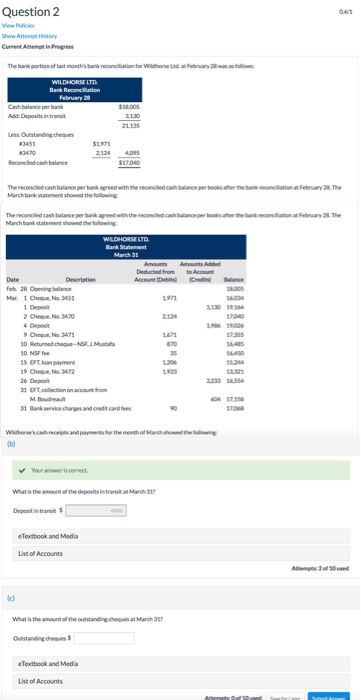

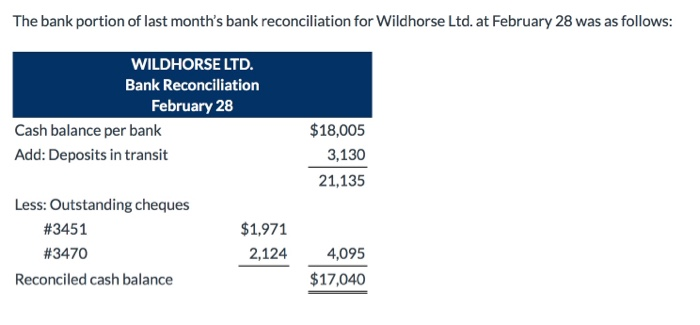

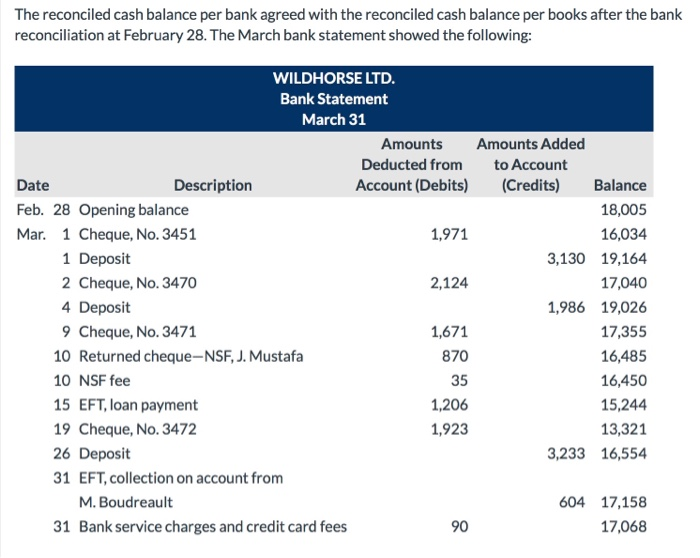

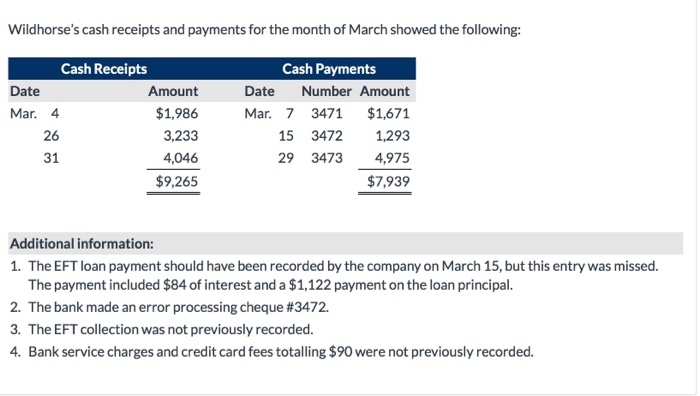

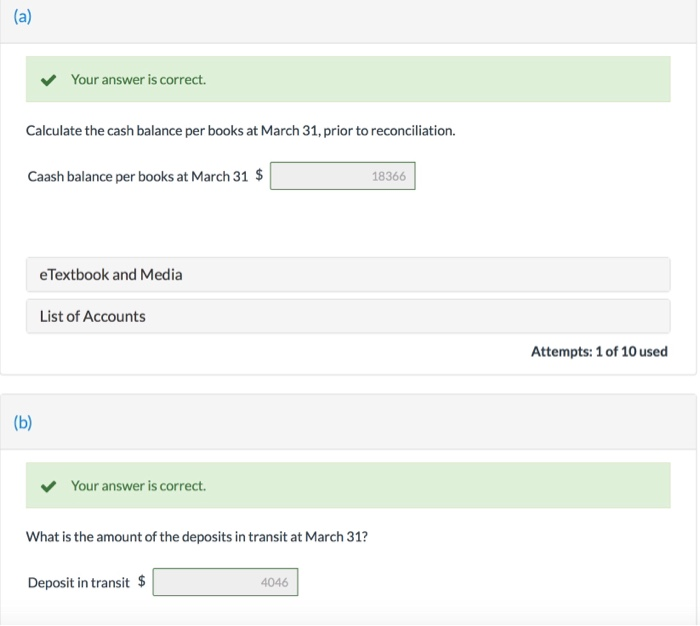

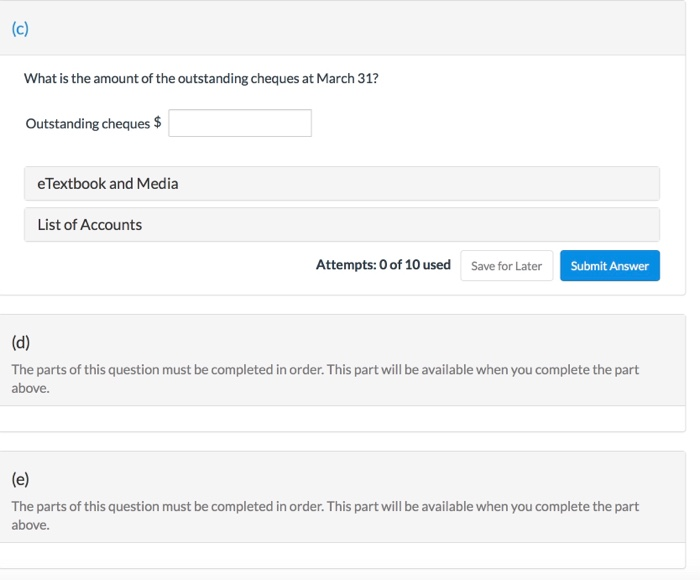

Question 2 View all Show Attemotory Current Progress The bank portion of last month's han reconciliation for Wicho d eruary WILDHORSE LTD Add: Deposits in transit 3,130 21.135 Les cheques 2.124 Reconciled cash balance 4.00 $12.00 The reconciled cash b eperk greed with March bank statement showed the following pr a c tion February 28. The The reconciled cash balance perbankared with the reconciled cash balanceerboo March bank statement showed the following r tebankconcionat February 21. The WILDHORSE LTD Bank Statement March 31 Amount Deducted from Added the Description Feb 28 Opening balance Mar. 1 Cheque No 3451 1 Deposit 2 Cheque. No: 3470 15 2355 9 Cheque. No 3471 30 Returned the Mustafa 30 NSF Ree 15 EFT longament 19 Cheque. No: 3472 26 Deposit 31 UT.collection on account from 31 Bank service charges and credit card fees 17.00 Wildhorse's cash recipes and payments for the month of March showed the following Your answer is correct What's the amount of the deposits in transit March 31 Deposit intres e Textbook and Media List of Accounts What is the amount of the standing the March Outstanding chess eTextbook and Media Ust of Accounts The bank portion of last month's bank reconciliation for Wildhorse Ltd. at February 28 was as follows: WILDHORSE LTD. Bank Reconciliation February 28 Cash balance per bank Add: Deposits in transit $18,005 3,130 21,135 Less: Outstanding cheques #3451 #3470 Reconciled cash balance $1,971 2,124 4,095 $17,040 The reconciled cash balance per bank agreed with the reconciled cash balance per books after the bank reconciliation at February 28. The March bank statement showed the following: WILDHORSE LTD. Bank Statement