Answered step by step

Verified Expert Solution

Question

1 Approved Answer

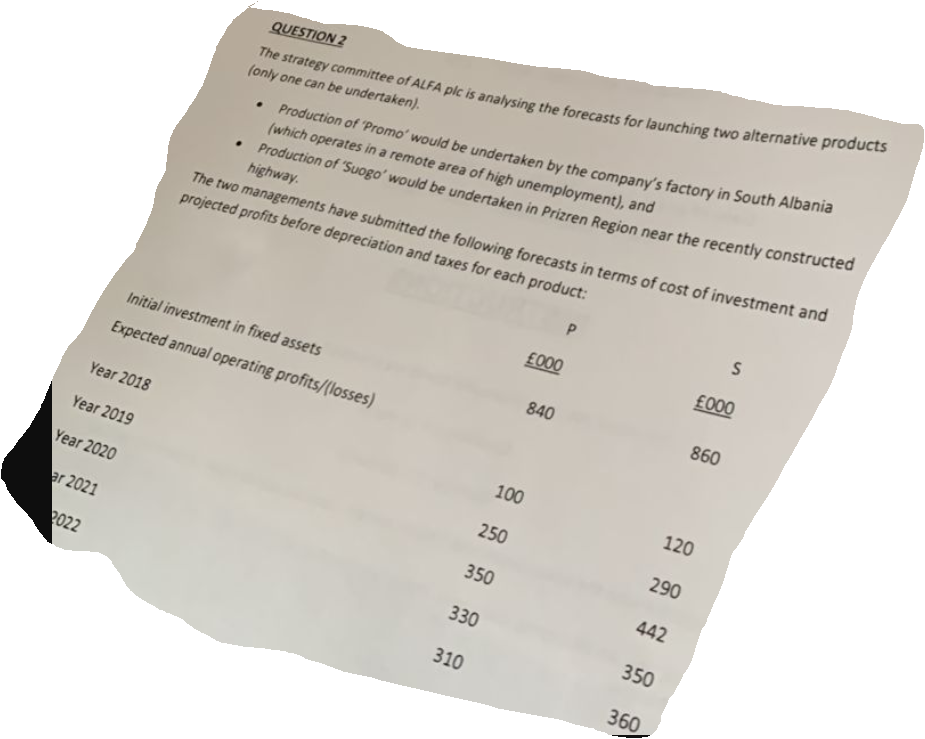

QUESTION 2 The strategy committee of ALFA plc is analysing the forecasts for launching two alternative products (only one can be undertaken). . Production

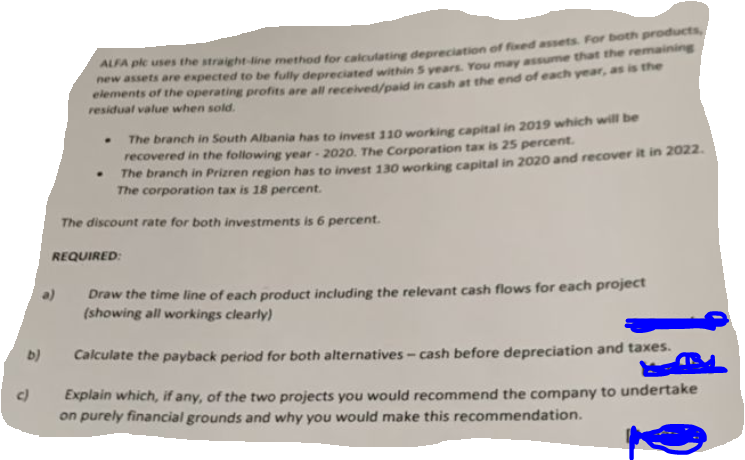

QUESTION 2 The strategy committee of ALFA plc is analysing the forecasts for launching two alternative products (only one can be undertaken). . Production of 'Promo' would be undertaken by the company's factory in South Albania (which operates in a remote area of high unemployment), and Production of 'Suogo' would be undertaken in Prizren Region near the recently constructed highway. The two managements have submitted the following forecasts in terms of cost of investment and projected profits before depreciation and taxes for each product: S P 000 000 Initial investment in fixed assets 840 860 Expected annual operating profits/(losses) Year 2018 100 120 Year 2019 250 290 Year 2020 350 442 ar 2021 330 350 2022 310 360 b) a) ALFA plc uses the straight-line method for calculating depreciation of fixed assets. For both products, new assets are expected to be fully depreciated within 5 years. You may assume that the remaining elements of the operating profits are all received/paid in cash at the end of each year, as is the residual value when sold. . The branch in South Albania has to invest 110 working capital in 2019 which will be recovered in the following year-2020. The Corporation tax is 25 percent. The branch in Prizren region has to invest 130 working capital in 2020 and recover it in 2022. The corporation tax is 18 percent. The discount rate for both investments is 6 percent. REQUIRED: Draw the time line of each product including the relevant cash flows for each project (showing all workings clearly) Calculate the payback period for both alternatives-cash before depreciation and taxes. Explain which, if any, of the two projects you would recommend the company to undertake on purely financial grounds and why you would make this recommendation. C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started