000 B. ADDITIONAL INFORMATION: 1. Credit sales amounting to R91 000 with the cost price of R42 600 were omitted from all the relevant journals and therefore no relevant posting to the general ledger accounts was done. 2. Mr Miya, a debtor whose outstanding account of R7 000 was previously written off as irrecoverable, paid 75% of the amount. 3. Provision for bad debts was correctly calculated as R8 900. 4. According to physical stock taking, the following was on hand: Stationery R2 000 Consumable stores R2 750 Trading stock R148 800 5. Rent has been recieved until 30 April 2022. Please note that a 10% per annum increase was imposed on 1 January 2022. 6. A vehicles with the cost price of R140 000 and accumulated depreciation of R70 000 on 1 March 2021 was sold for R71 000 cash on 30 August 2021. New Equipment costing R60 000 was purchased on credit on 1 December 2021. The bookkeeper did not enter these transactions in the books of the business. 7. Depreciation will be calculated as follows: . Vehicles are depreciated at 10% per annum on the cost price. Equipment are depreciated at 15% per annum on a diminishing balance method. 8. Write off further bad debts of R5 600. 9. An employees's salary does not appear in the Salaries Journal for February 2022. The following details are provided: Net Salary Total deductions R18 500 R3 500 10. Included in the insurance amount is an annual insurance premium of R60 000 paid for a period ending 30 June 2022. 11. Cash donation of R10 000 made to OLD AGE CENTRE on the 25 December 2021 was not recorded. 12. Invoice of R7 000 for both January and February 2022 for water and electricity from the municipality was only recived on the last day of the current financial year. 13. On 1 June 2021, a fixed deposit of R264 000 was made XYZ Bank at an interest rate of 10% p.a. 14. No entries were made of the following that appeared on bank statement for February 2022: Cash Handling fees R100 Service fees R300 ACCE 212: Study Unit 3 / Partnerships / Formal Assessment 2/ Question paper 4/4 QUESTION 2: STATEMENT OF COMPREHENSIVE INCOME OF A PARTNERSHIP (65 marks; 50 minutes) You are provided with information from the books of MINT-CHOC for the financial year ended 28 February 2022. The business sells bicycles in and around Pretoria and is owned by partners Mr. Mint and Mr. Choc. REQUIRED: 2.1 Prepare the Statement of Comprehensive Income of Mint-Choc for the financial year ended 28 February 2022. Show ALL your workings in brackets to earn part/bonus marks. (65) INFORMATION: A. MINT-CHOC EXTRACT FROM THE PRE-ADJUSTMENT TRIAL BALANCE AT THE END OF THE FINANCIAL YEAR ON 28 FEBRUARY 2022. DEBIT CREDIT BALANCE SHEET ACCOUNTS SECTION: Capital: Mint 600 250 Capital: Choc 457 900 Current Account: Mint 49 200 Current Account: Choc 30 000 Drawings: lint 15 000 Drawings: Choc 7 000 Land and Buildings 190 000 Trading stock 187 800 Bank 109 800 Vehicles 850 000 Equipment 400 000 Accumulated Depreciation: Vehicles (1/03/2021) 200 000 Accumulated Depreciation: Equipment (1/03/2021) 100 000 Creditors control 400 000 Provision for Bad debts 9 800 Debtors control 200 000 NOMINAL ACCOUNTS SECTION: Sales 998 900 Cost of Sales 580 000 Debtors Allowances 25 400 Salaries 50 000 Insurance 92 000 Interest on savings accounts 8 270 Rent income 72 000 Telephone 2 100 Water and Electricity 8 300 Interest on Mortgage loan 5 690 Stationary 6830 Consumable stores 8 090 Fuel expense 5 000 Bad debts 13 310 Bank charges 2 400 Bad debts recovered 20 000 B. ADDITIONAL INFORMATION: 1. Credit sales amounting to R91 000 with the cost price of R42 600 were omitted from all the relevant journals and therefore no relevant posting to the general ledger accounts was done. 2. Mr Miya, a debtor whose outstanding account of R7 000 was previously written off as irrecoverable, paid 75% of the amount. 3. Provision for bad debts was correctly calculated as R8 900. 4. According to physical stock taking, the following was on hand: Stationery R2 000 Consumable stores R2 750 Trading stock R148 800 5. Rent has been recieved until 30 April 2022. Please note that a 10% per annum increase was imposed on 1 January 2022. 6. A vehicles with the cost price of R140 000 and accumulated depreciation of R70 000 on 1 March 2021 was sold for R71 000 cash on 30 August 2021. New Equipment costing R60 000 was purchased on credit on 1 December 2021. The bookkeeper did not enter these transactions in the books of the business. 7. Depreciation will be calculated as follows: . Vehicles are depreciated at 10% per annum on the cost price. Equipment are depreciated at 15% per annum on a diminishing balance method. 8. Write off further bad debts of R5 600. 9. An employees's salary does not appear in the Salaries Journal for February 2022. The following details are provided: Net Salary Total deductions R18 500 R3 500 10. Included in the insurance amount is an annual insurance premium of R60 000 paid for a period ending 30 June 2022. 11. Cash donation of R10 000 made to OLD AGE CENTRE on the 25 December 2021 was not recorded. 12. Invoice of R7 000 for both January and February 2022 for water and electricity from the municipality was only recived on the last day of the current financial year. 13. On 1 June 2021, a fixed deposit of R264 000 was made XYZ Bank at an interest rate of 10% p.a. 14. No entries were made of the following that appeared on bank statement for February 2022: Cash Handling fees R100 Service fees R300 ACCE 212: Study Unit 3 / Partnerships / Formal Assessment 2/ Question paper 4/4