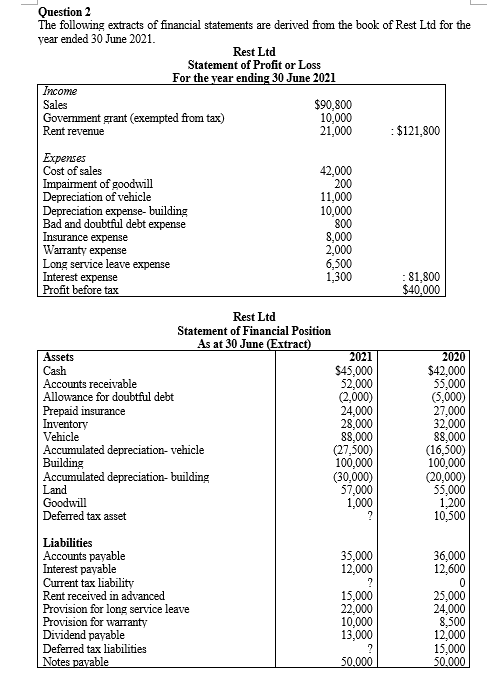

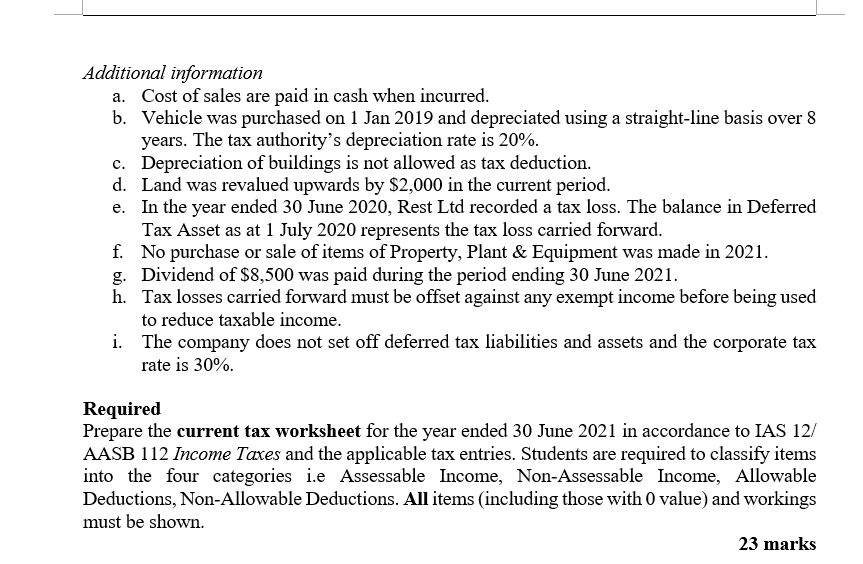

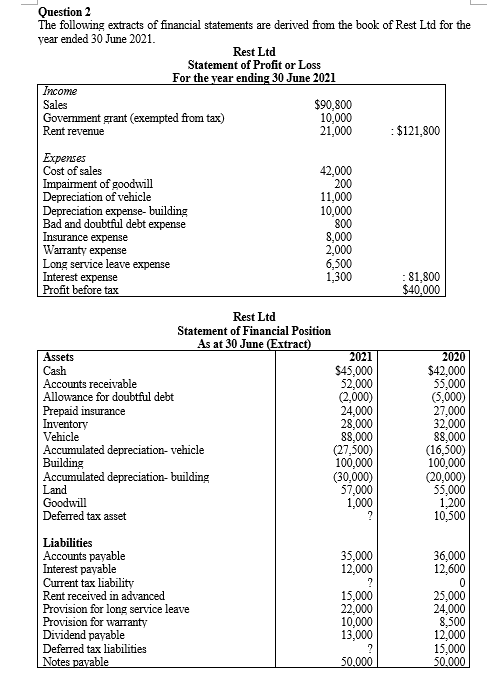

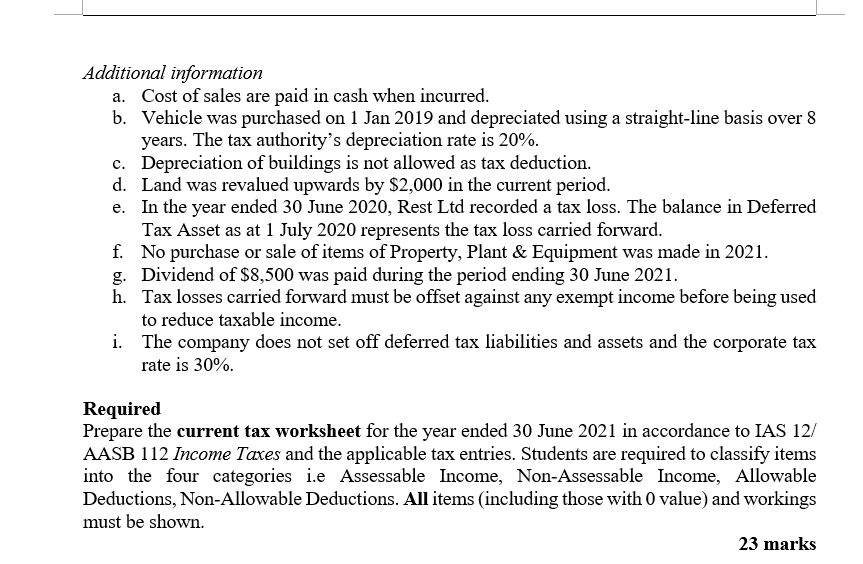

Question 2 The following extracts of financial statements are derived from the book of Rest Ltd for the year ended 30 June 2021. Rest Ltd Statement of Profit or Loss For the year ending 30 June 2021 Income Sales $90,800 Goverment grant (exempted from tax) 10,000 Rent revenue 21,000 : $121,800 Expenses Cost of sales Impaiment of goodwill Depreciation of vehicle Depreciation expense-building Bad and doubtful debt expense Insurance expense Warranty expense Long service leave expense Interest expense Profit before tax 42,000 200 11,000 10,000 800 8,000 2,000 6,500 1,300 : 81,800 $40,000 Rest Ltd Statement of Financial Position As at 30 June (Extract) Assets 2021 Cash $45,000 Accounts receivable 52,000 Allowance for doubtful debt (2,000) Prepaid insurance 24,000 Inventory 28,000 Vehicle ,000 Accumulated depreciation-vehicle (27,500) Building 100,000 Accumulated depreciation-building (30,000) Land 57,000 Goodwill 1,000 Deferred tax asset Liabilities Accounts payable 35,000 Interest payable 12,000 Current tax liability Rent received in advanced 15,000 Provision for long service leave 22,000 Provision for warranty 10,000 Dividend payable 13,000 Deferred tax liabilities Notes payable 50,000 2020 $42,000 55,000 (5,000) 27,000 32,000 88,000 (16,500) 100,000 (20,000) 55,000 1,200 10,500 36,000 12,600 0 25,000 24,000 8,500 12,000 15,000 50.000 Additional information a. Cost of sales are paid in cash when incurred. b. Vehicle was purchased on 1 Jan 2019 and depreciated using a straight-line basis over 8 years. The tax authority's depreciation rate is 20%. c. Depreciation of buildings is not allowed as tax deduction. d. Land was revalued upwards by $2,000 in the current period. e. In the year ended 30 June 2020, Rest Ltd recorded a tax loss. The balance in Deferred Tax Asset as at 1 July 2020 represents the tax loss carried forward. f. No purchase or sale of items of Property, Plant & Equipment was made in 2021. g. Dividend of $8,500 was paid during the period ending 30 June 2021. h. Tax losses carried forward must be offset against any exempt income before being used to reduce taxable income. i. The company does not set off deferred tax liabilities and assets and the corporate tax rate is 30%. Required Prepare the current tax worksheet for the year ended 30 June 2021 in accordance to IAS 12/ AASB 112 Income Taxes and the applicable tax entries. Students are required to classify items into the four categories i.e Assessable Income, Non-Assessable Income, Allowable Deductions, Non-Allowable Deductions. All items (including those with 0 value) and workings must be shown. 