Answered step by step

Verified Expert Solution

Question

1 Approved Answer

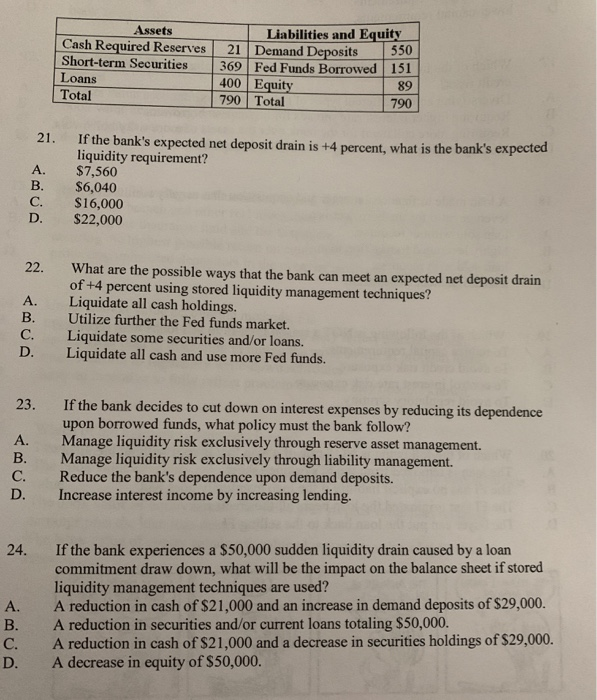

question 21 Assets Liabilities and Equity Cash Required Reserves 21 Demand Deposits- 550 Short-term Securities 369 Fed Funds Borrowed 151 Loans Total 89 790 790

question 21

Assets Liabilities and Equity Cash Required Reserves 21 Demand Deposits- 550 Short-term Securities 369 Fed Funds Borrowed 151 Loans Total 89 790 790 Total fthebank's expectednet deposit drain is +4 percent, what is the bank's expected liquidity requirement? 21. A. $7,560 B. $6,040 C. S16,000 D. $22,000 22. What are the possible ways that the bank can meet an expected net deposit drain of +4 percent using stored liquidity management techniques? A. Liquidate all cash holdings. B. Utilize further the Fed funds market. C. Liquidate some securities and/or loans. D. Liquidate all cash and use more Fed funds. 23. If the bank decides to cut down on interest expenses by reducing its dependence upon borrowed funds, what policy must the bank follow? Manage liquidity risk exclusively through reserve asset management. Manage liquidity risk exclusively through liability management. Reduce the bank's dependence upon demand deposits. Increase interest income by increasing lending A. B. C. D. 24. If the bank experiences a $50,000 sudden liquidity drain caused by a loan commitment draw down, what will be the impact on the balance sheet if stored liquidity management techniques are used? A. A reduction in cash of $21,000 and an increase in demand deposits of $29,000. B. A reduction in securities and/or current loans totaling $50,000 C. D. A reduction in cash of $21,000 and a decrease in securities holdings of $29,000. A decrease in equity of $50,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started