Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Stupendo Sdn. Bhd. is currently in the midst of evaluating a new product that can help to improve the company's overall corporate

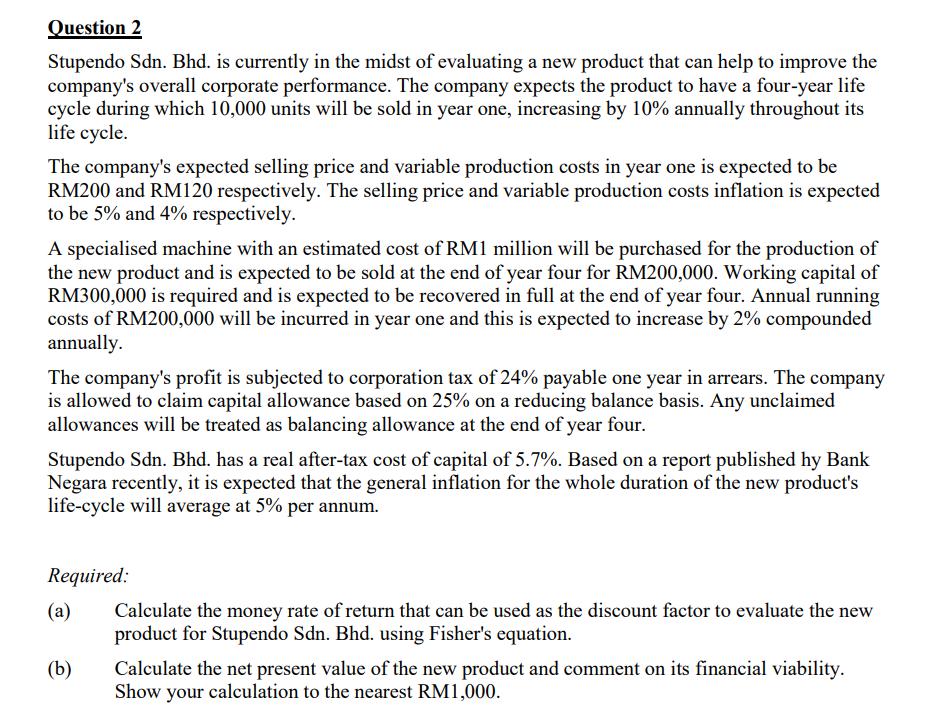

Question 2 Stupendo Sdn. Bhd. is currently in the midst of evaluating a new product that can help to improve the company's overall corporate performance. The company expects the product to have a four-year life cycle during which 10,000 units will be sold in year one, increasing by 10% annually throughout its life cycle. The company's expected selling price and variable production costs in year one is expected to be RM200 and RM120 respectively. The selling price and variable production costs inflation is expected to be 5% and 4% respectively. A specialised machine with an estimated cost of RM1 million will be purchased for the production of the new product and is expected to be sold at the end of year four for RM200,000. Working capital of RM300,000 is required and is expected to be recovered in full at the end of year four. Annual running costs of RM200,000 will be incurred in year one and this is expected to increase by 2% compounded annually. The company's profit is subjected to corporation tax of 24% payable one year in arrears. The company is allowed to claim capital allowance based on 25% on a reducing balance basis. Any unclaimed allowances will be treated as balancing allowance at the end of year four. Stupendo Sdn. Bhd. has a real after-tax cost of capital of 5.7%. Based on a report published hy Bank Negara recently, it is expected that the general inflation for the whole duration of the new product's life-cycle will average at 5% per annum. Required: (a) (b) Calculate the money rate of return that can be used as the discount factor to evaluate the new product for Stupendo Sdn. Bhd. using Fisher's equation. Calculate the net present value of the new product and comment on its financial viability. Show your calculation to the nearest RM1,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started