Question

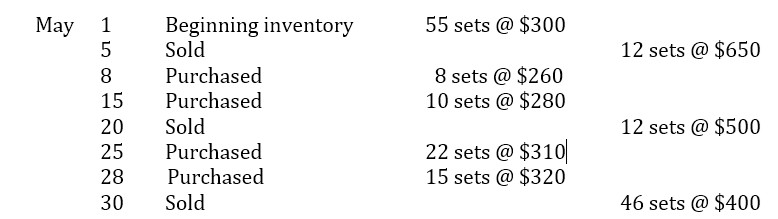

Question 2 The following information relates to the inventory of golf club sets in the records of Lion Golf Ltd for the month of May

Question 2

The following information relates to the inventory of golf club sets in the records of Lion Golf Ltd for the month of May 2020:

Lion Golf Ltd uses the perpetual inventory system.

Due to recent lockdown related to the pandemic, the sales of golf set has been affected tremendously. A the end of May 2020, Lion decided to revise the selling price at $300 per set.

In order to sell a set, Lion has to pay transportation costs of $40 a set to deliver the golf set to customers. No stock loss has occurred.

Required:

- Prepare the journal entries for the Cost of good sold for transaction dated May 30using the First-in-First-Out (FIFO) method.

- Determine the cost of goods sold for the month of May 2020 using the weighted average method. Show all your workings clearly for each sale.

- Determine the reported value of ending inventory under AASB 102 Inventories, using the weighted average method. Show all your workings clearly.

Prepare the journal entries to record the write-off of inventory value (include narrations).

- An intern Alan was recording the goods return from customers. He asked you as the Accountant of Lion Golf Ltd why sales return account is debited and not the sales account.

Explain to Alan the reason why sales return account is debited instead of sales account.

55 sets @ $300 12 sets @ $650 May 1 5 8 15 20 25 28 30 Beginning inventory Sold Purchased Purchased Sold Purchased Purchased Sold 8 sets @ $260 10 sets @ $280 12 sets @ $500 22 sets @ $310 15 sets @ $320 46 sets @ $400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started