Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 20 When should a lease be recorded as a capital lease? If the leased asset will be used for more than one year. If

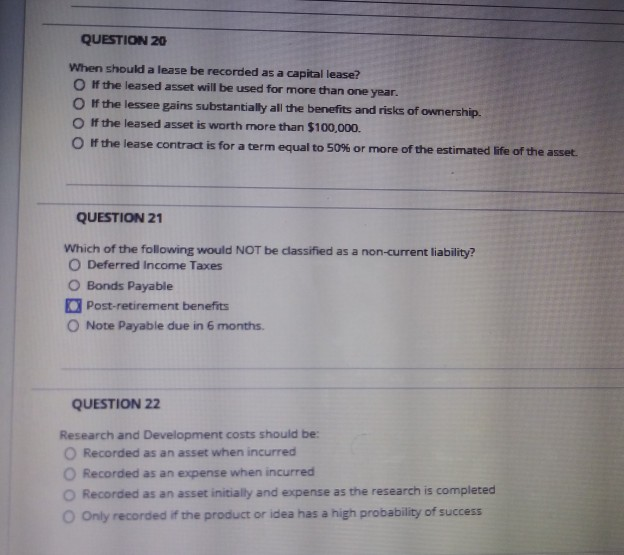

QUESTION 20 When should a lease be recorded as a capital lease? If the leased asset will be used for more than one year. If the lessee gains substantially all the benefits and risks of ownership If the leased asset is worth more than $100,000. If the lease contract is for a term equal to 50% or more of the estimated life of the asset. QUESTION 21 Which of the following would NOT be classified as a non-current liability? O Deferred Income Taxes O Bonds Payable Post-retirement benefits Note Payable due in 6 months QUESTION 22 Research and Development costs should be: Recorded as an asset when incurred Recorded as an expense when incurred Recorded as an asset initially and expense as the research is completed Only recorded if the product or idea has a high probability of success

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started