23 marks Question 2 The following extracts of financial statements are derived from the book of Rest Ltd for the year ended 30 June 2021. Rest Ltd Statement of Profit or Loss For the year ending 30 June 2021 Income Sales $90,800 Goverment grant (exempted from tax) 10,000 Rent revenue 21,000 : $121,800 Expenses Cost of sales Impaiment of goodwill Depreciation of vehicle Depreciation expense-building Bad and doubtful debt expense Insurance expense Warranty expense Long service leave expense Interest expense Profit before tax 42,000 200 11,000 10,000 800 8,000 2,000 6,500 1,300 : 81,800 $40,000 Rest Ltd Statement of Financial Position As at 30 June (Extract) Assets 2021 Cash $45,000 Accounts receivable 52,000 Allowance for doubtful debt (2,000) Prepaid insurance 24,000 Inventory 28,000 Vehicle ,000 Accumulated depreciation-vehicle (27,500) Building 100,000 Accumulated depreciation-building (30,000) Land 57,000 Goodwill 1,000 Deferred tax asset Liabilities Accounts payable 35,000 Interest payable 12,000 Current tax liability Rent received in advanced 15,000 Provision for long service leave 22,000 Provision for warranty 10,000 Dividend payable 13,000 Deferred tax liabilities Notes payable 50,000 2020 $42,000 55,000 (5,000) 27,000 32,000 88,000 (16,500) 100,000 (20,000) 55,000 1,200 10,500 36,000 12,600 0 25,000 24,000 8,500 12,000 15,000 50.000 Additional information a. Cost of sales are paid in cash when incurred. b. Vehicle was purchased on 1 Jan 2019 and depreciated using a straight-line basis over 8 years. The tax authority's depreciation rate is 20%. c. Depreciation of buildings is not allowed as tax deduction. d. Land was revalued upwards by $2,000 in the current period. e. In the year ended 30 June 2020, Rest Ltd recorded a tax loss. The balance in Deferred Tax Asset as at 1 July 2020 represents the tax loss carried forward. f. No purchase or sale of items of Property, Plant & Equipment was made in 2021. g. Dividend of $8,500 was paid during the period ending 30 June 2021. h. Tax losses carried forward must be offset against any exempt income before being used to reduce taxable income. i. The company does not set off deferred tax liabilities and assets and the corporate tax rate is 30%. Required Prepare the current tax worksheet for the year ended 30 June 2021 in accordance to IAS 12/ AASB 112 Income Taxes and the applicable tax entries. Students are required to classify items into the four categories i.e Assessable Income, Non-Assessable Income, Allowable Deductions, Non-Allowable Deductions. All items (including those with 0 value) and workings must be shown. 23 marks