Answered step by step

Verified Expert Solution

Question

1 Approved Answer

... Question 2 UniMode Corp ('UniMode') is an all-equity company trading in NYSE. The company produces cosmetic products. The company has recently entered the market

...

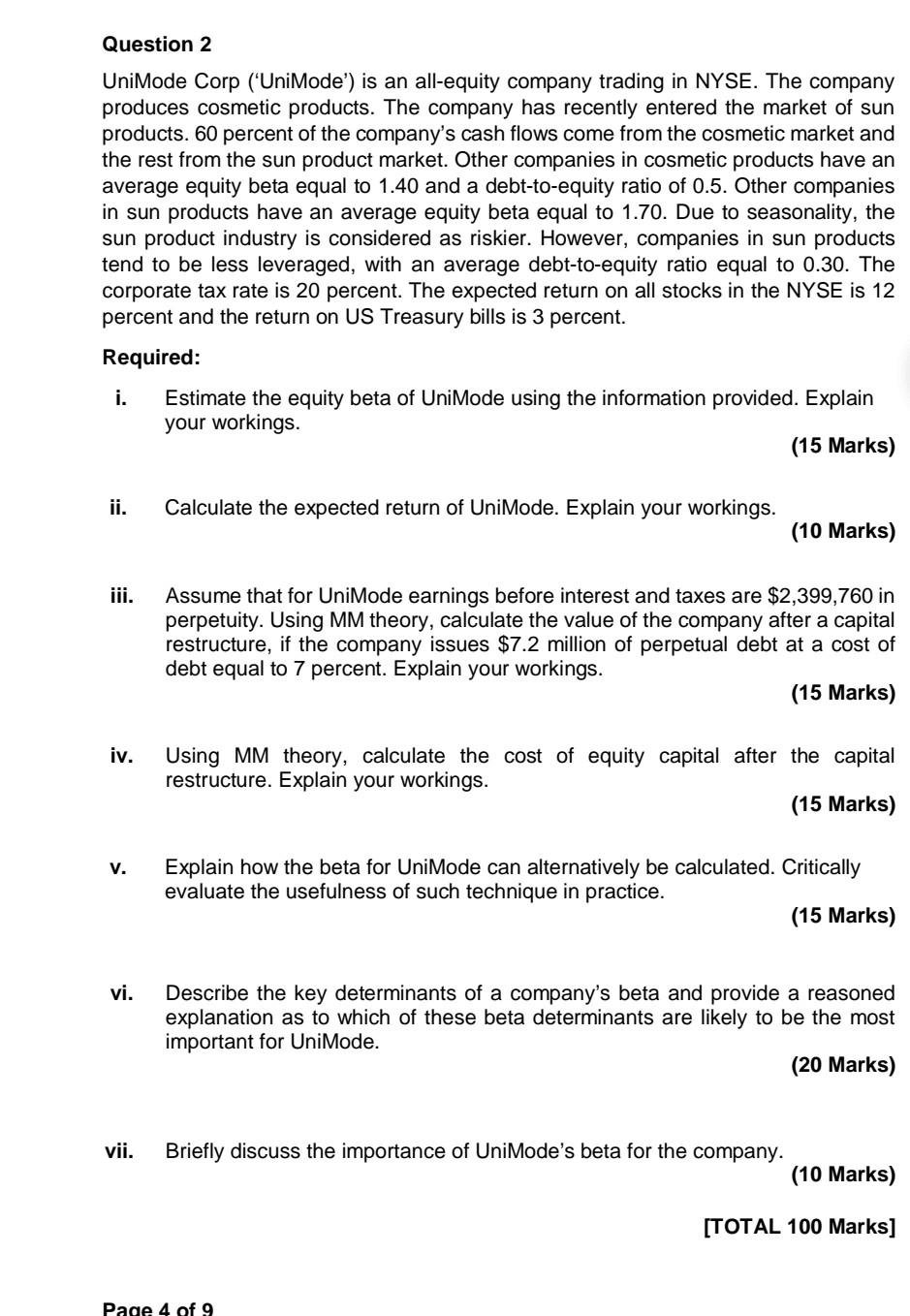

Question 2 UniMode Corp ('UniMode') is an all-equity company trading in NYSE. The company produces cosmetic products. The company has recently entered the market of sun products. 60 percent of the company's cash flows come from the cosmetic market and the rest from the sun product market. Other companies in cosmetic products have an average equity beta equal to 1.40 and a debt-to-equity ratio of 0.5. Other companies in sun products have an average equity beta equal to 1.70. Due to seasonality, the sun product industry is considered as riskier. However, companies in sun products tend to be less leveraged, with an average debt-to-equity ratio equal to 0.30. The corporate tax rate is 20 percent. The expected return on all stocks in the NYSE is 12 percent and the return on US Treasury bills is 3 percent. Required: i. Estimate the equity beta of UniMode using the information provided. Explain your workings. (15 Marks) ii. Calculate the expected return of UniMode. Explain your workings. (10 Marks) iii. Assume that for UniMode earnings before interest and taxes are $2,399,760 in perpetuity. Using MM theory, calculate the value of the company after a capital restructure, if the company issues $7.2 million of perpetual debt at a cost of debt equal to 7 percent. Explain your workings. (15 Marks) iv. Using MM theory, calculate the cost of equity capital after the capital restructure. Explain your workings. (15 Marks) V. Explain how the beta for UniMode can alternatively be calculated. Critically evaluate the usefulness of such technique in practice. (15 Marks) vi. Describe the key determinants of a company's beta and provide a reasoned explanation as to which of these beta determinants are likely to be the most important for UniMode. (20 Marks) vii. Briefly discuss the importance of UniMode's beta for the company. (10 Marks) [TOTAL 100 Marks] Page 4 of 9 Question 2 UniMode Corp ('UniMode') is an all-equity company trading in NYSE. The company produces cosmetic products. The company has recently entered the market of sun products. 60 percent of the company's cash flows come from the cosmetic market and the rest from the sun product market. Other companies in cosmetic products have an average equity beta equal to 1.40 and a debt-to-equity ratio of 0.5. Other companies in sun products have an average equity beta equal to 1.70. Due to seasonality, the sun product industry is considered as riskier. However, companies in sun products tend to be less leveraged, with an average debt-to-equity ratio equal to 0.30. The corporate tax rate is 20 percent. The expected return on all stocks in the NYSE is 12 percent and the return on US Treasury bills is 3 percent. Required: i. Estimate the equity beta of UniMode using the information provided. Explain your workings. (15 Marks) ii. Calculate the expected return of UniMode. Explain your workings. (10 Marks) iii. Assume that for UniMode earnings before interest and taxes are $2,399,760 in perpetuity. Using MM theory, calculate the value of the company after a capital restructure, if the company issues $7.2 million of perpetual debt at a cost of debt equal to 7 percent. Explain your workings. (15 Marks) iv. Using MM theory, calculate the cost of equity capital after the capital restructure. Explain your workings. (15 Marks) V. Explain how the beta for UniMode can alternatively be calculated. Critically evaluate the usefulness of such technique in practice. (15 Marks) vi. Describe the key determinants of a company's beta and provide a reasoned explanation as to which of these beta determinants are likely to be the most important for UniMode. (20 Marks) vii. Briefly discuss the importance of UniMode's beta for the company. (10 Marks) [TOTAL 100 Marks] Page 4 of 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started