March 31 Amounts Amounts Added Deducted from to Account Date Description Account (Debits) (Credits) Balance Feb. 28 Opening balance 18,005 Mar. 1 Cheque, No. 3451 1,971 16,034 1 Deposit 3,130 19,164 2 Cheque, No. 3470 2,124 17,040 4 Deposit 1,986 19,026 9 Cheque, No. 3471 1,671 17,355 10 Returned cheque-NSF, J. Mustafa 16,485 10 NSF fee 35 16,450 15 EFT, loan payment 1,206 15,244 19 Cheque, No. 3472 1,923 13,321 26 Deposit 3,233 16,554 31 EFT, collection on account from M. Boudreault 604 17,158 31 Bank service charges and credit card fees 90 17,068 870 Wildhorse's cash receipts and payments for the month of March showed the following: Cash Receipts Date Amount Mar. 4 $1,986 3,233 4,046 $9,265 Cash Payments Date Number Amount Mar. 7 3471 $1,671 15 3472 1,293 29 3473 4,975 $7,939 Additional information: 1. The EFT loan payment should have been recorded by the company on March 15, but this entry was missed. The payment included $84 of interest and a $1,122 payment on the loan principal. 2. The bank made an error processing cheque #3472. 3. The EFT collection was not previously recorded. 4. Bank service charges and credit card fees totalling $90 were not previously recorded. Your answer is correct. Calculate the cash balance per books at March 31, prior to reconciliation. Caash balance per books at March 31 $ 18366 e Textbook and Media List of Accounts Attempts: 1 of 10 used Your answer is correct. What is the amount of the deposits in transit at March 31? Deposit in transit $ 4046 (c) What is the amount of the outstanding cheques at March 31? Outstanding cheques $ e Textbook and Media List of Accounts Attempts: 0 of 10 used Save for Later Submit Answer (d) The parts of this question must be completed in order. This part will be available when you complete the part above. (e) The parts of this question must be completed in order. This part will be available when you complete the part above