Question 20

Question 26

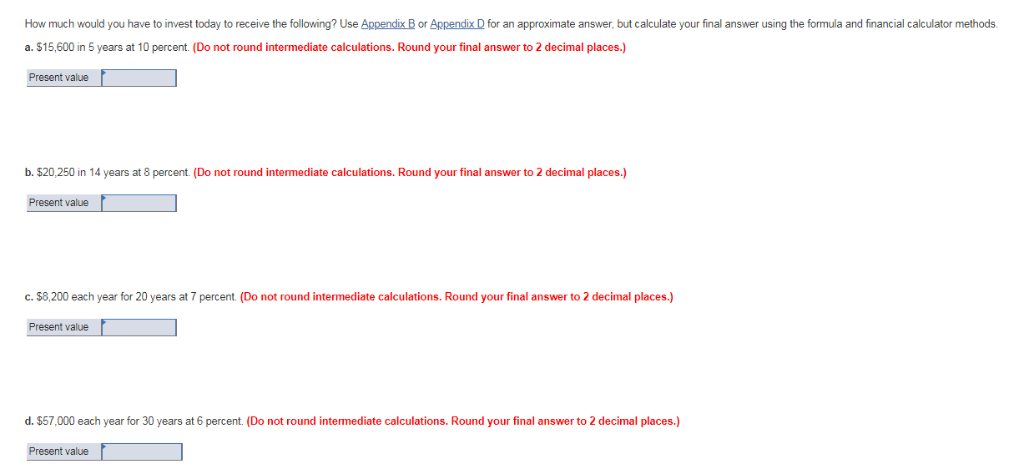

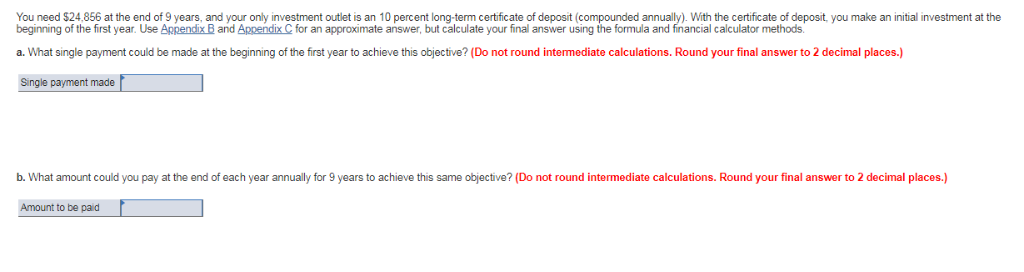

How much would you have to n est today to receive he follo ing? Use pp x or ppen s or an approximate answer but calculate your nal answer using the on a. $15,600 in 5 years at 10 percent. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value a and inanca calculator method b. $20,250 in 14 years at 8 percent. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value c. $8,200 each year for 20 years at 7 percent. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value d. $57,000 each year for 30 years at 6 percent. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value You need $24,856 at the end of 9 years, and your only investment outlet is an 10 percent long-term certificate of deposit (compounded annually). With the certificate of deposit, you make an initial investment at the beginning of the first year. Use Appendix B and Appendix C for an approximate answer, but calculate your final answer using the formula and financial calculator methods a. What single payment could be made at the beginning of the first year to achieve this objective? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Single payment made b. What amount could you pay at the end of each year annually for 9 years to achieve this same objective? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Amount to be paid How much would you have to n est today to receive he follo ing? Use pp x or ppen s or an approximate answer but calculate your nal answer using the on a. $15,600 in 5 years at 10 percent. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value a and inanca calculator method b. $20,250 in 14 years at 8 percent. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value c. $8,200 each year for 20 years at 7 percent. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value d. $57,000 each year for 30 years at 6 percent. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value You need $24,856 at the end of 9 years, and your only investment outlet is an 10 percent long-term certificate of deposit (compounded annually). With the certificate of deposit, you make an initial investment at the beginning of the first year. Use Appendix B and Appendix C for an approximate answer, but calculate your final answer using the formula and financial calculator methods a. What single payment could be made at the beginning of the first year to achieve this objective? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Single payment made b. What amount could you pay at the end of each year annually for 9 years to achieve this same objective? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Amount to be paid