Answered step by step

Verified Expert Solution

Question

1 Approved Answer

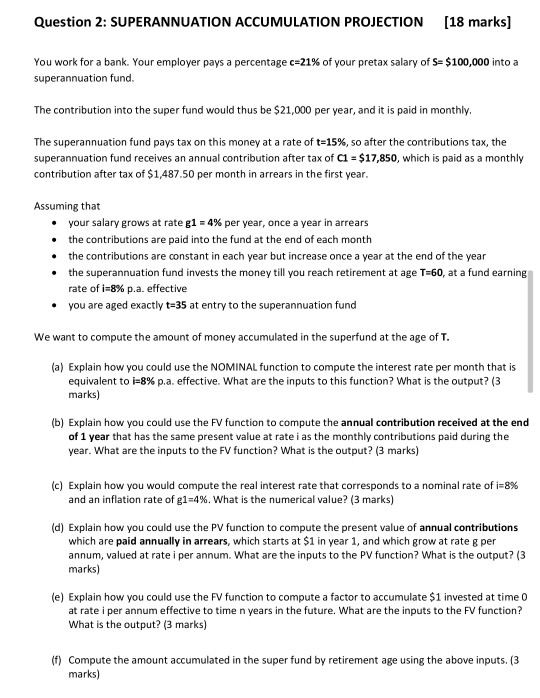

Question 2: SUPERANNUATION ACCUMULATION PROJECTION (18 marks) You work for a bank. Your employer pays a percentage c=21% of your pretax salary of S= $100,000

Question 2: SUPERANNUATION ACCUMULATION PROJECTION (18 marks) You work for a bank. Your employer pays a percentage c=21% of your pretax salary of S= $100,000 into a superannuation fund. The contribution into the super fund would thus be $21,000 per year, and it is paid in monthly The superannuation fund pays tax on this money at a rate of t=15%, so after the contributions tax, the superannuation fund receives an annual contribution after tax of C1 = $17,850, which is paid as a monthly contribution after tax of $1,487.50 per month in arrears in the first year. Assuming that your salary grows at rate gi = 4% per year, once a year in arrears the contributions are paid into the fund at the end of each month the contributions are constant in each year but increase once a year at the end of the year the superannuation fund invests the money till you reach retirement at age T=60, at a fund earning rate of i=8% p.a. effective you are aged exactly t=35 at entry to the superannuation fund We want to compute the amount of money accumulated in the superfund at the age of T. (a) Explain how you could use the NOMINAL function to compute the interest rate per month that is equivalent to i=8% p.a. effective. What are the inputs to this function? What is the output? (3 marks) (b) Explain how you could use the FV function to compute the annual contribution received at the end of 1 year that has the same present value at rate as the monthly contributions paid during the year. What are the inputs to the FV function? What is the output? (3 marks) (c) Explain how you would compute the real interest rate that corresponds to a nominal rate of i=8% and an inflation rate of g1=4%. What is the numerical value? (3 marks) (d) Explain how you could use the PV function to compute the present value of annual contributions which are paid annually in arrears, which starts at $1 in year 1, and which grow at rate g per annum, valued at rate i per annum. What are the inputs to the PV function? What is the output? (3 marks) (e) Explain how you could use the FV function to compute a factor to accumulate $1 invested at time o at rate i per annum effective to time n years in the future. What are the inputs to the FV function? What is the output? (3 marks) (f) Compute the amount accumulated in the super fund by retirement age using the above inputs. (3 marks) Question 2: SUPERANNUATION ACCUMULATION PROJECTION (18 marks) You work for a bank. Your employer pays a percentage c=21% of your pretax salary of S= $100,000 into a superannuation fund. The contribution into the super fund would thus be $21,000 per year, and it is paid in monthly The superannuation fund pays tax on this money at a rate of t=15%, so after the contributions tax, the superannuation fund receives an annual contribution after tax of C1 = $17,850, which is paid as a monthly contribution after tax of $1,487.50 per month in arrears in the first year. Assuming that your salary grows at rate gi = 4% per year, once a year in arrears the contributions are paid into the fund at the end of each month the contributions are constant in each year but increase once a year at the end of the year the superannuation fund invests the money till you reach retirement at age T=60, at a fund earning rate of i=8% p.a. effective you are aged exactly t=35 at entry to the superannuation fund We want to compute the amount of money accumulated in the superfund at the age of T. (a) Explain how you could use the NOMINAL function to compute the interest rate per month that is equivalent to i=8% p.a. effective. What are the inputs to this function? What is the output? (3 marks) (b) Explain how you could use the FV function to compute the annual contribution received at the end of 1 year that has the same present value at rate as the monthly contributions paid during the year. What are the inputs to the FV function? What is the output? (3 marks) (c) Explain how you would compute the real interest rate that corresponds to a nominal rate of i=8% and an inflation rate of g1=4%. What is the numerical value? (3 marks) (d) Explain how you could use the PV function to compute the present value of annual contributions which are paid annually in arrears, which starts at $1 in year 1, and which grow at rate g per annum, valued at rate i per annum. What are the inputs to the PV function? What is the output? (3 marks) (e) Explain how you could use the FV function to compute a factor to accumulate $1 invested at time o at rate i per annum effective to time n years in the future. What are the inputs to the FV function? What is the output? (3 marks) (f) Compute the amount accumulated in the super fund by retirement age using the above inputs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started