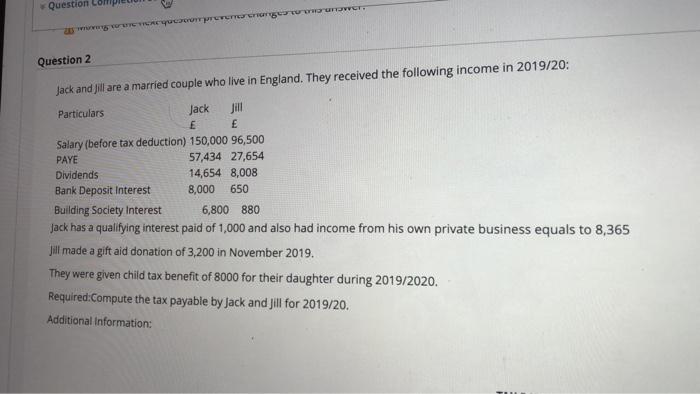

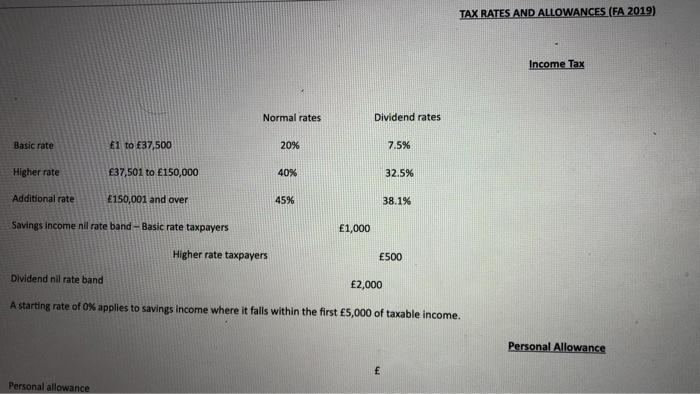

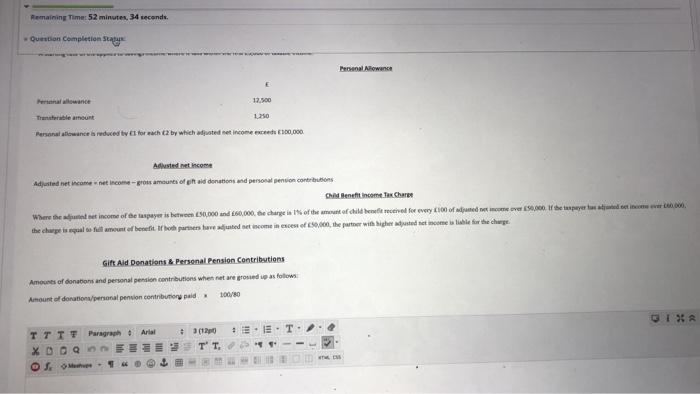

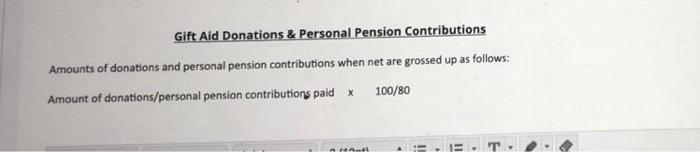

Question 20 YULOTTES HOW Question 2 Jack and fill are a married couple who live in England. They received the following income in 2019/20: Particulars Jack Jill E E Salary (before tax deduction) 150,000 96,500 PAYE 57,434 27,654 Dividends 14,654 8,008 Bank Deposit Interest 8,000 650 Building Society Interest 6,800 880 Jack has a qualifying interest paid of 1,000 and also had income from his own private business equals to 8,365 Jill made a gift aid donation of 3,200 in November 2019. They were given child tax benefit of 8000 for their daughter during 2019/2020. Required:Compute the tax payable by Jack and Jill for 2019/20. Additional Information: TAX RATES AND ALLOWANCES (FA 2019) Income Tax Normal rates Dividend rates Basic rate 1 to 37,500 20% 7.5% Higher rate 37,501 to 150,000 40% 32.5% Additional rate 150,001 and over 45% 38.1% Savings income nil rate band - Basic rate taxpayers 1,000 Higher rate taxpayers 500 Dividend nil rate band 2,000 A starting rate of 0% applies to savings income where it falls within the first 5,000 of taxable income. Personal Allowance E Personal allowance Remaining Time: 52 minutes, 34 seconds Question Completion Stay PRA 12.500 Personal allowance is reduced by foreach (2 by which adjusted net income 100.000 Addet income Adjusted net net income-gro amounts of a donations and personalension contributions Cenefit Income Tax Chare Where the set income of Geraspeyer is between 50,000 and 50,000. Becharge la 1 of the of child here received for every 100 of jede ver e aparece.000, the che alment of benefit of both pares have adjusted at come in exces of 30,000, the pure with Sighed me able for the charge Gift Aid Donations & Personal Pension Contributions Amounts of donations and personal pension contributions when net are grossed up as follows Amount of donation personal pension contribution paid 100/80 BIS : 312 TTTT Paragraph Arial XDOQOF EM Gift Aid Donations & Personal Pension Contributions Amounts of donations and personal pension contributions when net are grossed up as follows: Amount of donations/personal pension contributions paid x 100/80 11 Question 20 YULOTTES HOW Question 2 Jack and fill are a married couple who live in England. They received the following income in 2019/20: Particulars Jack Jill E E Salary (before tax deduction) 150,000 96,500 PAYE 57,434 27,654 Dividends 14,654 8,008 Bank Deposit Interest 8,000 650 Building Society Interest 6,800 880 Jack has a qualifying interest paid of 1,000 and also had income from his own private business equals to 8,365 Jill made a gift aid donation of 3,200 in November 2019. They were given child tax benefit of 8000 for their daughter during 2019/2020. Required:Compute the tax payable by Jack and Jill for 2019/20. Additional Information: TAX RATES AND ALLOWANCES (FA 2019) Income Tax Normal rates Dividend rates Basic rate 1 to 37,500 20% 7.5% Higher rate 37,501 to 150,000 40% 32.5% Additional rate 150,001 and over 45% 38.1% Savings income nil rate band - Basic rate taxpayers 1,000 Higher rate taxpayers 500 Dividend nil rate band 2,000 A starting rate of 0% applies to savings income where it falls within the first 5,000 of taxable income. Personal Allowance E Personal allowance Remaining Time: 52 minutes, 34 seconds Question Completion Stay PRA 12.500 Personal allowance is reduced by foreach (2 by which adjusted net income 100.000 Addet income Adjusted net net income-gro amounts of a donations and personalension contributions Cenefit Income Tax Chare Where the set income of Geraspeyer is between 50,000 and 50,000. Becharge la 1 of the of child here received for every 100 of jede ver e aparece.000, the che alment of benefit of both pares have adjusted at come in exces of 30,000, the pure with Sighed me able for the charge Gift Aid Donations & Personal Pension Contributions Amounts of donations and personal pension contributions when net are grossed up as follows Amount of donation personal pension contribution paid 100/80 BIS : 312 TTTT Paragraph Arial XDOQOF EM Gift Aid Donations & Personal Pension Contributions Amounts of donations and personal pension contributions when net are grossed up as follows: Amount of donations/personal pension contributions paid x 100/80 11