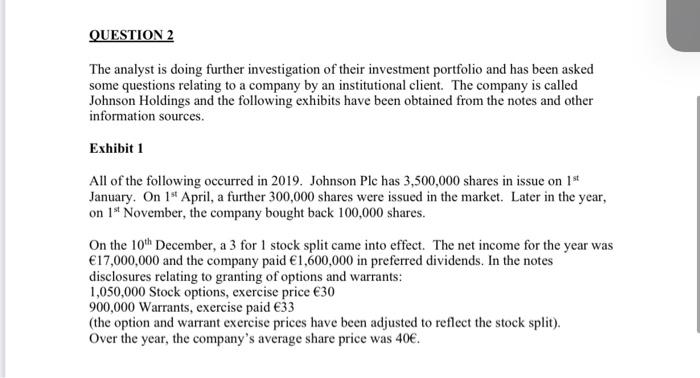

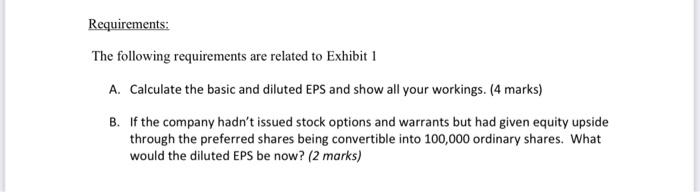

QUESTION 2 The analyst is doing further investigation of their investment portfolio and has been asked some questions relating to a company by an institutional client. The company is called Johnson Holdings and the following exhibits have been obtained from the notes and other information sources. Exhibit 1 All of the following occurred in 2019. Johnson Plc has 3,500,000 shares in issue on 1st January. On 1" April, a further 300,000 shares were issued in the market. Later in the year, on 1 November, the company bought back 100,000 shares. On the 10th December, a 3 for 1 stock split came into effect. The net income for the year was 17,000,000 and the company paid 1,600,000 in preferred dividends. In the notes disclosures relating to granting of options and warrants: 1,050,000 Stock options, exercise price 30 900,000 Warrants, exercise paid 33 (the option and warrant exercise prices have been adjusted to reflect the stock split). Over the year, the company's average share price was 40. Requirements: The following requirements are related to Exhibit 1 A. Calculate the basic and diluted EPS and show all your workings. (4 marks) B. If the company hadn't issued stock options and warrants but had given equity upside through the preferred shares being convertible into 100,000 ordinary shares. What would the diluted EPS be now? (2 marks) QUESTION 2 The analyst is doing further investigation of their investment portfolio and has been asked some questions relating to a company by an institutional client. The company is called Johnson Holdings and the following exhibits have been obtained from the notes and other information sources. Exhibit 1 All of the following occurred in 2019. Johnson Plc has 3,500,000 shares in issue on 1st January. On 1" April, a further 300,000 shares were issued in the market. Later in the year, on 1 November, the company bought back 100,000 shares. On the 10th December, a 3 for 1 stock split came into effect. The net income for the year was 17,000,000 and the company paid 1,600,000 in preferred dividends. In the notes disclosures relating to granting of options and warrants: 1,050,000 Stock options, exercise price 30 900,000 Warrants, exercise paid 33 (the option and warrant exercise prices have been adjusted to reflect the stock split). Over the year, the company's average share price was 40. Requirements: The following requirements are related to Exhibit 1 A. Calculate the basic and diluted EPS and show all your workings. (4 marks) B. If the company hadn't issued stock options and warrants but had given equity upside through the preferred shares being convertible into 100,000 ordinary shares. What would the diluted EPS be now? (2 marks)