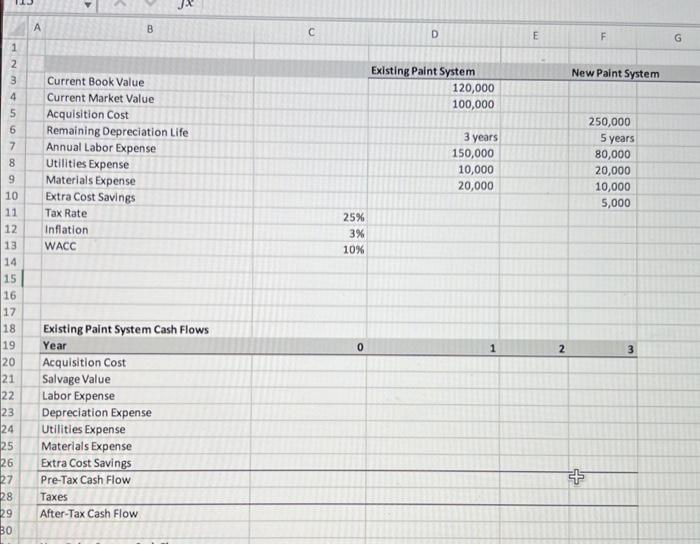

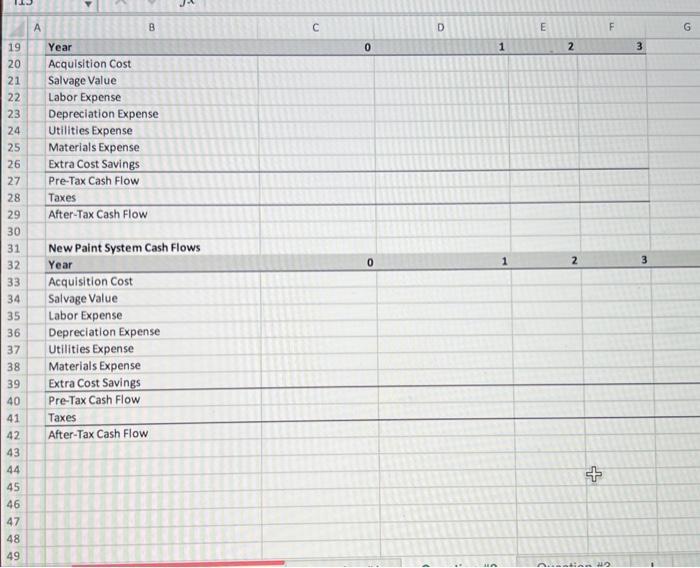

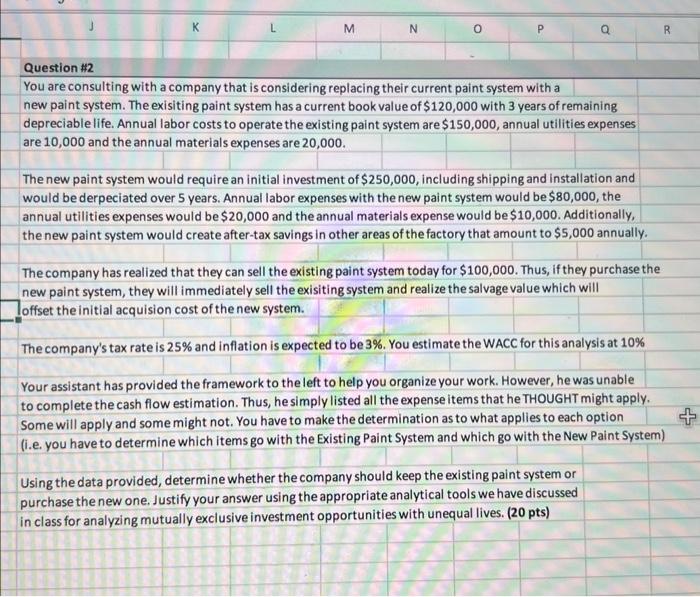

Question \#2 You are consulting with a company that is considering replacing their current paint system with a new paint system. The exisiting paint system has a current book value of $120,000 with 3 years of remaining depreciable life. Annual labor costs to operate the existing paint system are $150,000, annual utilities expenses are 10,000 and the annual materials expenses are 20,000 . The new paint system would require an initial investment of $250,000, including shipping and installation and would be derpeciated over 5 years. Annual labor expenses with the new paint system would be $80,000, the annual utilities expenses would be $20,000 and the annual materials expense would be $10,000. Additionally, the new paint system would create after-tax savings in other areas of the factory that amount to $5,000 annually. The company has realized that they can sell the existing paint system today for $100,000. Thus, if they purchase the new paint system, they will immediately sell the exisiting system and realize the salvage value which will loffset the initial acquision cost of the new system. The company's tax rate is 25% and inflation is expected to be 3%. You estimate the WACC for this analysis at 10% Your assistant has provided the framework to the left to help you organize your work. However, he was unable to complete the cash flow estimation. Thus, he simply listed all the expense items that he THOUGHT might apply. Some will apply and some might not. You have to make the determination as to what applies to each option (i.e. you have to determine which items go with the Existing Paint System and which go with the New Paint System) Using the data provided, determine whether the company should keep the existing paint system or purchase the new one. Justify your answer using the appropriate analytical tools we have discussed in class for analyzing mutually exclusive investment opportunities with unequal lives. (20 pts) Question \#2 You are consulting with a company that is considering replacing their current paint system with a new paint system. The exisiting paint system has a current book value of $120,000 with 3 years of remaining depreciable life. Annual labor costs to operate the existing paint system are $150,000, annual utilities expenses are 10,000 and the annual materials expenses are 20,000 . The new paint system would require an initial investment of $250,000, including shipping and installation and would be derpeciated over 5 years. Annual labor expenses with the new paint system would be $80,000, the annual utilities expenses would be $20,000 and the annual materials expense would be $10,000. Additionally, the new paint system would create after-tax savings in other areas of the factory that amount to $5,000 annually. The company has realized that they can sell the existing paint system today for $100,000. Thus, if they purchase the new paint system, they will immediately sell the exisiting system and realize the salvage value which will loffset the initial acquision cost of the new system. The company's tax rate is 25% and inflation is expected to be 3%. You estimate the WACC for this analysis at 10% Your assistant has provided the framework to the left to help you organize your work. However, he was unable to complete the cash flow estimation. Thus, he simply listed all the expense items that he THOUGHT might apply. Some will apply and some might not. You have to make the determination as to what applies to each option (i.e. you have to determine which items go with the Existing Paint System and which go with the New Paint System) Using the data provided, determine whether the company should keep the existing paint system or purchase the new one. Justify your answer using the appropriate analytical tools we have discussed in class for analyzing mutually exclusive investment opportunities with unequal lives. (20 pts)